- Canada

- /

- Oil and Gas

- /

- TSX:TAL

Can PetroTal’s (TSX:TAL) Dividend Pause Reshape Its Long-Term Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- PetroTal Corp. recently reported lower third-quarter earnings, with revenue falling to US$63.91 million and net income dropping to US$3.6 million, and announced the suspension of its regular quarterly dividend to preserve a minimum US$60 million cash balance amid higher planned development spending.

- While the company has returned nearly US$155 million to shareholders since 2023, management emphasized the need to prioritize future capital investments over distributions in the near term.

- We’ll examine how the dividend suspension and cautious capital approach may reshape PetroTal’s investment narrative going forward.

Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

What Is PetroTal's Investment Narrative?

For those considering PetroTal, the key focus now is on whether the company’s disciplined approach to capital allocation is the right call given recent headwinds. The dividend suspension is a significant pivot, reflecting management’s urgency to maintain liquidity and protect against volatility after a sharp dip in earnings and revenues. This shift will likely dampen one of PetroTal’s short-term investor catalysts, steady cash returns, while amplifying the importance of upcoming operational milestones, such as delivering on planned production growth. The balance between reinvestment and distribution has become even more central to the company’s profile, and near-term risks now skew towards execution: any setbacks in development or further oil price weakness could put additional pressure on margins and market sentiment. Recent steep price declines suggest the impact is material and warrant careful monitoring by investors.

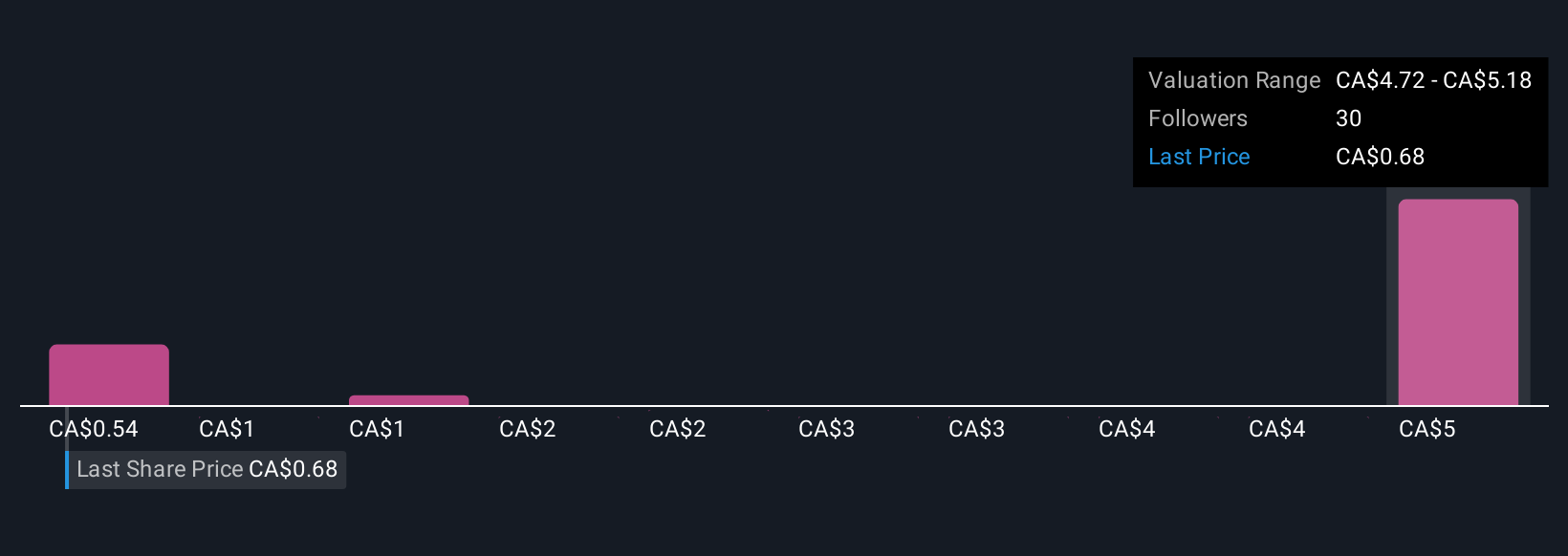

But with production guidance still elevated, what happens if volatility persists is crucial for investors to weigh. Despite retreating, PetroTal's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 15 other fair value estimates on PetroTal - why the stock might be a potential multi-bagger!

Build Your Own PetroTal Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PetroTal research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PetroTal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PetroTal's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TAL

PetroTal

Engages in the acquisition, exploration, appraisal, development, and production of oil and natural gas properties in Peru.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives