- Canada

- /

- Oil and Gas

- /

- TSX:SU

Suncor Energy (TSX:SU) Margin Decline Reinforces Concerns Over Growth and Earnings Outlook

Reviewed by Simply Wall St

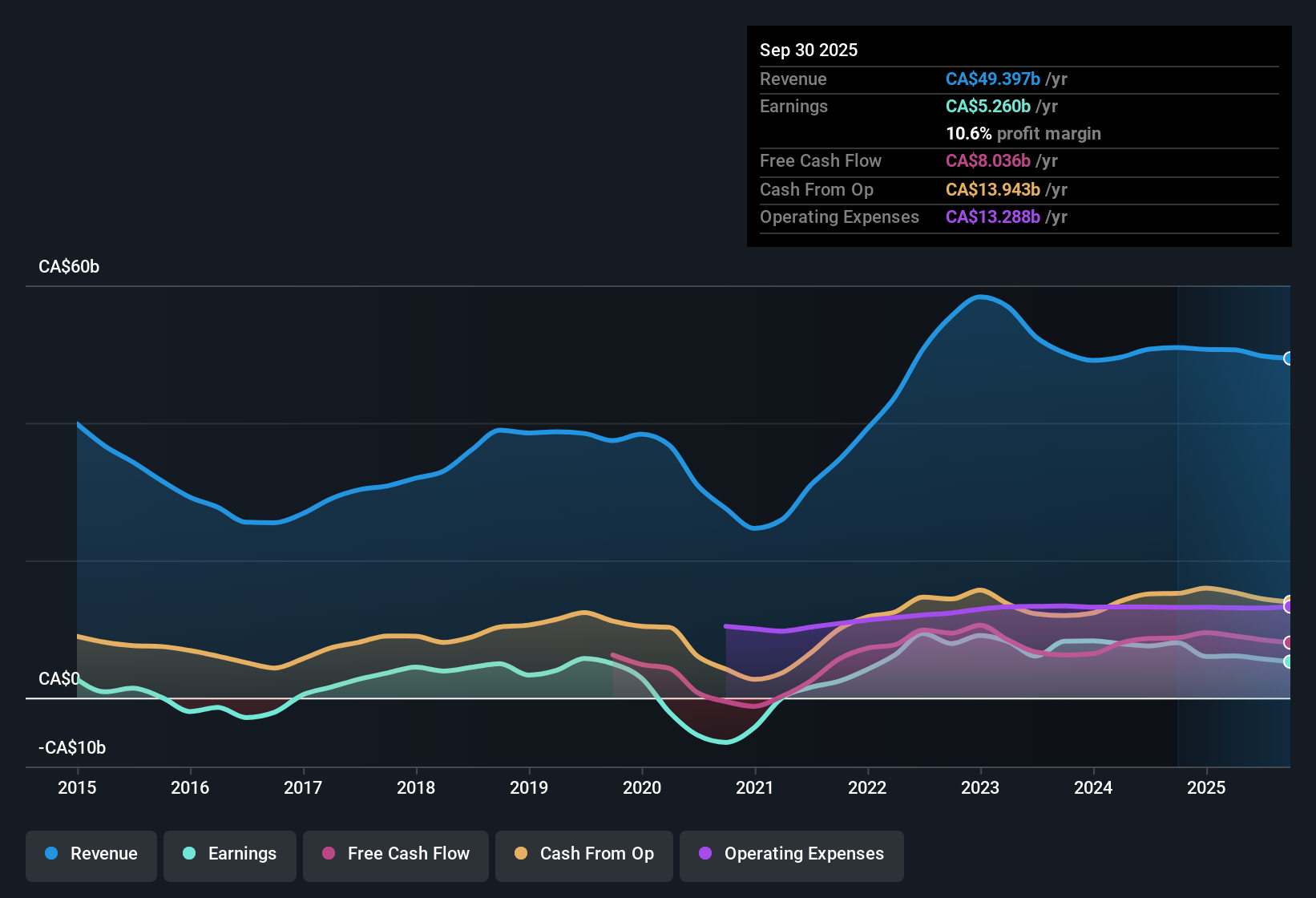

Suncor Energy (TSX:SU) posted an average annual earnings growth of 32.9% over the past five years. However, the most recent period reflected negative earnings growth, and revenue is forecast to decline by 0.3% per year over the next three years. Despite a current net profit margin of 11.4%, which is down from last year’s 14.9%, the market is watching closely. Suncor’s shares are trading at CA$58.17, below a fair value estimate of CA$134.50, and the Price-to-Earnings ratio is 12.5x, which is under both industry and peer averages. Although high-quality earnings are noted as a positive, investor sentiment is mixed as the risk of declining growth is being balanced against the perceived value based on current valuation.

See our full analysis for Suncor Energy.Next, we’ll see how the numbers compare with the widely followed market narratives, highlighting where consensus matches up and where surprises might emerge.

See what the community is saying about Suncor Energy

Margins Slip as Costs Stay High

- Suncor’s current net profit margin is 11.4%, down from 14.9% last year, showing that higher costs and possible pricing pressures are weighing on bottom-line performance even before new regulatory headwinds come into play.

- According to the analysts' consensus view, recent improvements in operational efficiency and automation have helped offset some cost pressures, but bears highlight that ongoing emissions regulations, high-maintenance assets, and global energy transition initiatives are threatening to erode margin stability in the years ahead.

- Structural risks such as rising carbon taxes and decarbonization targets directly challenge management’s efforts to maintain margins through cost discipline and automation.

- Bulls point to cost-cutting and record throughput as tailwinds, but the downward trend in margins means fixed costs could keep eating into future profits unless new efficiencies outpace these external headwinds.

Production Holds Up, But Revenue to Dip

- Analysts expect Suncor’s revenue to decline slightly by 1.1% per year for the next three years, despite the company hitting consistently high production levels; the top line is set to shrink as global energy transition and competition weigh on fossil fuel demand.

- The consensus narrative notes that Suncor’s strong upstream production and reliable cash flow help underpin dividends and share buybacks, but critics highlight that even these strengths may not shield the company from revenue slippage if secular demand for oil continues to fall.

- Bulls argue high production and better operational reliability should translate to stable or rising revenues, yet forecasts point to a small but steady drift lower.

- The projected revenue dip exposes a disconnect between Suncor’s solid internal execution and the broader, less forgiving market environment facing oil sands producers.

Valuation Discount Stirs Debate

- Suncor trades at CA$58.17, a 9.5% discount from the analyst target of CA$63.35, and far below the DCF fair value of CA$134.50; notably, the Price-to-Earnings ratio of 12.5x is also under both industry and peer averages, flagging it as potentially undervalued by traditional metrics.

- Analysts' consensus view frames this valuation gap as a core debate. While the current price is seen as offering good value based on past earning power, skeptics argue that mounting structural and regulatory risks may justify a persistent discount.

- Bulls see the valuation discount as a rare chance to buy reliable earnings at a bargain, but critics stress that fair value hinges on optimistic scenarios for profit margins and revenue, both of which face notable headwinds.

- The share price lag relative to fair value models and analyst targets signals uncertainty about whether Suncor can sustain its historical performance in a changing energy landscape.

- Mixed earnings trends and cautious guidance have set the stage for Suncor's next chapters. Read the full consensus narrative for a deeper dive into what could drive shares higher or lower. 📊 Read the full Suncor Energy Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Suncor Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? Use your insights to craft a fresh narrative in just a few minutes and Do it your way.

A great starting point for your Suncor Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Suncor faces shrinking profit margins and sluggish revenue forecasts as structural and regulatory pressures weigh on its outlook for consistent growth.

If you want steadier performance, use stable growth stocks screener (2082 results) to find companies that consistently deliver reliable growth, even when the broader market faces obstacles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SU

Suncor Energy

Operates as an integrated energy company in Canada, the United States, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion