- Canada

- /

- Oil and Gas

- /

- TSX:PPL

How Pembina Pipeline’s 20-Year LNG Deal With PETRONAS Could Shape Future Revenue (TSX:PPL)

Reviewed by Sasha Jovanovic

- Pembina Pipeline Corporation and Petroliam Nasional Berhad (PETRONAS) announced in early November 2025 the signing of a 20-year agreement for 1 million tonnes per annum of liquefaction capacity at the Cedar LNG facility.

- This agreement advances Pembina's progress in fully commercializing Cedar LNG, offering increased revenue visibility and helping to underpin project economics.

- We'll examine how Pembina's long-term LNG deal with PETRONAS supports its revenue outlook and strengthens its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Pembina Pipeline Investment Narrative Recap

To be a Pembina Pipeline shareholder, you need confidence in the long-term global demand for Canadian energy exports and Pembina's ability to successfully execute and commercialize major projects like Cedar LNG. The new 20-year LNG agreement with PETRONAS adds greater revenue certainty, but it does not materially shift the most immediate catalyst, securing the remaining Cedar LNG capacity or substantially mitigate the key risks around project delays and regulatory headwinds.

Among recent company announcements, Pembina's third-quarter earnings report stands out. While revenue dipped and net income declined from the previous year, the Cedar LNG agreement with PETRONAS has not yet altered the financial trajectory or resolved the company's exposure to large-project risk, including capital allocation and possible schedule changes.

However, investors should be aware that regulatory or policy setbacks remain a risk to Pembina’s growth strategy, particularly if...

Read the full narrative on Pembina Pipeline (it's free!)

Pembina Pipeline's outlook projects CA$8.1 billion in revenue and CA$1.9 billion in earnings by 2028. This is based on a 0.0% annual revenue growth rate and a CA$0.2 billion increase in earnings from the current CA$1.7 billion.

Uncover how Pembina Pipeline's forecasts yield a CA$58.89 fair value, a 8% upside to its current price.

Exploring Other Perspectives

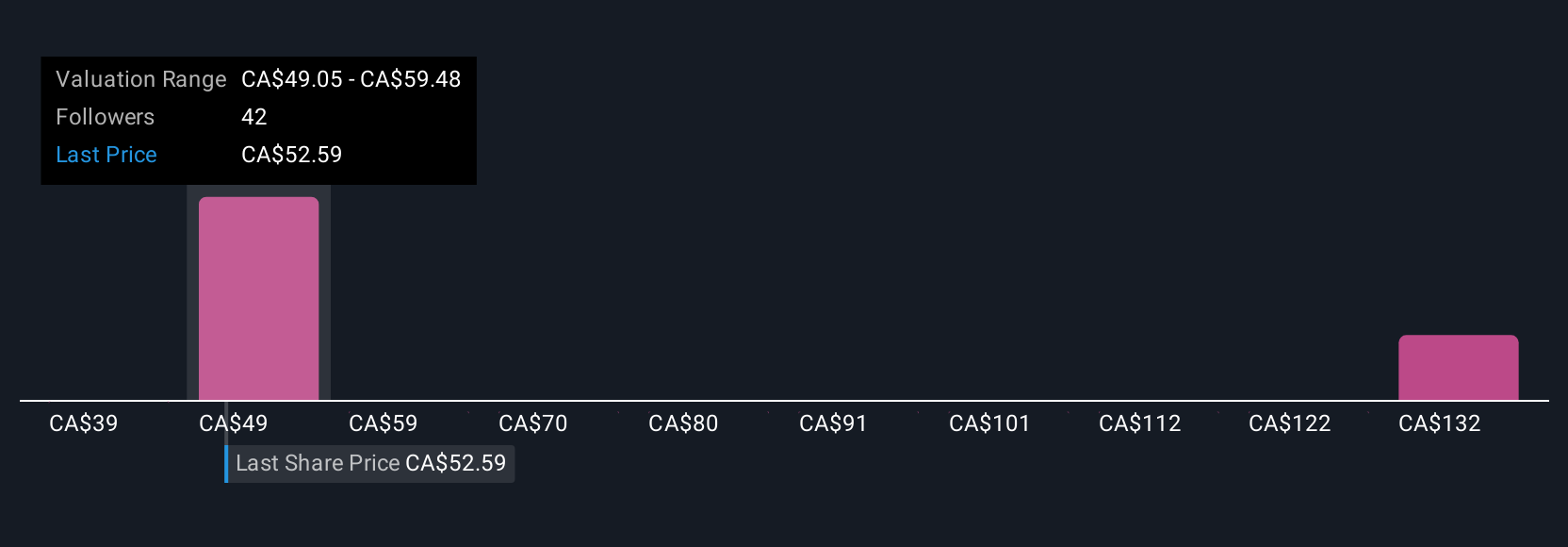

Fair value estimates from the Simply Wall St Community range widely from CA$31.80 to CA$147.07, with nine unique perspectives represented. Against this backdrop, uncertainties around large capital project execution present both opportunities and meaningful risks for those assessing the company’s future.

Explore 9 other fair value estimates on Pembina Pipeline - why the stock might be worth 41% less than the current price!

Build Your Own Pembina Pipeline Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pembina Pipeline research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pembina Pipeline research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pembina Pipeline's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PPL

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives