- Canada

- /

- Oil and Gas

- /

- TSX:PXT

Are Shares of Parex Resources Attractive After a 59% Climb and Oil Price Surge?

Reviewed by Bailey Pemberton

- Ever wondered if Parex Resources might just be undervalued right now? Let’s take a closer look at whether this stock could be offering more than meets the eye.

- Parex’s share price has been on a tear, climbing nearly 24% year to date and an impressive 59.4% over the past 12 months, though there has been a slight dip of 0.3% in the past week.

- Part of this momentum traces back to a recent jump in oil prices, which has lifted many energy stocks. In addition, positive sentiment around the company’s successful exploration activities in Colombia has helped bolster investor confidence and drawn renewed attention from analysts and institutions.

- Parex scores a 5 out of 6 on our valuation checks, making it a standout in its sector. Soon we will break down why, and reveal a fresher, more holistic way to size up its real market value.

Approach 1: Parex Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to the present day. This approach gives investors an informed sense of a company’s underlying worth beyond market sentiment.

For Parex Resources, the most recent Free Cash Flow stands at $122.6 Million. Analysts forecast cash flows for up to five years, with estimates suggesting relatively stable annual values. Looking further ahead, projections indicate that by 2035, Parex's Free Cash Flow could reach nearly $132.4 Million. These extended forecasts beyond analyst coverage have been extrapolated to capture potential long-term performance.

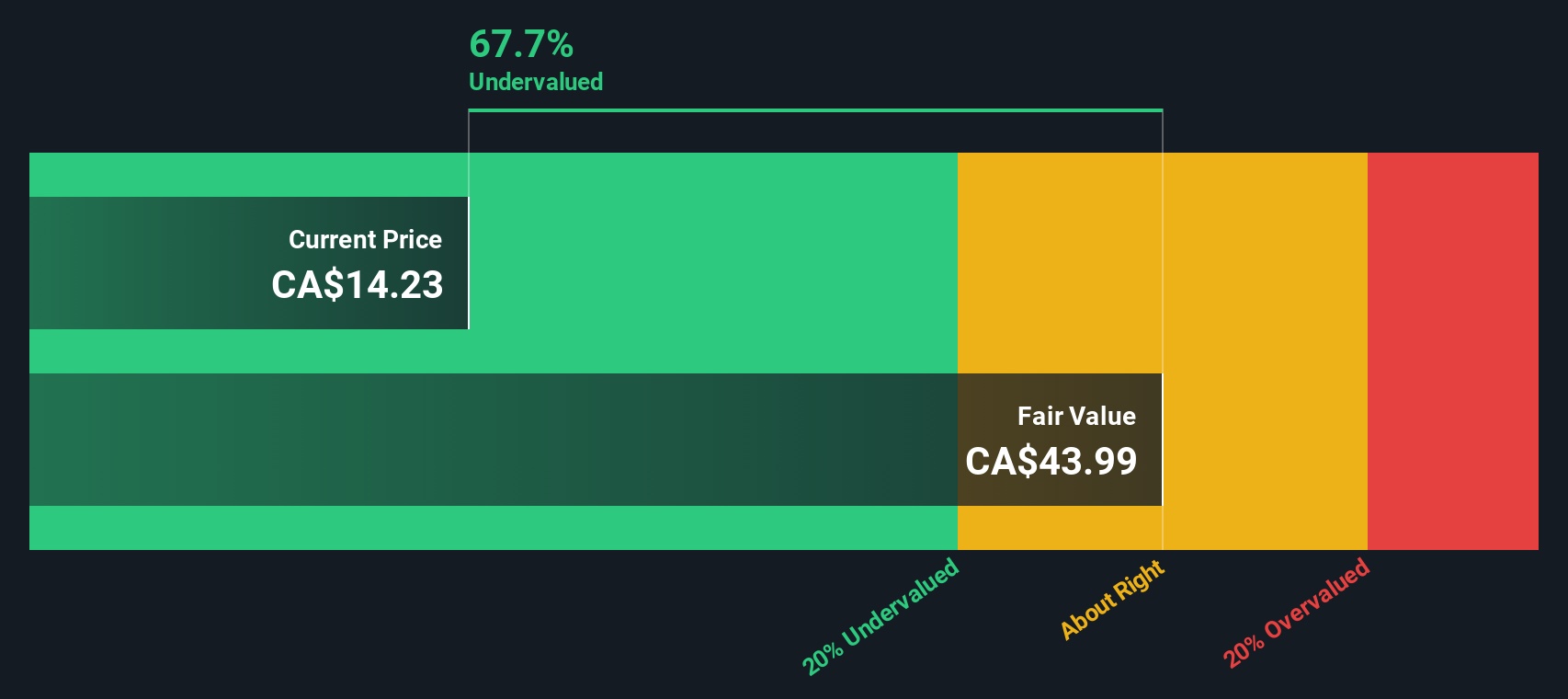

Based on these cash flow estimates, the DCF model sets Parex Resources’ intrinsic value at $45.66 per share. This implies the stock is trading at a significant 59.3% discount compared to its calculated fair value. This may indicate that the market is underappreciating Parex’s prospects.

The discounted cash flow analysis suggests that Parex Resources offers considerable value relative to its current price, especially when compared to its future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Parex Resources is undervalued by 59.3%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Parex Resources Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Parex Resources. It offers a snapshot of how much investors are willing to pay today for each dollar of the company’s earnings. This makes it particularly helpful for gauging conventional market sentiment about a stock’s growth outlook and risk profile.

Generally, higher growth prospects and lower risks warrant a higher PE ratio, while limited growth or greater uncertainty justifies a lower figure. Therefore, the “fair” PE for any given stock should reflect expectations about its future earnings, industry characteristics, size, and risk factors, rather than just what the average peer might trade at.

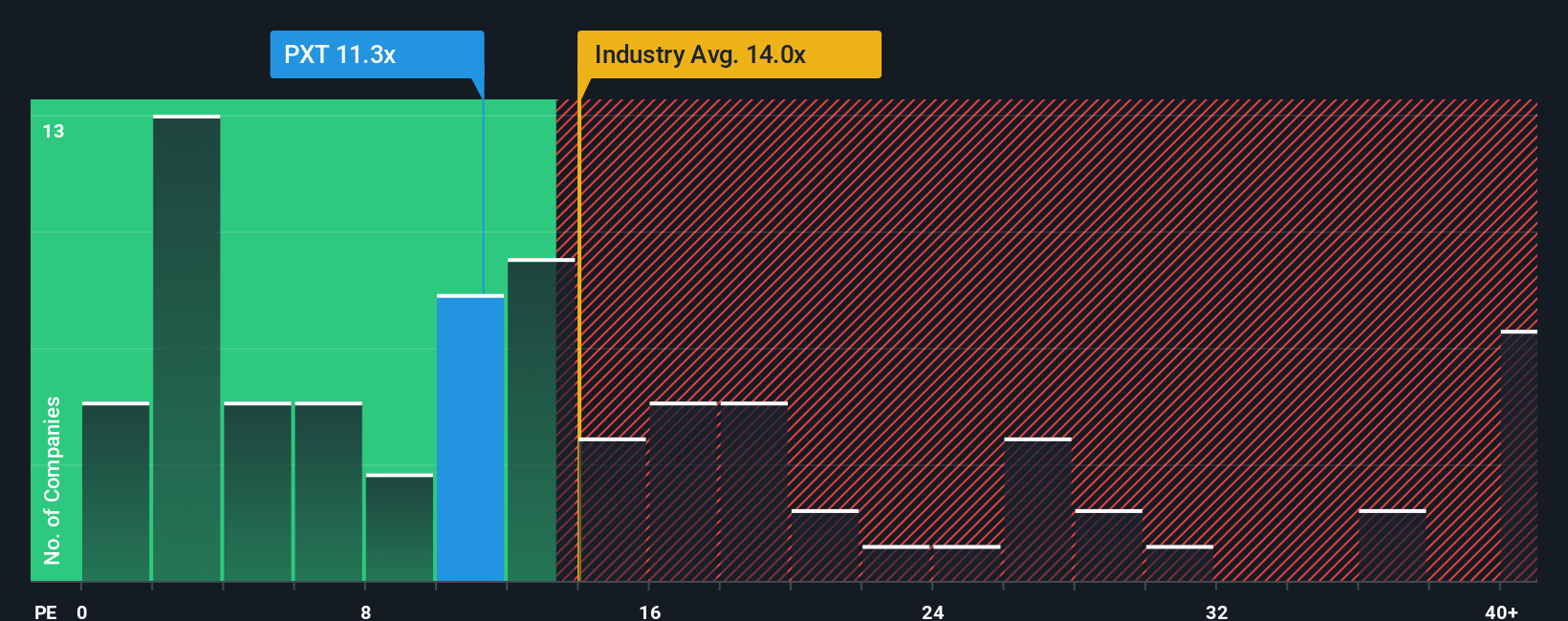

Parex Resources currently trades at a PE ratio of 10.1x. This is well below the Oil and Gas industry average of 12.5x and the average among close peers of 21.0x. More importantly, our proprietary Fair Ratio model sets Parex’s fair PE at 12.1x, which calibrates industry benchmarks with variables such as profit margins, growth forecasts, company size, and risk.

Simply Wall St’s Fair Ratio provides a more tailored benchmark than generic averages because it accounts for Parex’s specific strengths and challenges instead of relying solely on a one-size-fits-all comparison.

Sitting below both its Fair Ratio and broader benchmarks, Parex Resources appears undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Parex Resources Narrative

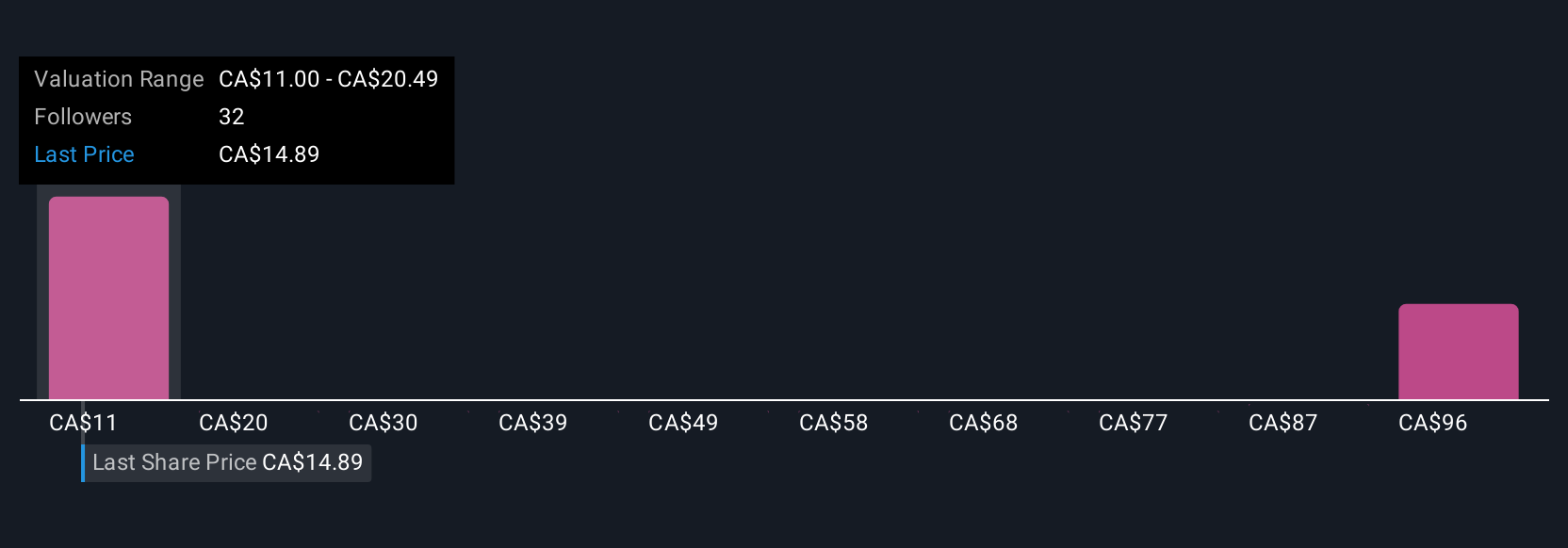

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique perspective or “story” about a company, combining your estimates for its future revenue, earnings and margins with your assumed fair value. This creates a clear link between the business story, your financial forecast, and whether the stock is fairly priced.

Narratives are easy to create and use on the Simply Wall St Community page. They empower millions of investors to go beyond the numbers and anchor their buy or sell decisions to their own understanding of what really matters. Because Narratives compare your fair value directly to today’s market price, you can instantly see if you believe the stock is attractive. Since they update dynamically when news or earnings arrive, your view always stays relevant.

For example, if you think Parex Resources will expand its reserves and capture new markets, your Narrative could reflect strong earnings growth and a higher fair value. Another investor may take a more conservative view, focusing on risks in Colombia and mature assets, which could lead them to a lower fair value. Narratives put the story and control in your hands, helping you invest with conviction and clarity.

Do you think there's more to the story for Parex Resources? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PXT

Parex Resources

Engages in the exploration, development, production, and marketing of oil and natural gas in Colombia.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion