- Canada

- /

- Energy Services

- /

- TSX:PSD

Are Pulse Seismic's (TSX:PSD) Dividends and Buybacks Reframing Its Capital Allocation Story?

Reviewed by Sasha Jovanovic

- Pulse Seismic Inc. recently reported its third quarter 2025 earnings, revealing a net loss of C$1.5 million but a sharp increase in net income to C$21.44 million for the nine months ended September 30, 2025, compared to the prior year.

- The company declared both regular and special dividends and continued share buybacks, underscoring its focus on capital returns even in the face of sector uncertainty.

- We'll examine how Pulse Seismic's dividend declarations and strong balance sheet shape its evolving investment narrative amid shifting industry trends.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Pulse Seismic's Investment Narrative?

To make a case for Pulse Seismic as a compelling stock, investors typically need to believe in the company’s ability to consistently generate strong cash flows from its seismic data library, reward shareholders with dividends and buybacks, and maintain discipline regardless of commodity cycles. The latest set of results, showing a small net loss in the most recent quarter but a dramatic surge in net income over the nine months, doesn’t fundamentally change this long-term story. The regular and special dividends, combined with a debt-free balance sheet, still signal strong capital management. However, the pullback in share repurchases this quarter and the market’s recent price drop may point to some shifting priorities or softer near-term demand for data licensing. While the headline profit swing and continued capital return matter, they don’t seem material enough to offset ongoing risks like volatility in seismic data sales linked to energy sector uncertainty.

Conversely, short-term swings in licensing revenues can change the outlook quickly for shareholders.

Exploring Other Perspectives

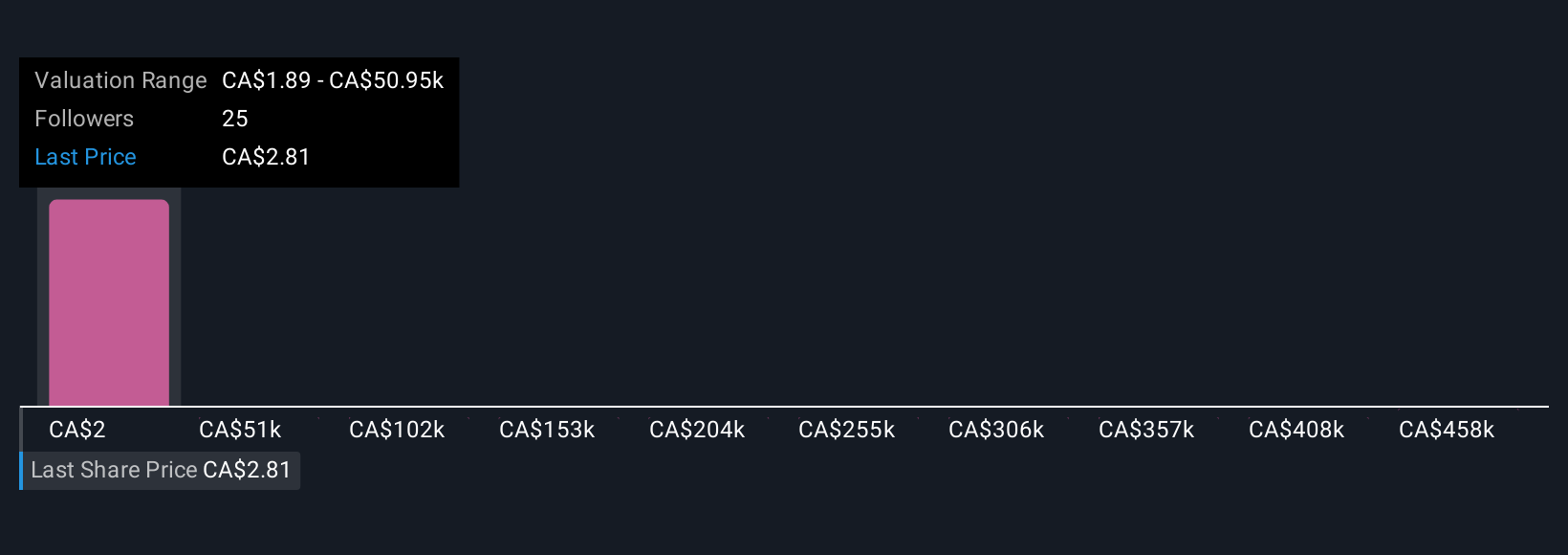

Explore 13 other fair value estimates on Pulse Seismic - why the stock might be a potential multi-bagger!

Build Your Own Pulse Seismic Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pulse Seismic research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pulse Seismic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pulse Seismic's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PSD

Pulse Seismic

Acquires, markets, and licenses two-dimensional (2D) and three-dimensional (3D) seismic data for the energy sector in Canada.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion