- Canada

- /

- Oil and Gas

- /

- TSX:PKI

A Closer Look at Parkland (TSX:PKI) Valuation Following Recent Upward Momentum

Reviewed by Simply Wall St

Parkland (TSX:PKI) Stock Catches Investor Attention After Subtle Upward Move

If you have been keeping an eye on Parkland (TSX:PKI), you may have noticed its shares quietly inching higher recently. While there is no big headline or breaking news event behind the move, the uptick is catching investor attention and raising questions about whether there is a signal here worth exploring. Sometimes, it is these less dramatic shifts that spark the most interesting debates, especially when it comes to figuring out whether the market recognizes underlying value or if it is just business as usual.

Looking at the past year, Parkland’s stock has delivered a 13% total return, with a nearly 19% gain year-to-date. Momentum has built up gradually, supported in part by annual revenue and net income growth. There have not been any major announcements to explain the most recent movement, so it is possible investors are reacting to fundamental improvements or recalibrating expectations for future results.

Does this quiet rally suggest Parkland is trading below its true value, or are investors already pricing in potential growth ahead? Let’s dig into the numbers.

Most Popular Narrative: 9.7% Undervalued

According to the most widely followed narrative, Parkland shares are trading below what analysts consider their fair value. This presents a potential opportunity for investors looking for undervalued assets with improving fundamentals.

The strategic review initiated by Parkland's Board seeks to explore various strategic alternatives, including mergers, divestitures, acquisitions, and the sale of the company. These actions could unlock intrinsic value and optimize the business portfolio, potentially impacting revenue and earnings.

Want to know what’s driving this bullish outlook on Parkland? The secret behind this valuation could be bold financial projections that defy recent profit trends. Curious how future margins and growth rates could influence the fair value? The underlying assumptions may surprise you.

Result: Fair Value of $43.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weak fuel demand or political turbulence could quickly upend these expectations. This would make Parkland’s outlook far less predictable than recent numbers suggest.

Find out about the key risks to this Parkland narrative.Another View: Are Shares Actually Overpriced?

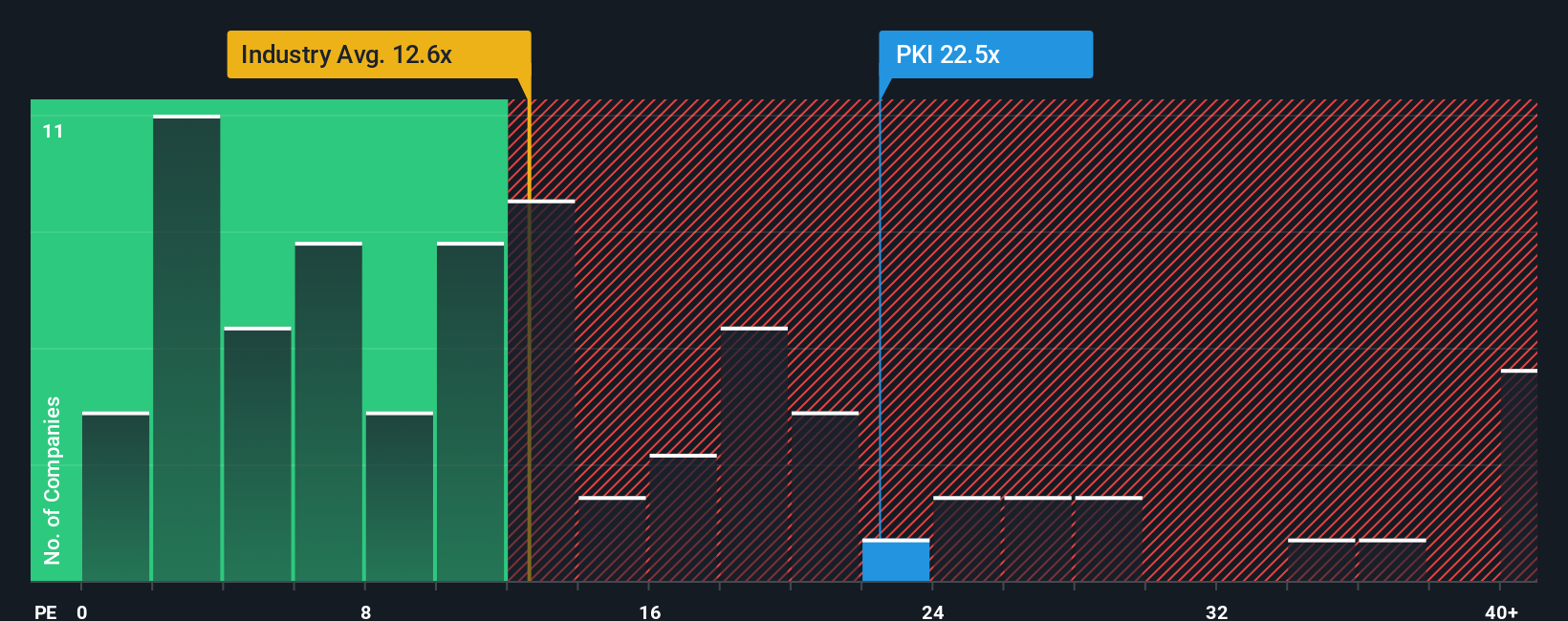

While the analyst consensus points to Parkland being undervalued, some investors look at typical valuation ratios and see a different story. Parkland currently trades at a much higher price compared to its industry, which hints it could actually be expensive right now. Which method do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Parkland to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Parkland Narrative

Keep in mind, if you see things differently or want to run your own numbers, it is quick and easy to craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Parkland research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your search to just one opportunity. Use the right tools to give yourself an edge. The Simply Wall Street Screener puts the world of potential investments at your fingertips.

- Spot high-yield opportunities by scanning for companies providing dividend stocks with yields > 3% that could boost your income and strengthen your portfolio.

- Tap into tomorrow’s breakthroughs by tracking quantum computing stocks and see which businesses are pioneering advances in this transformational field.

- Uncover hidden bargain buys with access to undervalued stocks based on cash flows so you never let potential value opportunities slip off your radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:PKI

Parkland

Operates food and convenience stores in Canada, the United States, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives