- Canada

- /

- Oil and Gas

- /

- TSX:PSK

How Will PrairieSky Royalty's (TSX:PSK) Mixed Q3 Results and Leadership Changes Shape Its Investment Story?

Reviewed by Sasha Jovanovic

- PrairieSky Royalty recently reported its third-quarter 2025 results, revealing revenue of C$114.8 million and net income of C$45.9 million, both slightly lower than the same period last year, despite an 11% increase in oil royalty production volumes.

- Alongside earnings, the company announced the completion of a C$66.5 million share buyback and the upcoming appointment of Ian Dundas, an experienced industry executive, to its board effective January 1, 2026.

- We’ll explore how PrairieSky Royalty’s mix of increased production and reduced profitability may influence its investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is PrairieSky Royalty's Investment Narrative?

To be comfortable owning shares of PrairieSky Royalty, investors typically need to believe in the company’s ability to generate stable royalties from oil and gas production, manage costs effectively, and maintain a disciplined approach to capital allocation. The recent news, where revenue and net income came in slightly lower despite improved production, suggests the company may be wrestling with price pressures or rising expenses, potentially impacting short-term performance and the case for profit growth. The completed C$66.5 million share buyback shows a commitment to returning capital, but it doesn’t offset earnings softness. Meanwhile, the appointment of Ian Dundas to the board is unlikely to alter these immediate catalysts or risks, as any boardroom influence takes time to play out. For now, the most significant risks remain profitability pressures and relative valuation versus peers, rather than any immediate change stemming from this news. On the other hand, dividend coverage and payout sustainability require attention now more than ever.

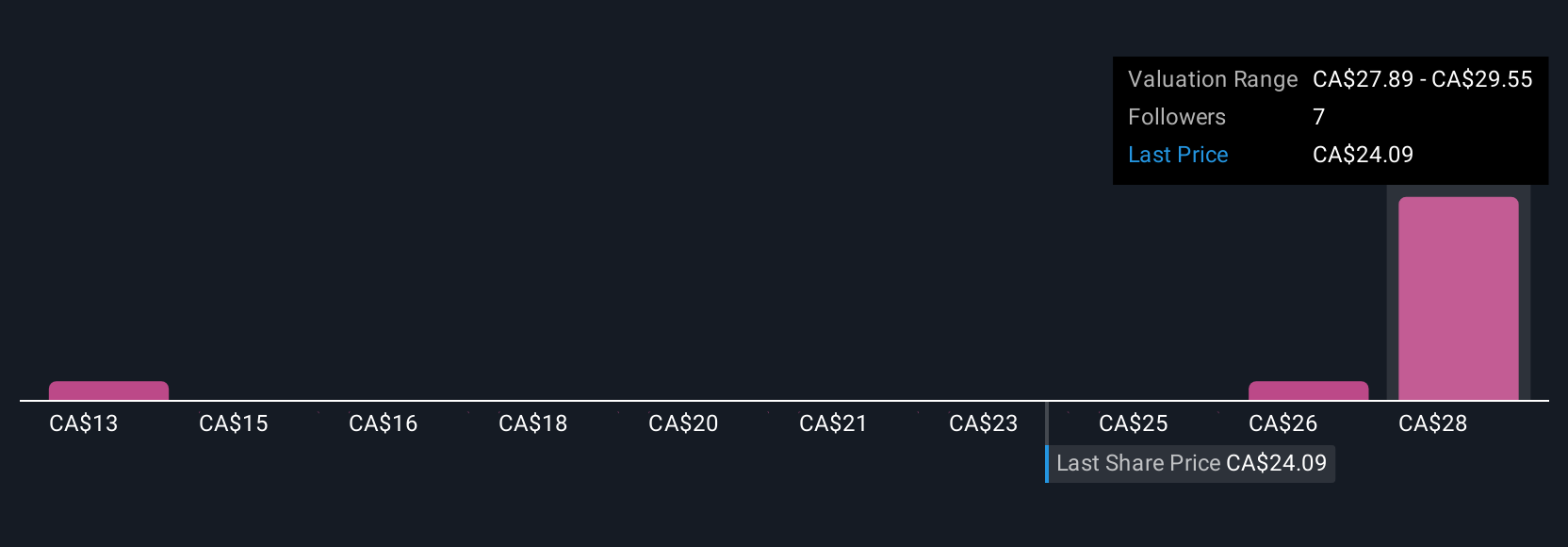

PrairieSky Royalty's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 4 other fair value estimates on PrairieSky Royalty - why the stock might be worth 49% less than the current price!

Build Your Own PrairieSky Royalty Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PrairieSky Royalty research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PrairieSky Royalty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PrairieSky Royalty's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PSK

PrairieSky Royalty

PrairieSky Royalty Ltd. holds crude oil and natural gas royalty interests in Canada.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives