- Canada

- /

- Oil and Gas

- /

- TSX:TAL

Why PetroTal (TSX:TAL) Is Up 9.7% After Reporting 21 Percent Year-Over-Year Production Growth

Reviewed by Sasha Jovanovic

- Earlier this month, PetroTal Corp. reported its third quarter and nine-month 2025 operating results, marking a 21% year-over-year increase in group oil production to an average of 18,414 barrels per day for the quarter and 20,894 barrels per day for the year to date.

- This surge in output, achieved despite sequential declines at certain fields, pushed cumulative annual production to just over 5.7 million barrels through September 30, 2025.

- We’ll examine how these strong production growth figures shape PetroTal’s investment story and the operational resilience they highlight.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is PetroTal's Investment Narrative?

The big picture for PetroTal revolves around consistent production growth, effective management of operational setbacks and maintaining capital discipline in a competitive oil sector. With Q3's impressive 21% year-over-year production jump, despite sequential declines at key fields, PetroTal has delivered a clear signal of its operational resilience and execution, helping to reinforce recent management guidance. This latest result could ease concern around short-term catalysts, like production guidance and dividend stability, by demonstrating continued field performance. That said, earlier falloffs at the Bretana field and declines in revenue and net income throughout 2025 highlight how operational risks and commodity price exposure remain front of mind for shareholders. The upside of strong production may moderate some of these risks, but the catalyst of earnings momentum is now more uncertain, pending November's results. While the recent news points to robust field delivery, sustained margin pressure and the leadership transition still warrant close attention in the months ahead.

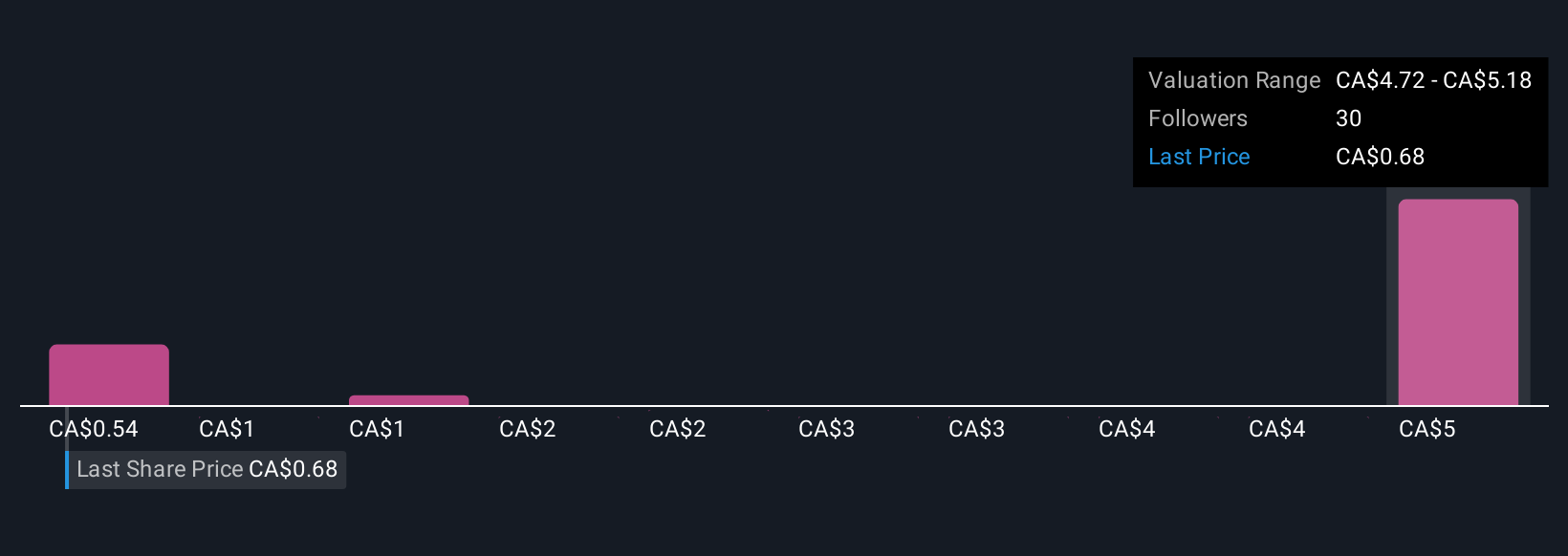

However, the impact of field-level fluctuations and margin trends is something investors should not overlook. PetroTal's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 15 other fair value estimates on PetroTal - why the stock might be worth over 7x more than the current price!

Build Your Own PetroTal Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PetroTal research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PetroTal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PetroTal's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TAL

PetroTal

Engages in the exploration, appraisal and development of oil and natural gas in Peru, South America.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives