In the last week, the Canadian market has been flat, but it has risen 19% over the past 12 months with earnings expected to grow by 15% per annum in the coming years. In this promising environment, dividend stocks yielding over 3.1% can offer both income and potential for growth, making them attractive options for investors seeking stability and returns.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 6.97% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.20% | ★★★★★☆ |

| Labrador Iron Ore Royalty (TSX:LIF) | 8.20% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.22% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.13% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.60% | ★★★★★☆ |

| iA Financial (TSX:IAG) | 3.01% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.57% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.17% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.41% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Enghouse Systems (TSX:ENGH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Enghouse Systems Limited, with a market cap of CA$1.78 billion, develops enterprise software solutions worldwide through its subsidiaries.

Operations: Enghouse Systems Limited generates revenue through its Asset Management Group (CA$187.17 million) and Interactive Management Group (CA$312.77 million).

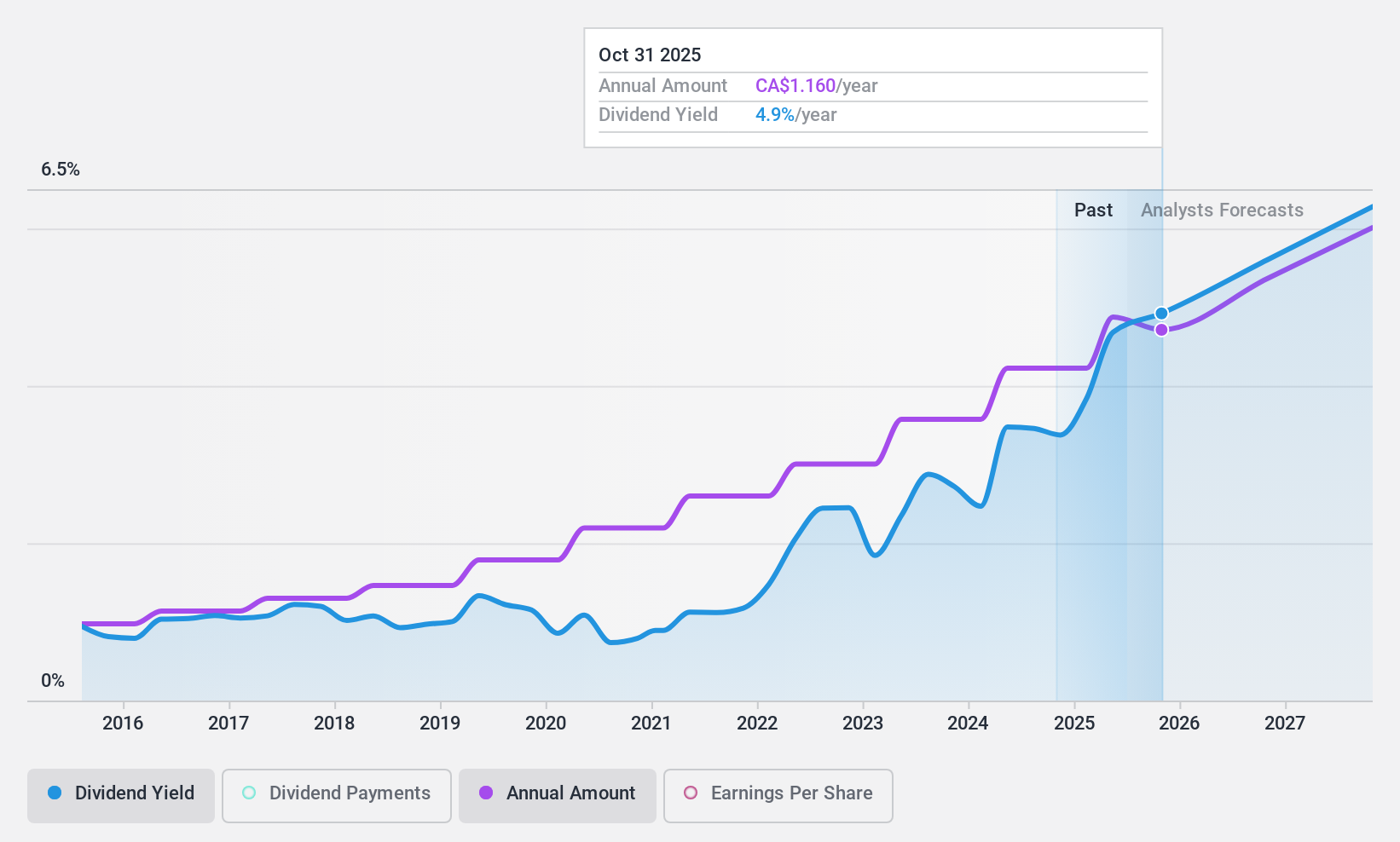

Dividend Yield: 3.1%

Enghouse Systems Limited reported Q3 2024 revenue of C$130.5 million and net income of C$20.58 million, showing growth from the previous year. The company declared a quarterly dividend of C$0.26 per share, covered by earnings with a payout ratio of 66% and cash flows with a cash payout ratio of 45.4%. Although its dividend yield is lower than top-tier Canadian payers, it has been stable and growing over the past decade.

- Navigate through the intricacies of Enghouse Systems with our comprehensive dividend report here.

- Our valuation report here indicates Enghouse Systems may be undervalued.

Olympia Financial Group (TSX:OLY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Olympia Financial Group Inc., with a market cap of CA$243.04 million, operates in Canada through its subsidiary Olympia Trust Company as a non-deposit taking trust company.

Operations: Olympia Financial Group Inc. generates revenue through several segments: Health (CA$10.21 million), Corporate (CA$0.13 million), Exempt Edge (EE) (CA$1.41 million), Investment Account Services (IAS) (CA$79.02 million), Currency and Global Payments (CGP) (CA$8.43 million), and Corporate and Shareholder Services (CSS) (CA$3.98 million).

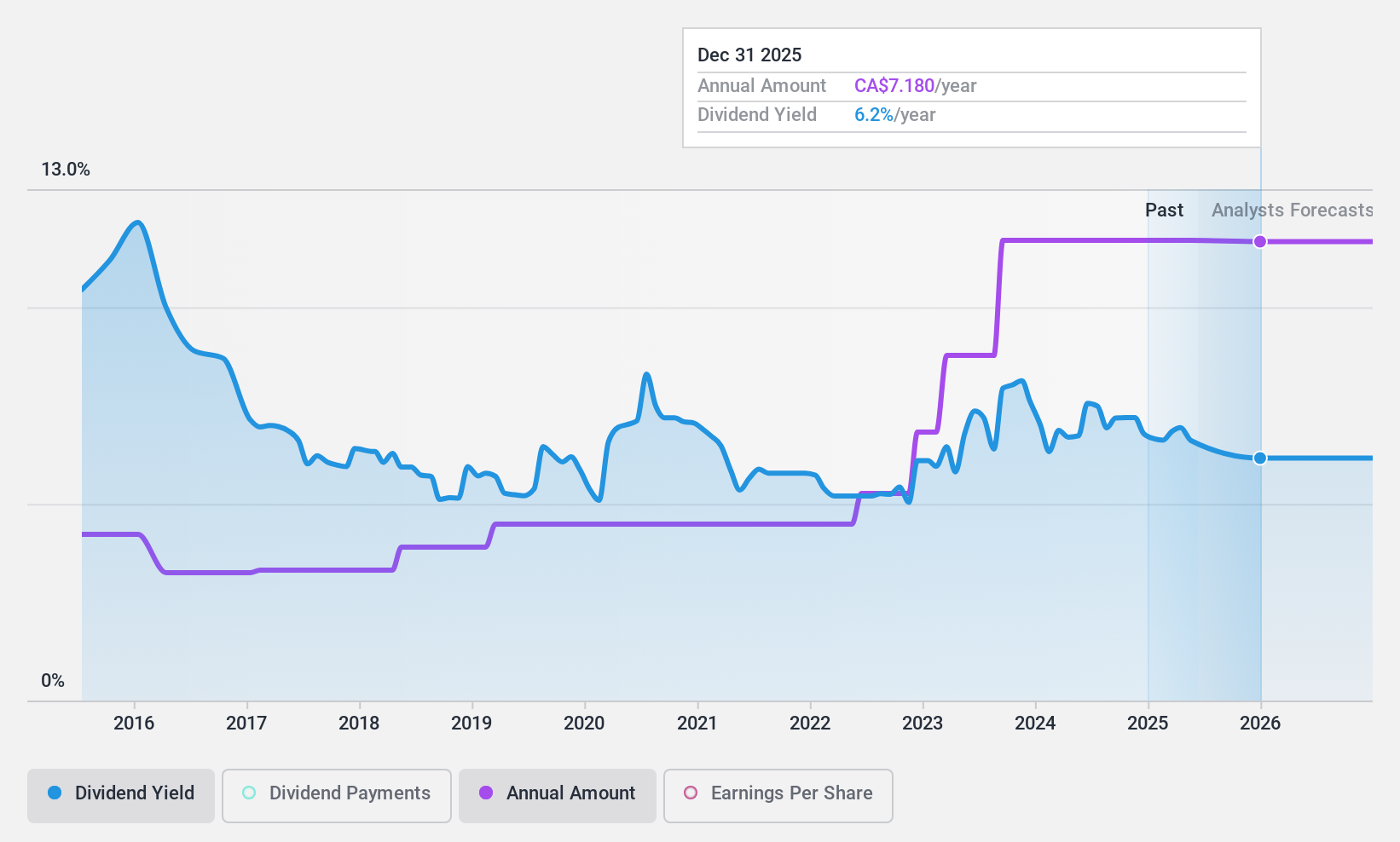

Dividend Yield: 7.2%

Olympia Financial Group has declared consistent monthly dividends of C$0.60 per share, with recent ex-dividend dates on September 18, August 21, and July 22, 2024. Despite a volatile dividend history over the past decade, current payments are covered by earnings (68.1% payout ratio) and cash flows (72.7% cash payout ratio). Q2 2024 revenue was C$26.25 million with net income of C$5.89 million, showing stability but no significant growth compared to last year.

- Get an in-depth perspective on Olympia Financial Group's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Olympia Financial Group's share price might be too pessimistic.

Secure Energy Services (TSX:SES)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Secure Energy Services Inc. operates in the waste management and energy infrastructure sectors across Canada and the United States, with a market cap of CA$2.86 billion.

Operations: Secure Energy Services Inc.'s revenue segments include CA$8.61 billion from Energy Infrastructure and CA$1.13 billion from Environmental Waste Management (EWM).

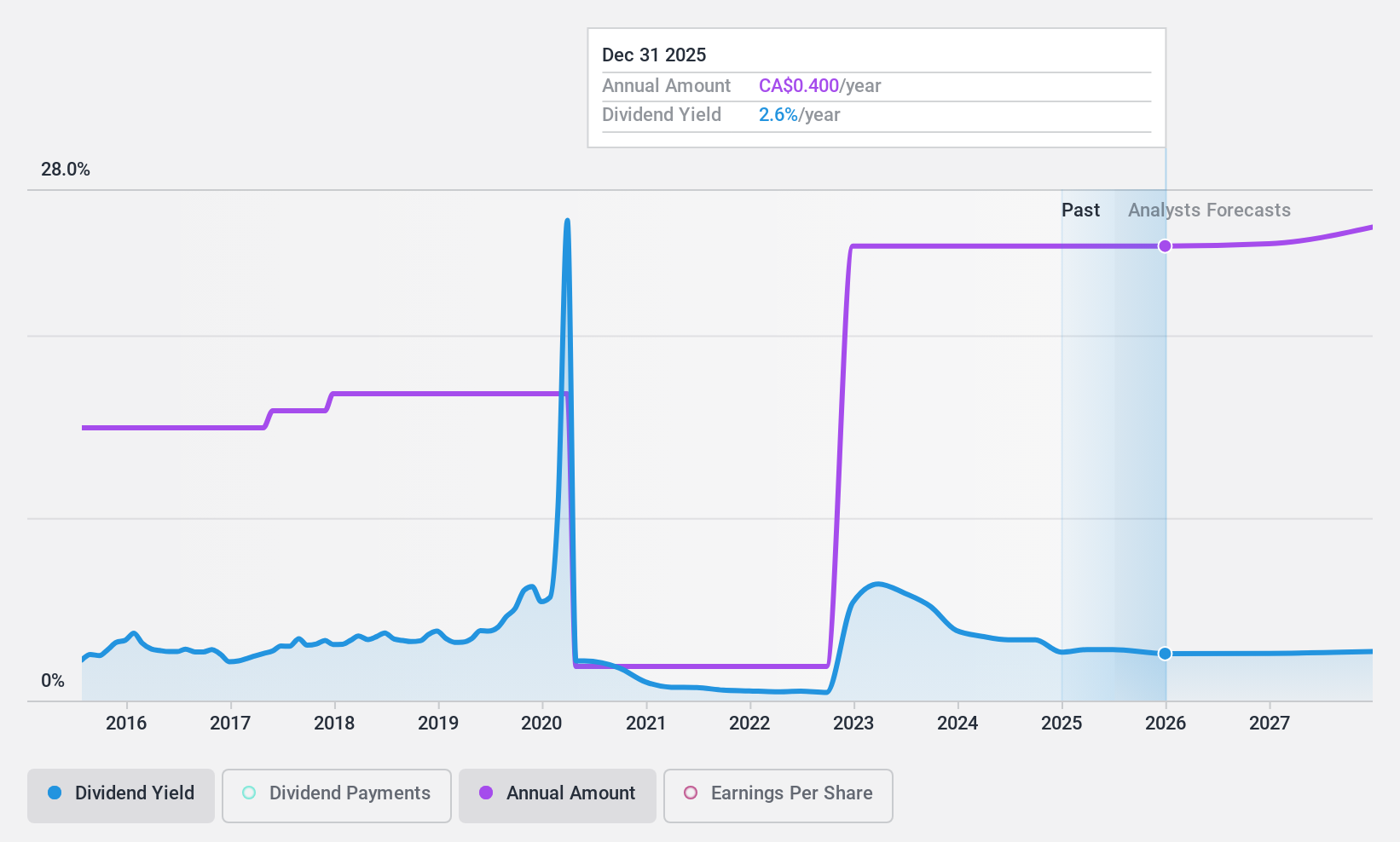

Dividend Yield: 3.2%

Secure Energy Services pays a reliable 3.2% dividend, well-covered by earnings (20.1% payout ratio) and cash flows (38.3% cash payout ratio). Despite stable dividends over the past decade, recent news includes being dropped from the S&P/TSX Capped Energy Index and reporting mixed Q2 2024 results with CAD 2.55 billion in sales but a slight decline in net income to CAD 32 million from CAD 34 million last year.

- Unlock comprehensive insights into our analysis of Secure Energy Services stock in this dividend report.

- Our expertly prepared valuation report Secure Energy Services implies its share price may be lower than expected.

Taking Advantage

- Explore the 32 names from our Top TSX Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enghouse Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ENGH

Very undervalued with flawless balance sheet and pays a dividend.