- Canada

- /

- Energy Services

- /

- TSX:TCW

Trican Well Service (TSX:TCW) Is Down 11.1% After Reporting Higher Q3 Sales and Net Income Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Trican Well Service Ltd. recently announced its third quarter 2025 results, reporting sales of CA$300.59 million and net income of CA$28.9 million, both up from the same period a year earlier.

- This increase in revenue and earnings highlights the company's ability to grow its operational performance even amid fluctuations in the broader energy market.

- We'll explore how stronger quarterly sales and net income shape Trican's outlook given analyst expectations for future revenue and margin growth.

We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Trican Well Service Investment Narrative Recap

To invest in Trican Well Service, you need confidence in the company’s ability to leverage rising North American LNG demand for sustainable growth, while recognizing how volatile natural gas prices could limit near-term visibility. The third quarter's stronger sales and earnings provide welcome confirmation of Trican’s operational gains, but the company’s heavy exposure to gas prices and the pressure pumping market means this news alone does not fundamentally shift the most important short-term catalyst or elevate the largest business risk at this time.

Among recent developments, Trican's board-approved share repurchase program in October stands out as closely tied to unlocking shareholder value, especially given the improved third-quarter financial results. Continued execution on buybacks may support per-share earnings, but the broader implications for free cash flow and long-term capital efficiency remain important considerations for investors focused on near-term catalysts.

However, against recent financial momentum, investors should be aware that if natural gas prices remain depressed, Trican’s revenue growth opportunities could be affected in ways that ...

Read the full narrative on Trican Well Service (it's free!)

Trican Well Service's narrative projects CA$1.2 billion revenue and CA$147.9 million earnings by 2028. This requires 8.8% yearly revenue growth and a CA$44.5 million earnings increase from current earnings of CA$103.4 million.

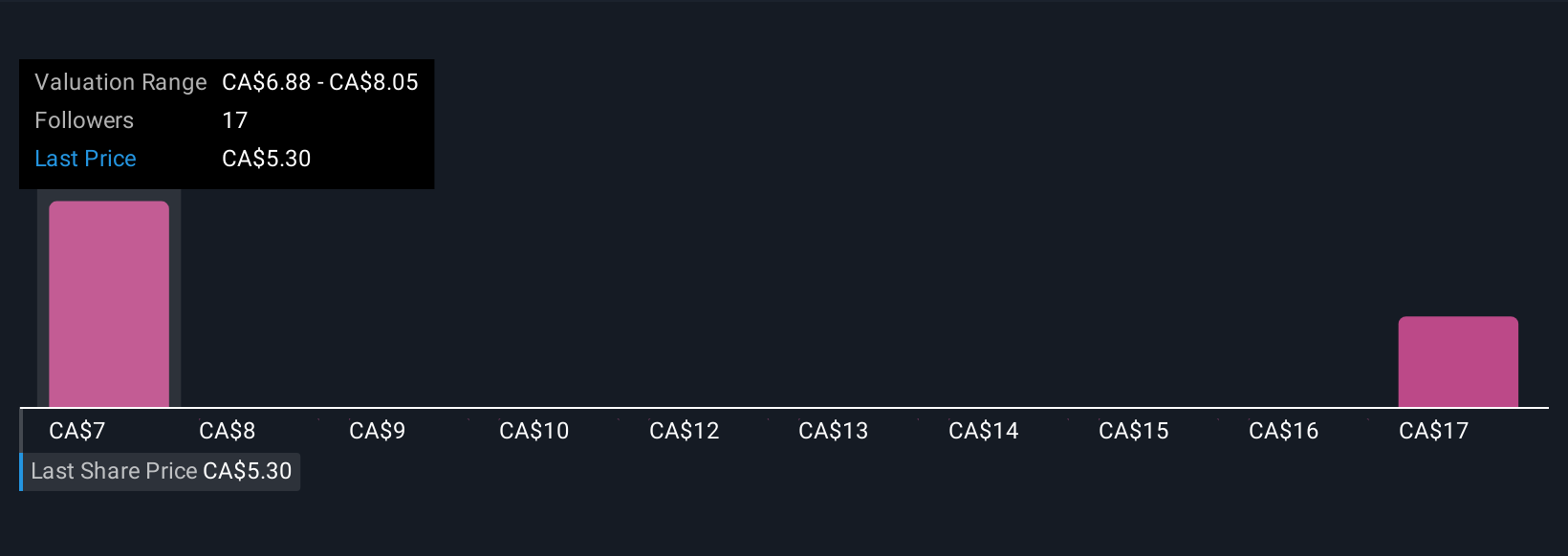

Uncover how Trican Well Service's forecasts yield a CA$6.88 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members produced fair value estimates for Trican ranging from CA$6.88 to CA$14.81 per share, illustrating a wide spread between just two perspectives. With much of Trican’s business tied to gas activity, shifts in energy prices can significantly influence performance, making it worthwhile to compare these individual outlooks.

Explore 2 other fair value estimates on Trican Well Service - why the stock might be worth over 2x more than the current price!

Build Your Own Trican Well Service Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trican Well Service research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trican Well Service research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trican Well Service's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Trican Well Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TCW

Trican Well Service

An equipment services company, provides various products, equipment, services, and technology for use in the drilling, completion, stimulation, and reworking of oil and gas wells in Canada.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion