- Canada

- /

- Oil and Gas

- /

- TSX:PEY

Will Peyto CEO’s Recent Share Sale Alter Investor Perceptions of Management’s Outlook (TSX:PEY)?

Reviewed by Sasha Jovanovic

- On November 27th, 2025, Jean-Paul Henri Lachance, CEO and Director of Peyto Exploration & Development, exercised options and sold 74,000 common shares at a price of CA$22.00.

- This insider transaction is now drawing investor attention, as such moves by senior management can sometimes offer insights into how executives perceive the company’s current position or prospects.

- We’ll now consider what this CEO share sale could mean for Peyto’s investment narrative, especially in relation to leadership’s outlook.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Peyto Exploration & Development Investment Narrative Recap

To be a shareholder in Peyto Exploration & Development, you need confidence in the long-term demand for Canadian natural gas, especially as LNG export facilities grow and Peyto leverages its cost structure to maintain margins. The recent sale of shares by the CEO is drawing attention but does not appear to materially impact the company’s main short-term catalyst: the benefit from ramping LNG exports. The biggest risk remains Peyto’s concentrated exposure to Alberta gas production and the associated local regulatory and pricing hurdles.

Most relevant to the CEO share sale is Peyto’s consistent monthly dividend of CA$0.11 per share, recently reaffirmed for December 2025. This continued pattern of payouts signals management’s ongoing focus on rewarding shareholders, even as the company manages price volatility and infrastructure constraints.

In contrast, investors should be aware that the concentration of Peyto’s gas production in Alberta means exposure to...

Read the full narrative on Peyto Exploration & Development (it's free!)

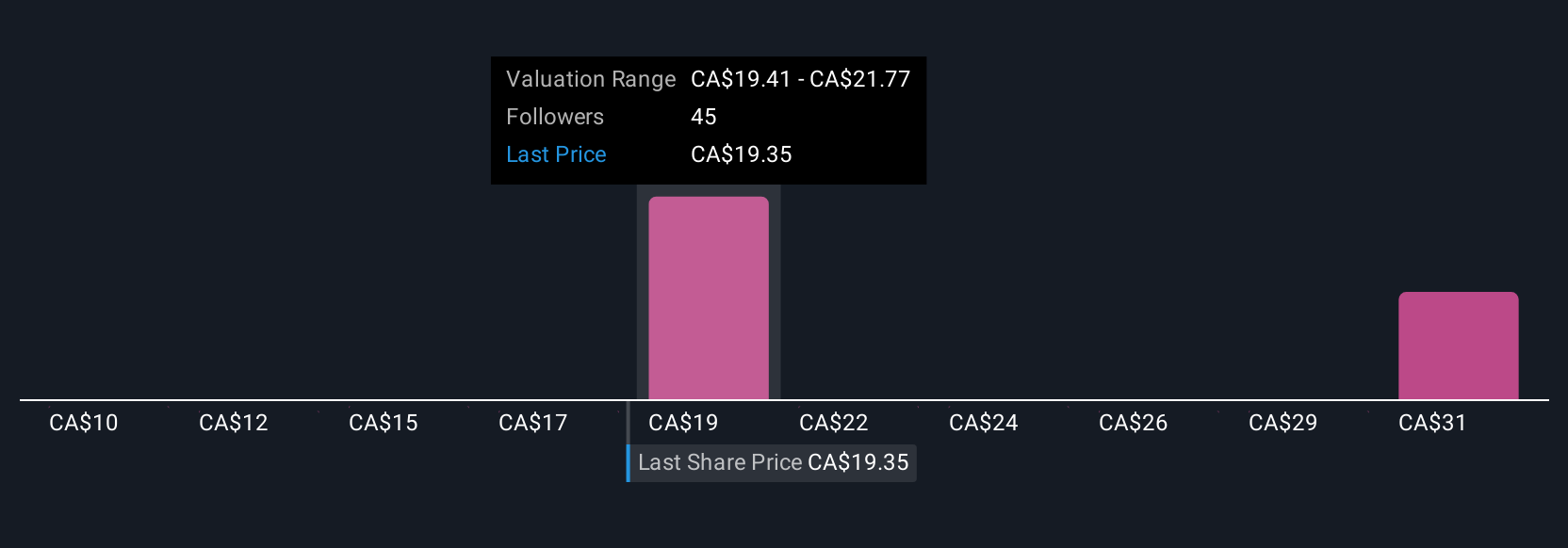

Peyto Exploration & Development's outlook anticipates CA$1.5 billion in revenue and CA$477.4 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 16.6% and represents an earnings increase of CA$146.2 million from current earnings of CA$331.2 million.

Uncover how Peyto Exploration & Development's forecasts yield a CA$22.91 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from four Simply Wall St Community members range from CA$22.91 to CA$64.26, a difference of over CA$41.00. With LNG export growth expected to lift demand but Alberta-focused risk still present, consider how diverging views can shape your research.

Explore 4 other fair value estimates on Peyto Exploration & Development - why the stock might be worth just CA$22.91!

Build Your Own Peyto Exploration & Development Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peyto Exploration & Development research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Peyto Exploration & Development research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peyto Exploration & Development's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PEY

Peyto Exploration & Development

Engages in the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta’s deep basin.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026