- Canada

- /

- Oil and Gas

- /

- TSX:PXT

Did Q3 Production Gains and Dividend Move Just Shift Parex Resources' (TSX:PXT) Investment Narrative?

Reviewed by Sasha Jovanovic

- Parex Resources recently reported its third-quarter 2025 results, including unaudited production, financials, and the approval of a fourth-quarter CA$0.385 dividend per share, alongside ongoing share buybacks.

- Production figures showed both increased output in certain product streams and reaffirmed annual guidance, reflecting operational resilience amid a period of heightened activity across its Colombian assets.

- We'll examine how reaffirmed guidance and rising production volumes may reshape the company’s investment narrative and outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Parex Resources Investment Narrative Recap

To invest in Parex Resources, shareholders must be confident in the company’s ability to drive consistent production growth and manage its concentrated exposure to Colombia’s regulatory environment. The latest quarterly results reaffirm production guidance and highlight increasing light and medium oil as well as natural gas output, but do not materially change the biggest short-term catalyst, successful new exploration and production ramp-up, or the central risk of geographic and political exposure in Colombia. For now, the trajectory of the company’s value remains closely tied to these factors.

Among the recent updates, Parex Resources’ reaffirmed 2025 production guidance, with expectations to exceed the higher end in the fourth quarter, directly ties into the most important short-term catalyst for the business. This operational consistency lends support to its near-term outlook, especially as new exploration results are anticipated by year-end.

By contrast, investors should be aware that, despite reassuring production figures, Parex’s exclusive focus on Colombia continues to expose shareholders to...

Read the full narrative on Parex Resources (it's free!)

Parex Resources' outlook calls for $956.5 million in revenue and $243.7 million in earnings by 2028. This is based on a -0.6% annual revenue decline and a $117.2 million increase in earnings from the current $126.5 million level.

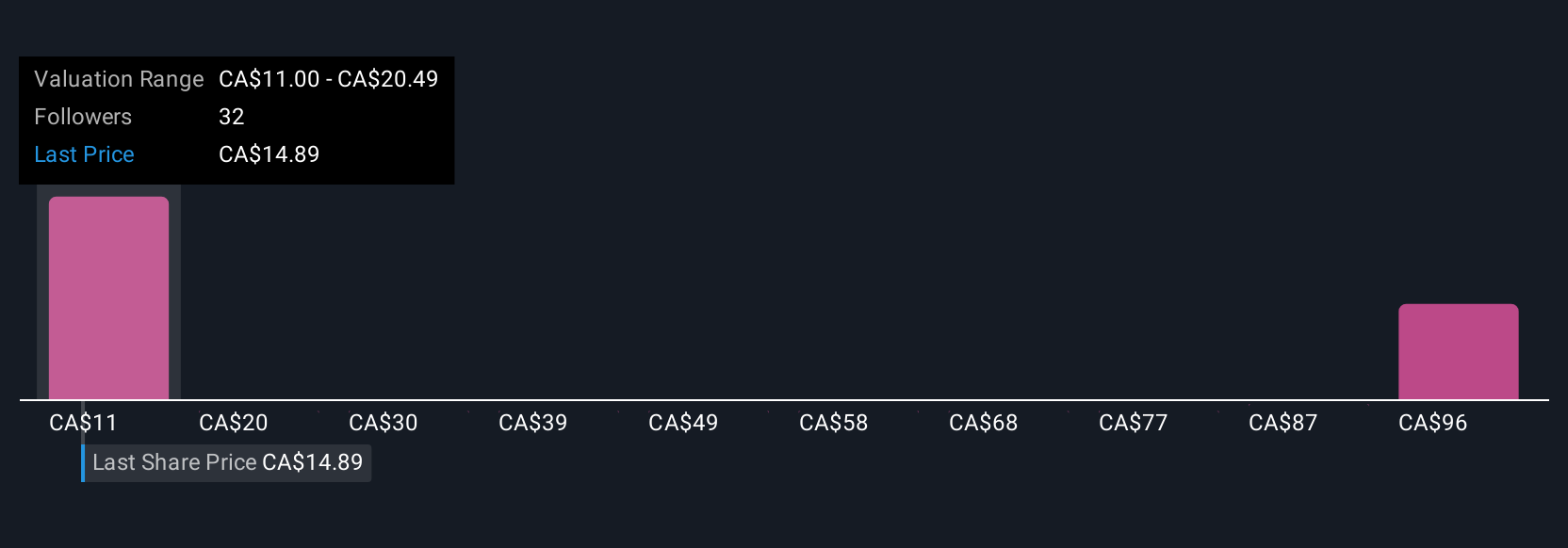

Uncover how Parex Resources' forecasts yield a CA$19.83 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Nine different Simply Wall St Community fair value estimates for Parex Resources range from CA$12.72 to CA$76.25 per share. While production guidance supports the near-term outlook, reliance on Colombian assets means outcomes can still shift quickly; compare these perspectives for a richer view.

Explore 9 other fair value estimates on Parex Resources - why the stock might be worth 31% less than the current price!

Build Your Own Parex Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Parex Resources research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Parex Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Parex Resources' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PXT

Parex Resources

Engages in the exploration, development, production, and marketing of oil and natural gas in Colombia.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives