The Canadian market has stayed flat over the past 7 days but is up 19% over the past year, with earnings expected to grow by 15% per annum in the coming years. In this environment, dividend stocks that offer substantial yields can be an attractive option for investors seeking steady income and potential growth.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 6.96% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.34% | ★★★★★☆ |

| Labrador Iron Ore Royalty (TSX:LIF) | 8.31% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.28% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.24% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.64% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.44% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.49% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.22% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.18% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

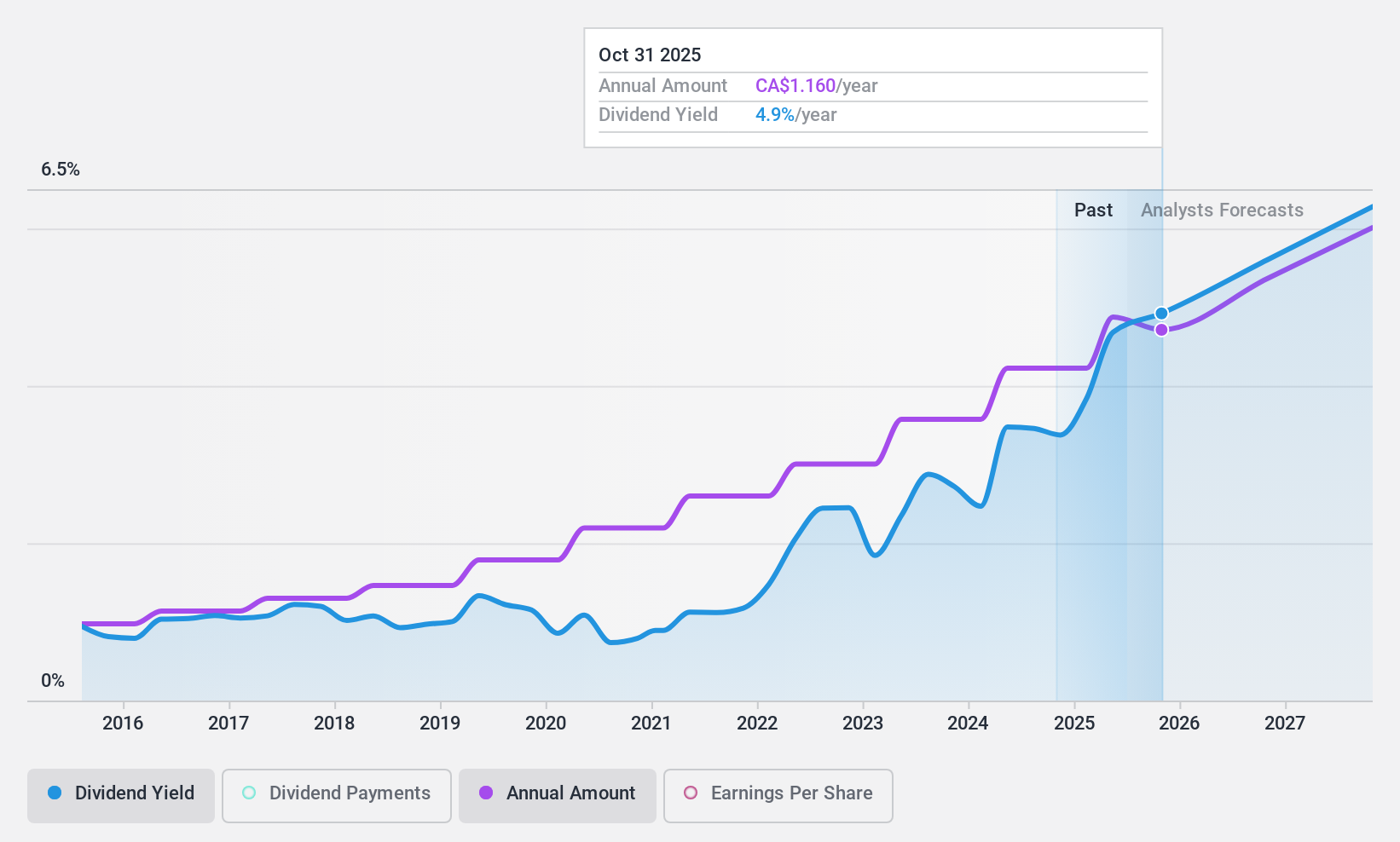

Enghouse Systems (TSX:ENGH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Enghouse Systems Limited, with a market cap of CA$1.78 billion, develops enterprise software solutions globally through its subsidiaries.

Operations: Enghouse Systems Limited generates revenue from two main segments: CA$187.17 million from the Asset Management Group and CA$312.77 million from the Interactive Management Group.

Dividend Yield: 3.2%

Enghouse Systems reported a strong Q3 2024 with revenue of C$130.5 million and net income of C$20.58 million, reflecting growth from the previous year. The company affirmed its quarterly dividend of C$0.26 per share, maintaining a stable and reliable dividend history over the past decade. Trading at 48% below its estimated fair value, Enghouse offers good relative value with a sustainable payout ratio (66%) and well-covered dividends by cash flows (45%).

- Click to explore a detailed breakdown of our findings in Enghouse Systems' dividend report.

- The valuation report we've compiled suggests that Enghouse Systems' current price could be quite moderate.

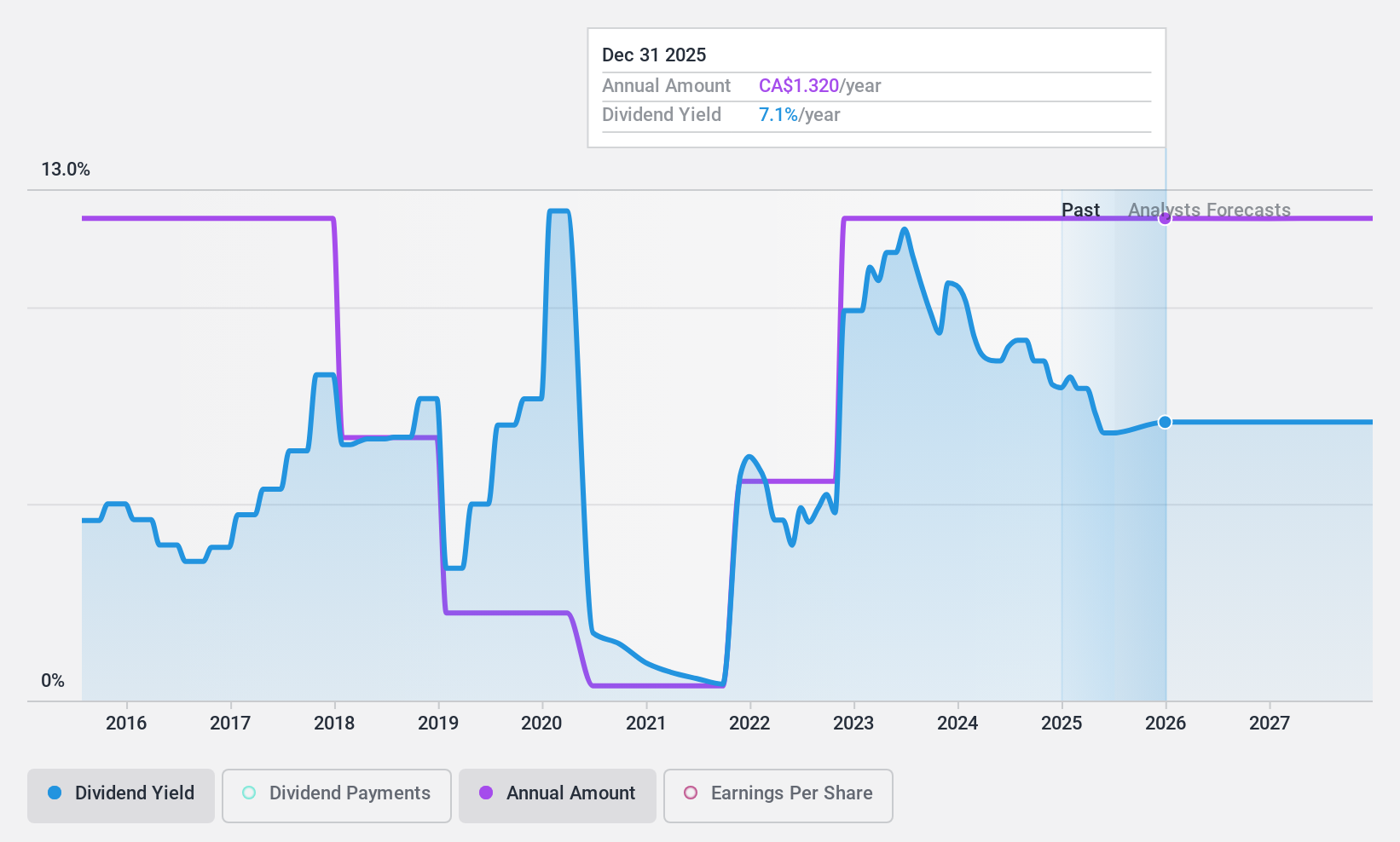

Peyto Exploration & Development (TSX:PEY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Peyto Exploration & Development Corp. is an energy company focused on the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta's Deep Basin, with a market cap of CA$2.89 billion.

Operations: Peyto Exploration & Development Corp. generates CA$901.99 million from its oil and gas exploration and production activities.

Dividend Yield: 8.9%

Peyto Exploration & Development confirmed monthly dividends of C$0.11 per share for July, August, and September 2024. Despite a high dividend yield (8.94%), the payouts are not well-covered by free cash flows (113.4% cash payout ratio). Recent earnings showed revenue growth to C$256.55 million in Q2 2024, but net income declined to C$51.44 million from the previous year. The company has a high debt level and its dividend payments have been volatile over the past decade.

- Delve into the full analysis dividend report here for a deeper understanding of Peyto Exploration & Development.

- Upon reviewing our latest valuation report, Peyto Exploration & Development's share price might be too pessimistic.

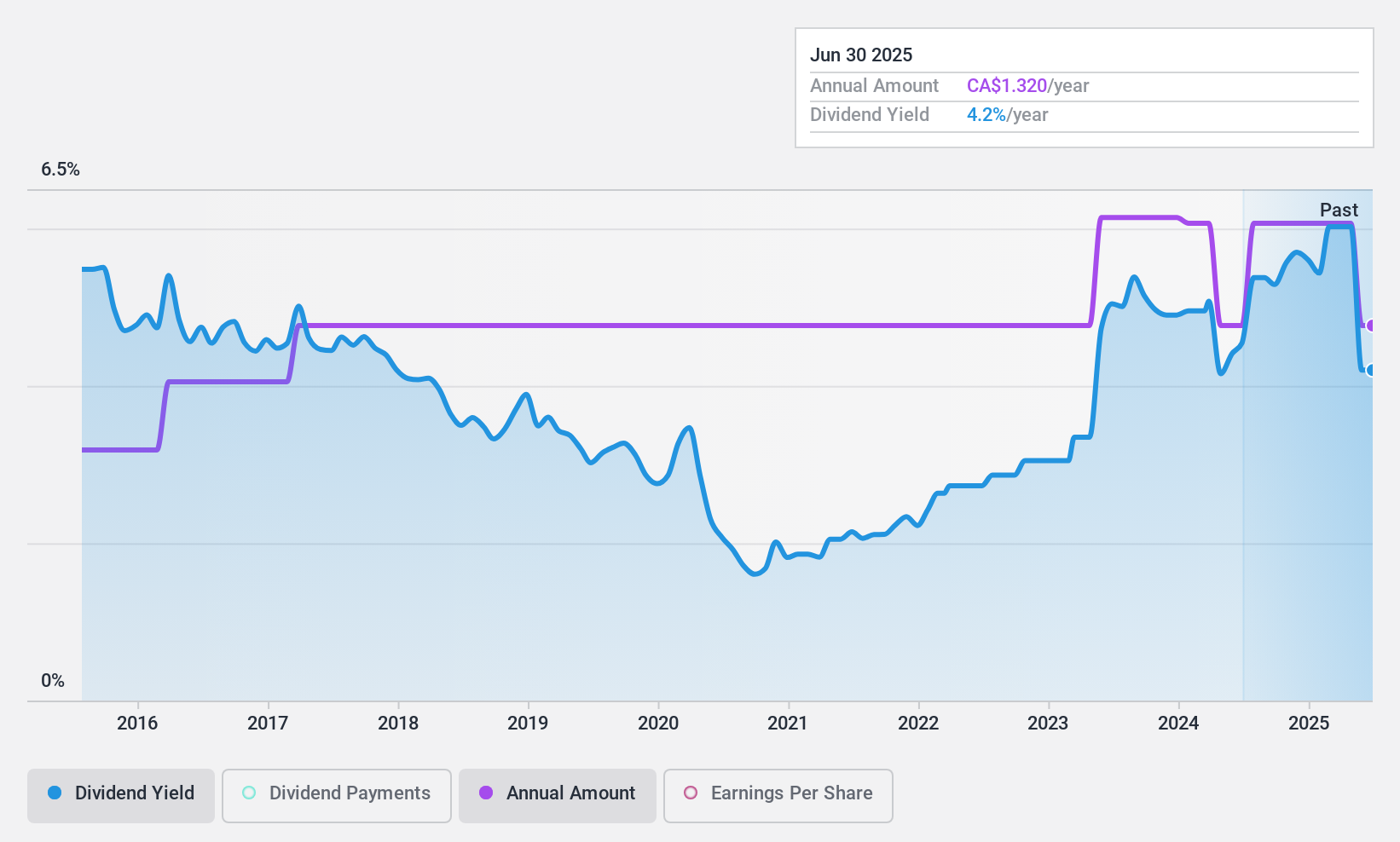

Richards Packaging Income Fund (TSX:RPI.UN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Richards Packaging Income Fund, with a market cap of CA$344.53 million, designs, manufactures, and distributes packaging containers and healthcare supplies across North America.

Operations: Richards Packaging Income Fund generates CA$415.52 million in revenue from its wholesale miscellaneous segment.

Dividend Yield: 4.2%

Richards Packaging Income Fund announced consistent monthly cash distributions of C$0.11 per unit for July, August, and September 2024. Despite a lower dividend yield (4.2%) compared to top Canadian payers, the payouts are well-covered by earnings (56.4% payout ratio) and cash flows (20.6% cash payout ratio). Recent financials show stable performance with Q2 2024 net income rising to C$11.8 million from C$10.91 million a year ago, supporting reliable and stable dividends over the past decade.

- Get an in-depth perspective on Richards Packaging Income Fund's performance by reading our dividend report here.

- Our valuation report here indicates Richards Packaging Income Fund may be undervalued.

Summing It All Up

- Dive into all 31 of the Top TSX Dividend Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RPI.UN

Richards Packaging Income Fund

Designs, manufactures, and distributes packaging containers and healthcare supplies and products in North America.

Flawless balance sheet established dividend payer.