- Canada

- /

- Oil and Gas

- /

- TSX:NXE

The Bull Case For NexGen Energy (TSX:NXE) Could Change Following Major Dual-Market Equity Raise and New Underwriter

Reviewed by Sasha Jovanovic

- NexGen Energy recently completed major follow-on equity offerings, raising C$400 million through common shares and A$600 million via Chess Depositary Interests, with Merrill Lynch Canada, Inc. added as the new lead underwriter.

- This dual-market fundraising approach highlights NexGen Energy’s expanding access to global capital and strengthened relationships with major financial institutions.

- We'll explore how the new lead underwriter and major capital raise shape NexGen Energy's investment narrative and future opportunities.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is NexGen Energy's Investment Narrative?

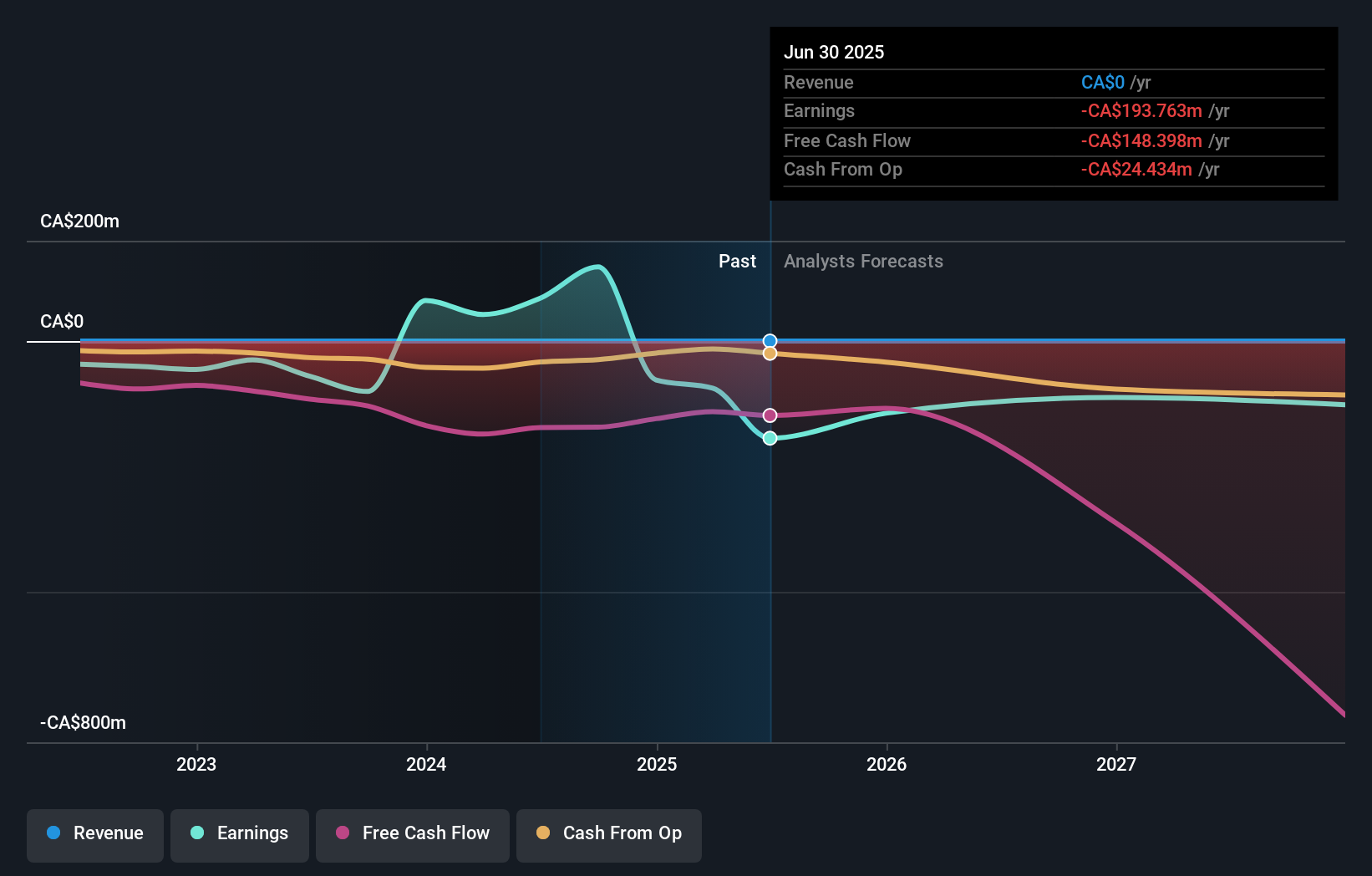

Being a NexGen Energy shareholder means buying into the vision of a company advancing uranium development with major resource potential in Saskatchewan’s Athabasca Basin, a sector often driven by catalysts like mineral resource updates, permitting milestones, and offtake agreements with utilities. The recent sizable equity offerings, totaling C$400 million and A$600 million, and the appointment of Merrill Lynch Canada as lead underwriter, present an immediate impact by firming up NexGen’s balance sheet while broadening its global reach. This new capital could help fund ongoing exploration and near-term development objectives, such as further drilling or advancing Rook I. However, existing risks such as persistent net losses (with a Q2 net loss of C$86.69 million), shareholder dilution, and limited revenue remain front of mind. The capital raise may alleviate financial strain near-term but some risks, including future profitability timelines and ongoing cash burn, are unchanged and will remain key points for investors tracking progress. But a fresh influx of shares means dilution risk isn’t off the table yet.

Our valuation report here indicates NexGen Energy may be overvalued.Exploring Other Perspectives

Explore 5 other fair value estimates on NexGen Energy - why the stock might be worth less than half the current price!

Build Your Own NexGen Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NexGen Energy research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free NexGen Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NexGen Energy's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NexGen Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NXE

NexGen Energy

An exploration and development stage company, engages in the acquisition, exploration, evaluation, and development of uranium properties in Canada.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives