- Canada

- /

- Commercial Services

- /

- TSX:KBL

Top 3 TSX Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Amidst a backdrop of easing inflation and cautious central bank policies, the Canadian market has been navigating through a whirlwind of economic indicators and corporate earnings reports. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for investors looking to enhance their portfolios.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.78% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.38% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.49% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.55% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.58% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.35% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.84% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.94% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.95% | ★★★★★☆ |

| Canadian Western Bank (TSX:CWB) | 3.04% | ★★★★★☆ |

Click here to see the full list of 35 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

K-Bro Linen (TSX:KBL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: K-Bro Linen Inc. provides laundry and linen services to healthcare institutions, hotels, and other commercial organizations in Canada and the United Kingdom, with a market cap of CA$371.74 million.

Operations: K-Bro Linen Inc. generates CA$330.33 million in revenue from providing laundry and linen services to the healthcare and hospitality sectors.

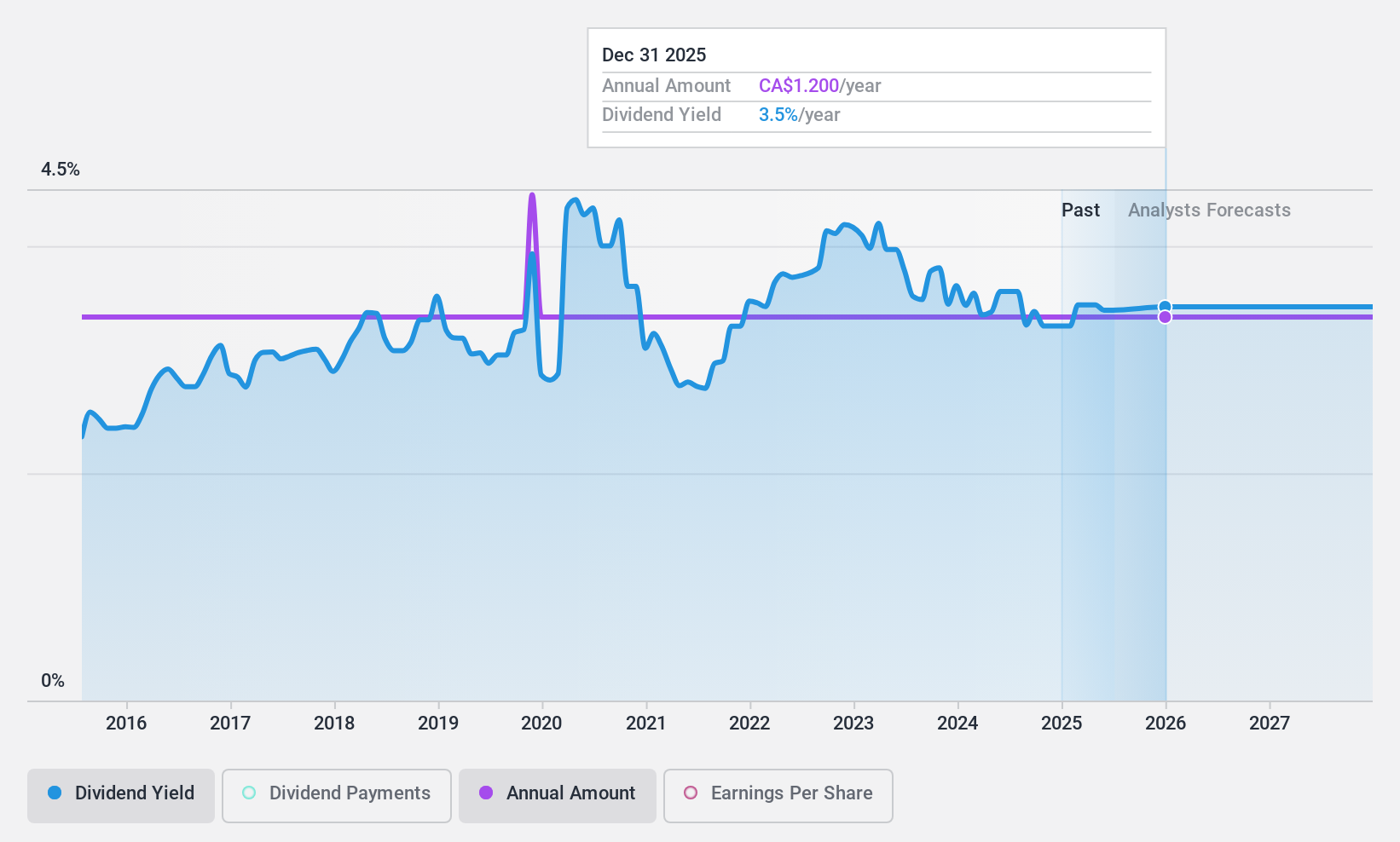

Dividend Yield: 3.4%

K-Bro Linen offers a stable dividend yield of 3.43%, backed by consistent payments over the past decade and reasonable payout ratios (earnings: 73.2%, cash flows: 38.5%). Despite recent earnings showing slight declines, with Q2 net income at C$4.54 million compared to C$4.69 million last year, the company maintains its dividend reliability and growth potential, supported by ongoing share repurchase programs and analyst optimism for future price appreciation.

- Take a closer look at K-Bro Linen's potential here in our dividend report.

- According our valuation report, there's an indication that K-Bro Linen's share price might be on the cheaper side.

Olympia Financial Group (TSX:OLY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Olympia Financial Group Inc., with a market cap of CA$238.23 million, operates in Canada through its subsidiary Olympia Trust Company as a non-deposit taking trust company.

Operations: Olympia Financial Group Inc. generates revenue through various segments, including Health (CA$10.04 million), Corporate (CA$0.18 million), Exempt Edge (EE) (CA$1.37 million), Investment Account Services (IAS) (CA$78.05 million), Currency and Global Payments (CGP) (CA$8.63 million), and Corporate and Shareholder Services (CSS) (CA$3.78 million).

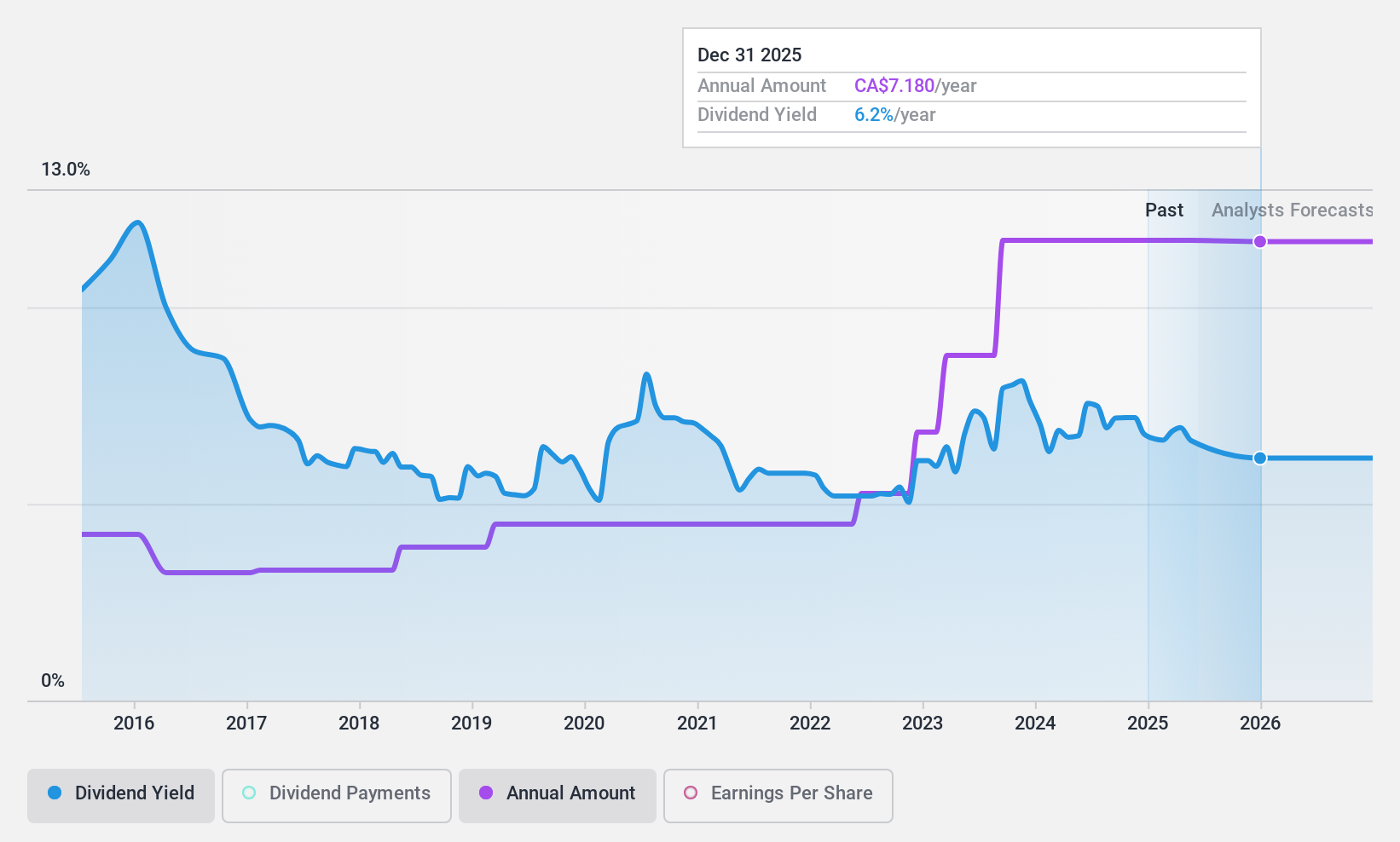

Dividend Yield: 7.2%

Olympia Financial Group's dividend yield of 7.2% ranks in the top 25% of Canadian dividend payers. The company's dividends are covered by earnings (payout ratio: 63.4%) and cash flows (cash payout ratio: 76%). However, its dividend payments have been volatile over the past decade. Recent earnings grew by 43.1%, with Q1 net income at C$5.74 million, up from C$5.23 million last year, supporting continued monthly dividends of C$0.60 per share.

- Dive into the specifics of Olympia Financial Group here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Olympia Financial Group is priced higher than what may be justified by its financials.

Peyto Exploration & Development (TSX:PEY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Peyto Exploration & Development Corp. is an energy company focused on the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta's Deep Basin with a market cap of CA$2.66 billion.

Operations: Peyto Exploration & Development Corp. generates CA$876.26 million from its oil and gas exploration and production activities.

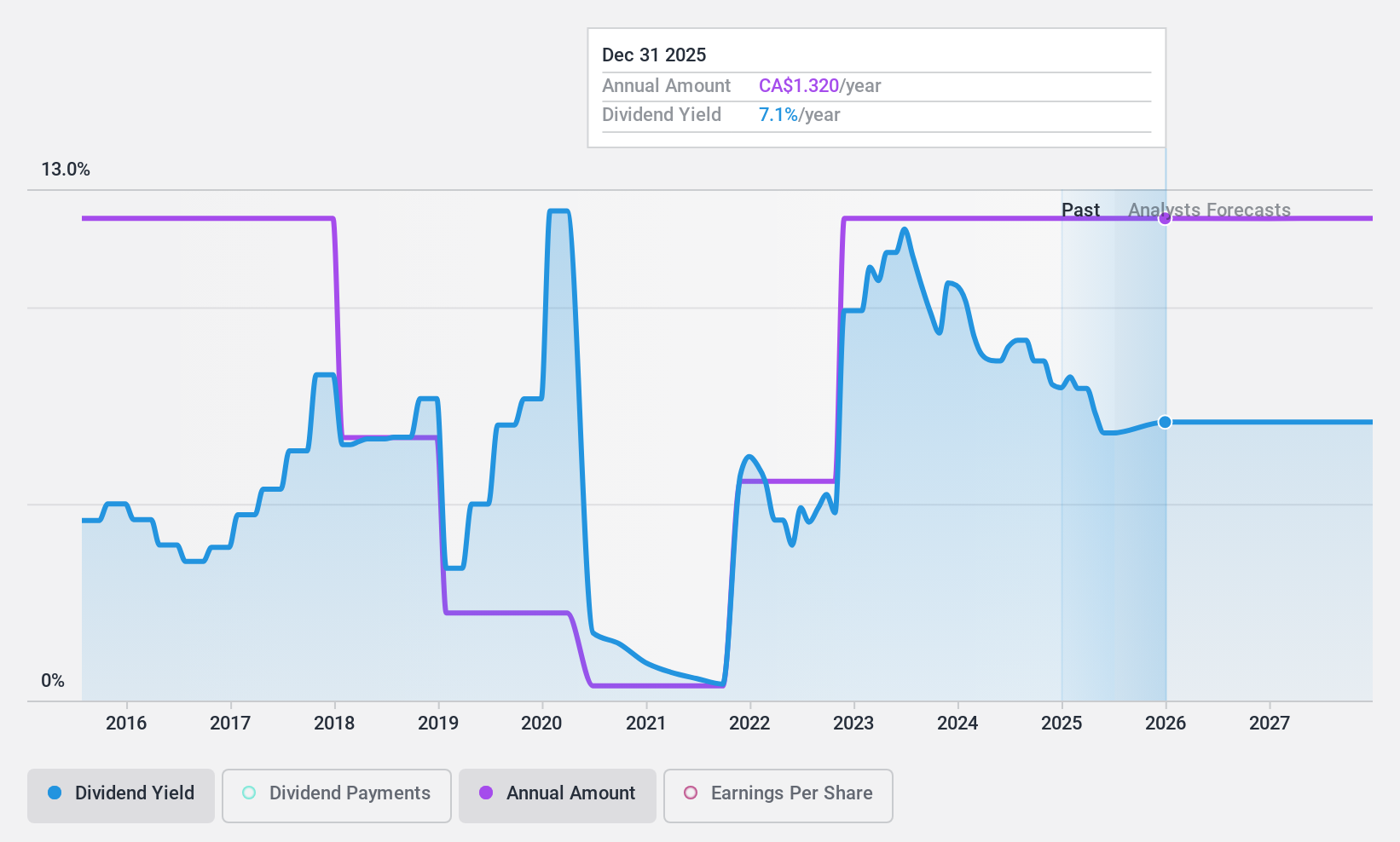

Dividend Yield: 9.6%

Peyto Exploration & Development offers a high dividend yield of 9.64%, placing it among the top 25% of Canadian dividend payers. However, its dividends have been volatile and are not well covered by free cash flow (cash payout ratio: 103%). The company recently affirmed monthly dividends of C$0.11 per share for July and June 2024. Despite trading at a significant discount to fair value, Peyto carries substantial debt, impacting financial stability.

- Navigate through the intricacies of Peyto Exploration & Development with our comprehensive dividend report here.

- Our valuation report here indicates Peyto Exploration & Development may be undervalued.

Summing It All Up

- Dive into all 35 of the Top TSX Dividend Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K-Bro Linen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KBL

K-Bro Linen

Provides laundry and linen services to healthcare institutions, hotels, and other commercial organizations in Canada and the United Kingdom.

Very undervalued with solid track record and pays a dividend.