- Canada

- /

- Oil and Gas

- /

- TSX:POU

Those Who Purchased Paramount Resources (TSE:POU) Shares Five Years Ago Have A 91% Loss To Show For It

Long term investing works well, but it doesn't always work for each individual stock. It hits us in the gut when we see fellow investors suffer a loss. Spare a thought for those who held Paramount Resources Ltd. (TSE:POU) for five whole years - as the share price tanked 91%. And we doubt long term believers are the only worried holders, since the stock price has declined 58% over the last twelve months. Shareholders have had an even rougher run lately, with the share price down 40% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Paramount Resources

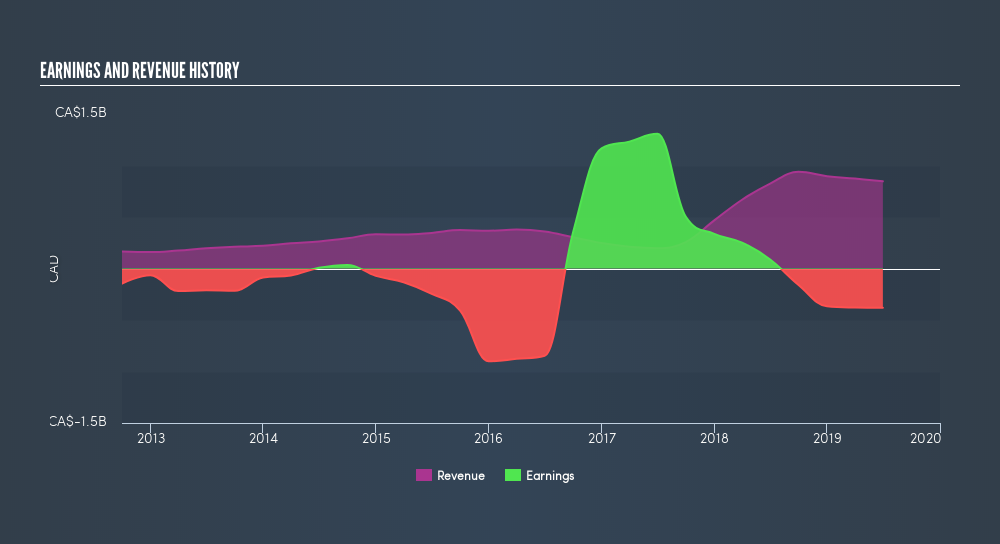

Paramount Resources isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Paramount Resources saw its revenue increase by 27% per year. That's well above most other pre-profit companies. So it's not at all clear to us why the share price sunk 38% throughout that time. It could be that the stock was over-hyped before. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Paramount Resources will earn in the future (free profit forecasts).

A Different Perspective

We regret to report that Paramount Resources shareholders are down 58% for the year. Unfortunately, that's worse than the broader market decline of 0.4%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 38% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Paramount Resources is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:POU

Paramount Resources

An energy company, explores for and develops conventional and unconventional petroleum and natural gas reserves and resources in Canada.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives