- Canada

- /

- Oil and Gas

- /

- TSX:PKI

Parkland (TSX:PKI): Assessing Valuation as Investors Weigh Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 11% Undervalued

According to the prevailing narrative, Parkland shares are considered undervalued, with market pricing failing to fully reflect the company’s future earnings potential and operational catalysts.

The strategic review initiated by Parkland's Board seeks to explore various strategic alternatives, including mergers, divestitures, acquisitions, and the sale of the company. These actions could unlock intrinsic value and optimize the business portfolio, potentially impacting revenue and earnings.

Curious about the big numbers behind Parkland’s fair value? The narrative hints at major upgrades to earnings and profitability, all tied to ambitious projections and a profit multiple most stocks would envy. What assumptions power this bold price target? The underlying financial playbook just might surprise you.

Result: Fair Value of $43.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weak fuel demand and ongoing refinery challenges could easily overturn current optimism and put Parkland’s growth expectations to the test in the months ahead.

Find out about the key risks to this Parkland narrative.Another View

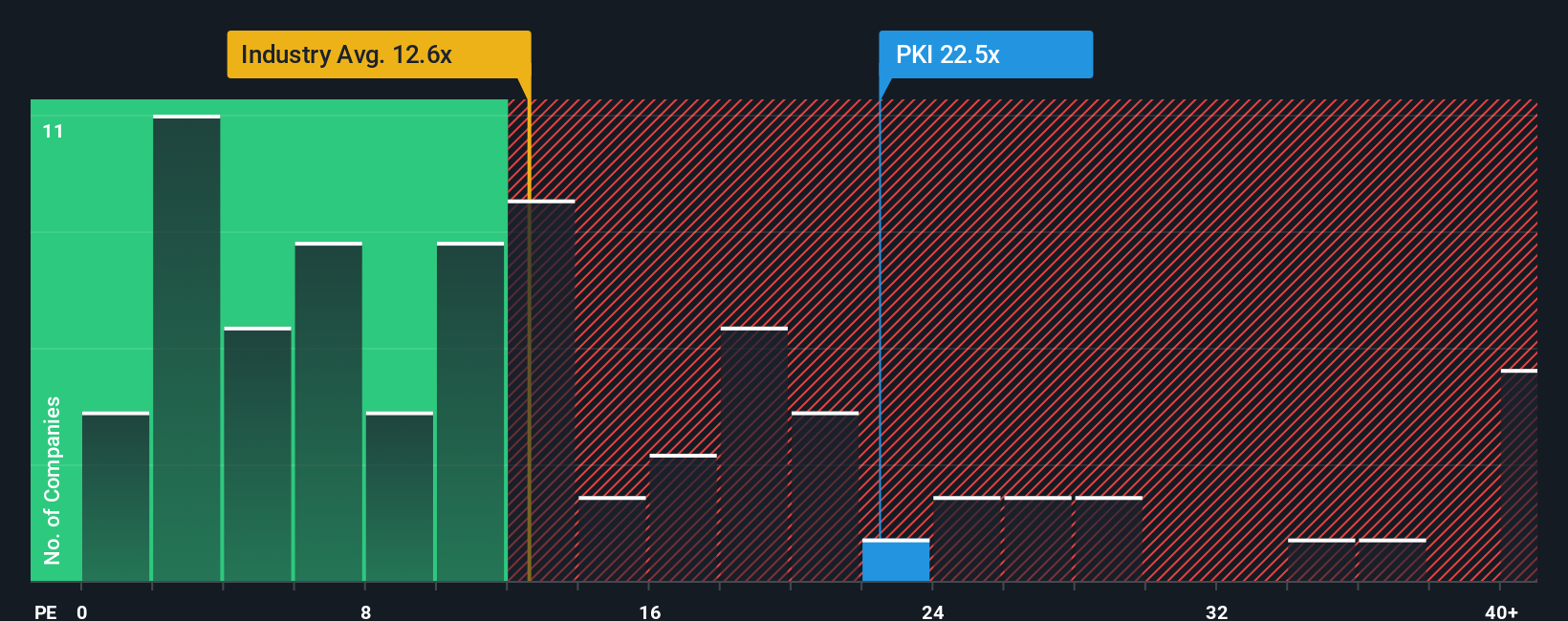

While fair value estimates suggest Parkland is undervalued, looking at its price compared to industry norms paints a different picture. By this measure, Parkland appears more expensive than many similar energy companies. Which side will the market believe?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Parkland Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own Parkland story in just a few minutes. Do it your way

A great starting point for your Parkland research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investing Ideas?

Don’t let opportunity pass you by. Broaden your financial horizons and spot tomorrow’s winners by tapping into the latest themes and trends, all in one place.

- Uncover fresh income streams and maximize your portfolio’s potential with dividend stocks with yields > 3% built to spotlight companies delivering yields above 3%.

- Capitalize on the artificial intelligence wave by finding early movers and standout players through our exclusive list of AI penny stocks shaking up multiple industries.

- Sharpen your value strategy and seize stocks trading below their real worth with undervalued stocks based on cash flows designed for those who want more from every dollar invested.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PKI

Parkland

Operates food and convenience stores in Canada, the United States, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives