- Canada

- /

- Oil and Gas

- /

- TSX:QEC

Questerre Energy Corporation's (TSE:QEC) 32% Price Boost Is Out Of Tune With Revenues

Questerre Energy Corporation (TSE:QEC) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 24% is also fairly reasonable.

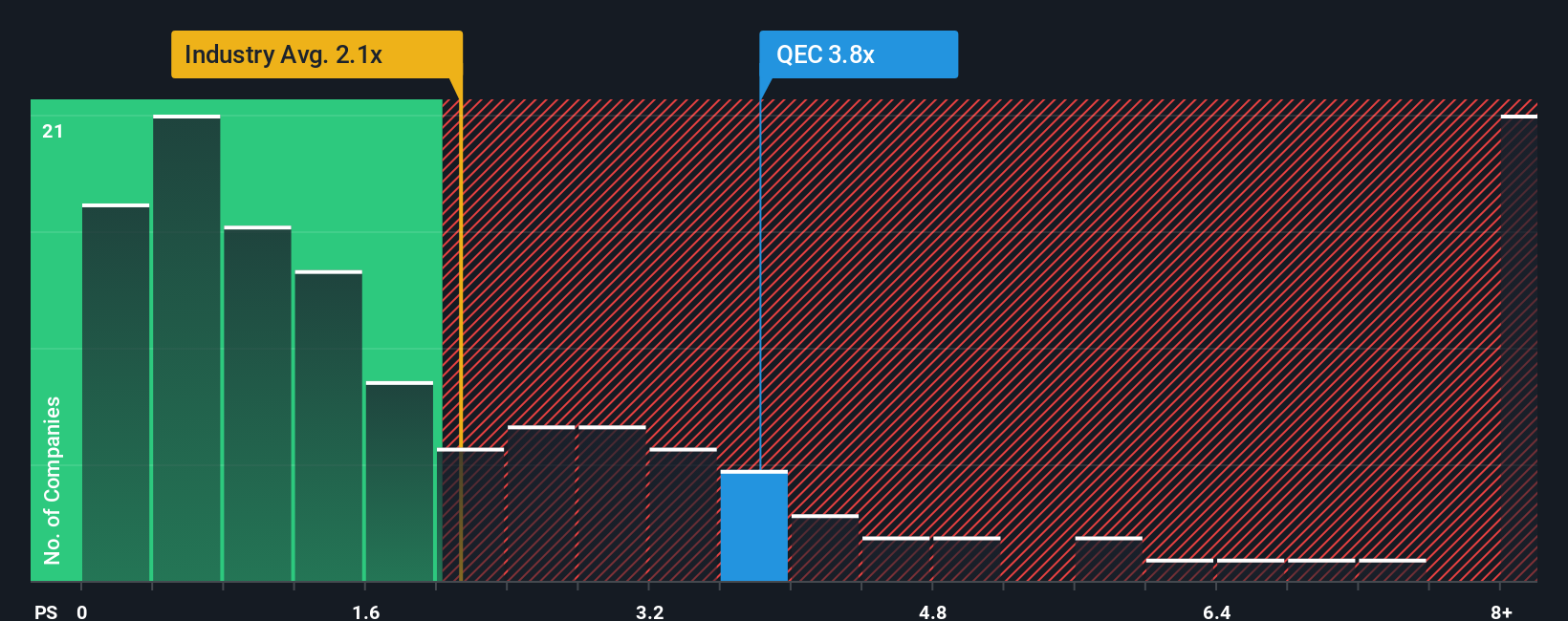

Following the firm bounce in price, you could be forgiven for thinking Questerre Energy is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.8x, considering almost half the companies in Canada's Oil and Gas industry have P/S ratios below 2.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Questerre Energy

How Questerre Energy Has Been Performing

It looks like revenue growth has deserted Questerre Energy recently, which is not something to boast about. One possibility is that the P/S is high because investors think the benign revenue growth will improve to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Questerre Energy will help you shine a light on its historical performance.How Is Questerre Energy's Revenue Growth Trending?

Questerre Energy's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Regardless, revenue has managed to lift by a handy 13% in aggregate from three years ago, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 5.6% shows it's about the same on an annualised basis.

With this information, we find it interesting that Questerre Energy is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Questerre Energy's P/S?

The large bounce in Questerre Energy's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We didn't expect to see Questerre Energy trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Questerre Energy you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Questerre Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:QEC

Questerre Energy

An energy technology and innovation company, engages in the acquisition, exploration, and development non-conventional oil and gas projects in Canada.

Imperfect balance sheet with minimal risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026