- Canada

- /

- Oil and Gas

- /

- TSX:PKI

Parkland (TSX:PKI) Reports CA$148 Million One-Off Loss, Challenging Strong Growth Narrative

Reviewed by Simply Wall St

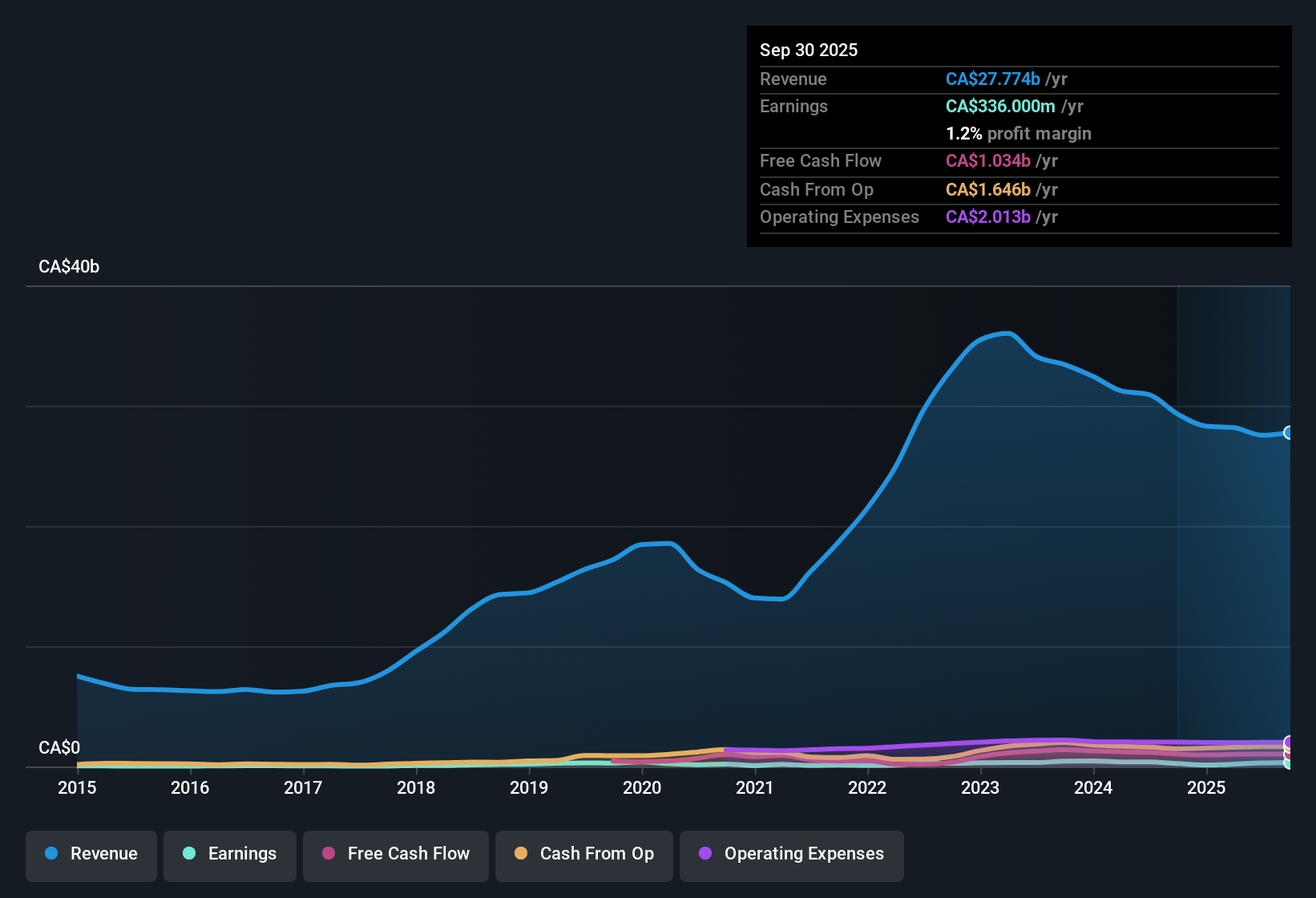

Parkland (TSX:PKI) reported consensus forecast gains, with annual earnings projected to grow by 15.4% and revenue by 4.1% per year. Despite this outlook, recent results show a negative earnings rate, net profit margins slipping to 1.1% from last year’s 1.2%, and a notable one-off loss of CA$148 million weighing down trailing twelve-month profits. Over the past five years, earnings grew at an average of 16.5% annually, setting up stronger anticipated growth but with profitability pressure lingering from recent extraordinary items.

See our full analysis for Parkland.Next, we will compare these latest numbers with the key narratives that investors and analysts follow, highlighting where expectations and new realities either align or diverge.

See what the community is saying about Parkland

Premium Price-to-Earnings Ratio Despite Peer Discount

- Parkland trades at a price-to-earnings ratio of 24x, well above both its peer group average of 16.3x and the broader Canadian oil and gas industry at 12.5x. However, its share price of CA$41.03 sits notably below the DCF fair value of CA$131.66.

- According to the analysts' consensus view, this apparent valuation gap is tied to expectations that Parkland will grow earnings at a robust 15.4% annually, with catalysts including strategic reviews and business optimization efforts.

- Despite the high P/E, analysts project annual earnings will jump from CA$298 million to CA$817.2 million over roughly five years. This would justify a much lower future P/E (11.4x) compared to what the company currently commands.

- This creates a situation where investors must decide whether the current market price undervalues long-term growth or if the lofty multiple already prices in the best-case scenario.

Margins Under Pressure From Non-Recurring Losses

- Parkland's net profit margin holds at 1.1%, slipping slightly from 1.2% in the prior year, while the trailing twelve months included a sizable one-off loss of CA$148 million.

- Consensus narrative highlights that while the company is targeting margin expansion to 2.7% in three years, one-off losses have distorted near-term profitability, raising questions about the reliability of current margins as a growth base.

- Analysts expect that U.S. business restructuring and international investments can lift operational efficiency, but the significant recent loss flags the risk that future gains may be slower than projected if non-recurring issues persist.

- Operational improvements need to materialize quickly to help margins catch up to future targets. Otherwise, current setbacks could linger longer than management expects.

Strategic Reviews and Expansion Drive Revenue Bets

- Parkland's Board is conducting a strategic review, including options such as mergers, acquisitions, or a potential sale, alongside expansion into higher-margin retail like alcohol sales in Ontario and investments in the Caribbean infrastructure.

- From the consensus narrative, these actions are expected to grow annual revenue by 3.4% for the next three years, but face headwinds from macro risks such as political instability and weak U.S. segment performance.

- Increased membership in JOURNIE Rewards and partnerships are aimed at boosting market share and recurring sales, which could pad top-line growth if economic and regulatory backdrops are supportive.

- However, market critics warn that soft fuel demand and margin compression in the U.S. could limit the upside, indicating that expansion efforts must overcome both structural and cyclical obstacles to deliver as projected.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Parkland on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique perspective on these figures? Share your own take in just a few minutes and make your voice heard. Do it your way

A great starting point for your Parkland research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Recent results expose Parkland’s vulnerability to profit setbacks from one-off losses and slipping margins, which raises questions about its long-term stability.

If dependable growth aligns better with your goals, focus on stable growth stocks screener (2111 results) to identify companies consistently delivering steady earnings and revenue regardless of market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PKI

Parkland

Operates food and convenience stores in Canada, the United States, and internationally.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives