- Canada

- /

- Oil and Gas

- /

- TSX:TAL

PetroTal (TSX:TAL) Valuation in Focus After Share Buyback and Production Strength

Reviewed by Simply Wall St

PetroTal (TSX:TAL) has caught investor attention after announcing that it repurchased and canceled a tranche of its common shares. Share buybacks like this are often seen as a positive signal regarding management’s outlook and capital priorities.

See our latest analysis for PetroTal.

PetroTal’s move to buy back shares comes after upbeat production results and a surge in recent momentum, with a 1-day share price return of 1.49% and a strong 9.68% gain over the past week. Investors who have held on longer have seen even more impressive figures, as the company delivered a 19.17% total shareholder return over the last year and more than 500% over five years. The combination of robust operational results and these returns suggests increasing optimism around PetroTal’s long-term outlook, even as short-term price swings continue.

If you're considering what else is moving in the market, now is an ideal time to broaden your investing horizons and discover fast growing stocks with high insider ownership

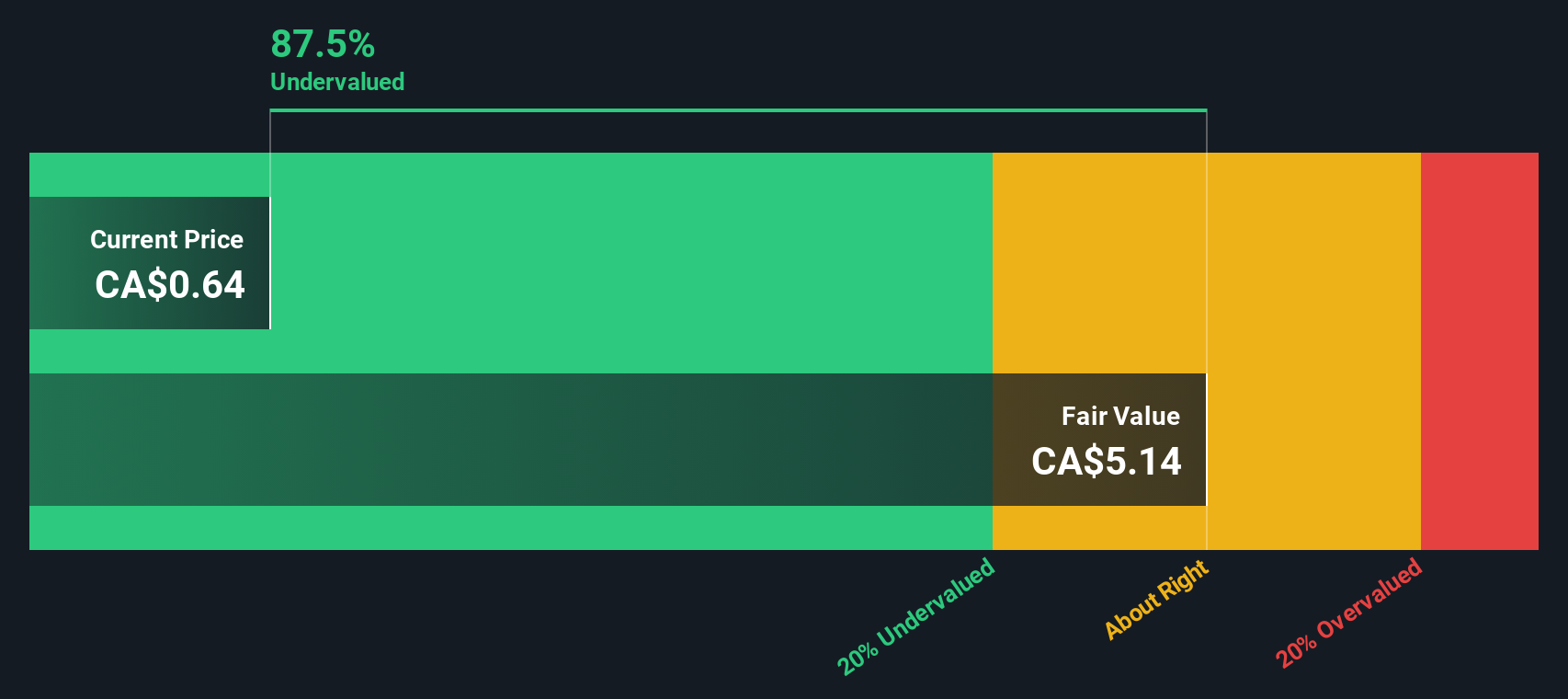

With strong production growth and an active buyback program boosting investor confidence, the key question remains: Is PetroTal undervalued at current levels, or is the market already pricing in its future expansion?

Price-to-Earnings of 5.8x: Is it justified?

PetroTal’s shares currently trade at a price-to-earnings (P/E) ratio of 5.8x, which points to a substantial discount compared to both peers and the broader industry. With the last close at CA$0.68, the market appears to be pricing in lower growth prospects versus competitors in the oil and gas sector.

The P/E multiple represents the price investors are willing to pay per dollar of PetroTal’s current earnings. For oil and gas companies, this is a common valuation tool since profitability can be volatile and subject to commodity price fluctuations. A low P/E often suggests that the market is skeptical about the company’s future earnings outlook or is discounting one-off gains.

PetroTal’s current valuation stands out against its industry, where the average P/E is 12.5x and the peer average is 11.5x. The company’s multiple is less than half of these benchmarks. In addition, our fair value analysis suggests the market could move toward a P/E of 11.8x for PetroTal, highlighting meaningful upside if the company meets or exceeds future earnings expectations.

Explore the SWS fair ratio for PetroTal

Result: Price-to-Earnings of 5.8x (UNDERVALUED)

However, slower revenue growth and recent share price volatility could challenge PetroTal's bullish outlook if industry conditions remain uncertain.

Find out about the key risks to this PetroTal narrative.

Another View: What Does the Discounted Cash Flow Say?

While the low price-to-earnings ratio points to potential value, our DCF model suggests an even bigger gap. According to the SWS DCF model, PetroTal is trading well below its estimated fair value. This could open the door for a possible rerating if market expectations shift. Is the market overlooking hidden value, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PetroTal for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PetroTal Narrative

If you'd like to dig deeper and draw your own conclusions from the numbers, you can easily craft a personalized analysis in just minutes. Do it your way

A great starting point for your PetroTal research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investment Moves?

Capitalize on market shifts and maximize your portfolio by taking action now. The smartest investment opportunities can slip away in seconds if you hesitate.

- Pounce on hidden value by spotting these 876 undervalued stocks based on cash flows with strong cash flow potential before the crowd catches on.

- Secure a stream of returns by targeting these 17 dividend stocks with yields > 3% offering attractive yields for reliable income.

- Tap into the future by targeting these 28 quantum computing stocks paving the way for breakthroughs in technology and computing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TAL

PetroTal

Engages in the exploration, appraisal and development of oil and natural gas in Peru, South America.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives