- Canada

- /

- Oil and Gas

- /

- TSX:NXE

Should You Be Worried About Insider Transactions At NexGen Energy Ltd. (TSE:NXE)?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So we'll take a look at whether insiders have been buying or selling shares in NexGen Energy Ltd. (TSE:NXE).

Do Insider Transactions Matter?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

View our latest analysis for NexGen Energy

The Last 12 Months Of Insider Transactions At NexGen Energy

Over the last year, we can see that the biggest insider sale was by the Founder, Leigh Curyer, for CA$988k worth of shares, at about CA$2.57 per share. While we don't usually like to see insider selling, it's more concerning if the sales take price at a lower price. The good news is that this large sale was at well above current price of CA$1.91. So it may not shed much light on insider confidence at current levels.

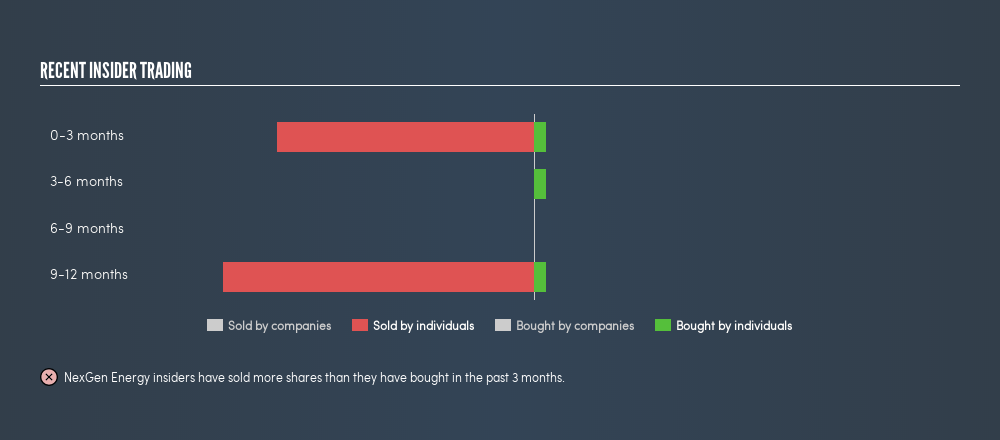

In total, NexGen Energy insiders sold more than they bought over the last year. You can see the insider transactions (by individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Insiders at NexGen Energy Have Sold Stock Recently

There was substantially more insider selling, than buying, of NexGen Energy shares over the last three months. In that time, Leigh Curyer dumped CA$988k worth of shares. On the flip side, Independent Director Sybil Veenman spent CA$41k on purchasing shares. We don't view these transactions as a positive sign.

Insider Ownership of NexGen Energy

For a common shareholder, it is worth checking how many shares are held by company insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. From looking at our data, insiders own CA$5.9m worth of NexGen Energy stock, about 0.9% of the company. We consider this fairly low insider ownership.

So What Do The NexGen Energy Insider Transactions Indicate?

The insider sales have outweighed the insider buying, at NexGen Energy, in the last three months. Zooming out, the longer term picture doesn't give us much comfort. When you combine this with the relatively low insider ownership, we are very cautious about the stock. As the saying goes, only fools rush in. If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

Of course NexGen Energy may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:NXE

NexGen Energy

An exploration and development stage company, engages in the acquisition, exploration, evaluation, and development of uranium properties in Canada.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives