- Canada

- /

- Oil and Gas

- /

- TSX:SES

Will SECURE Waste Infrastructure’s New Debt Issue Unlock Strategic Flexibility for TSX:SES?

Reviewed by Sasha Jovanovic

- SECURE Waste Infrastructure Corp. recently completed a private placement of CA$300 million in 5.75% senior unsecured notes due 2032, underwritten by major Canadian financial institutions, with proceeds earmarked for repaying existing credit facility debt and general corporate purposes.

- This debt financing signals an active approach toward capital structure management and may reflect leadership's intentions to enhance financial flexibility for future initiatives.

- We'll explore how this substantial debt issuance and its use of proceeds may influence SECURE's earnings growth and risk profile going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

SECURE Waste Infrastructure Investment Narrative Recap

Being a SECURE Waste Infrastructure shareholder means believing in a future where strong waste management demand and infrastructure contracts can drive steady growth, but recognizing that volatile energy sector exposure remains a central risk. The new CA$300 million unsecured notes improve near-term financial flexibility, but the core challenges of industry concentration and macroeconomic headwinds in metals recycling still overshadow the biggest growth opportunities, so the immediate catalyst, the ramp-up of new long-term contracted disposal facilities, may not be impacted in a material way by this financing.

Among recent announcements, SECURE’s consistent declaration of quarterly dividends underscores its management’s confidence despite recent earnings volatility and capital structure changes. Reliable dividend payouts may provide some reassurance while the company navigates through risks tied to sector reliance and integration of acquired assets.

Yet, on the other hand, investors should be aware that a high concentration in oil and gas exposes SECURE to persistent pressure from...

Read the full narrative on SECURE Waste Infrastructure (it's free!)

SECURE Waste Infrastructure's outlook projects CA$262.9 million in revenue and CA$254.0 million in earnings by 2028. This implies a 70.6% annual decline in revenue and an earnings increase of CA$57.0 million from current earnings of CA$197.0 million.

Uncover how SECURE Waste Infrastructure's forecasts yield a CA$19.92 fair value, a 12% upside to its current price.

Exploring Other Perspectives

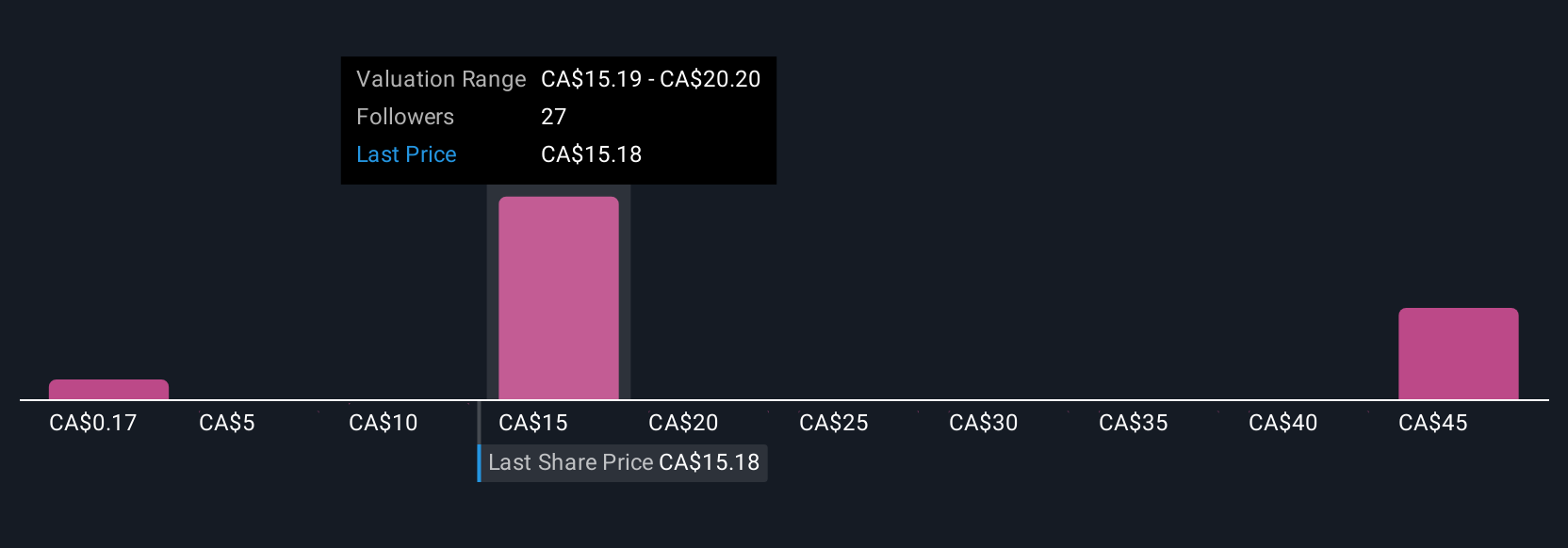

Ten Simply Wall St Community members estimate SECURE’s fair value between CA$0.17 and CA$43.05 per share, reflecting starkly different outlooks. With exposure to the oil and gas sector still a primary risk, you can explore several alternative viewpoints on how this influences future returns.

Explore 10 other fair value estimates on SECURE Waste Infrastructure - why the stock might be worth less than half the current price!

Build Your Own SECURE Waste Infrastructure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SECURE Waste Infrastructure research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SECURE Waste Infrastructure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SECURE Waste Infrastructure's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SES

SECURE Waste Infrastructure

Engages in the waste management and energy infrastructure businesses primarily in Canada and the United States.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives