- Canada

- /

- Oil and Gas

- /

- TSX:NVA

Does NuVista Energy's (TSX:NVA) Steady Production Target Reflect Operational Strength or Risk Appetite?

Reviewed by Simply Wall St

- NuVista Energy Ltd. confirmed its 2025 annual average production guidance of approximately 83,000 Boe/d, despite commissioning delays at the Pipestone Gas Plant, and noted early startup of operations in the greater Wapiti area.

- The company highlighted ongoing progress on its shareholder return strategy supported by financial stability, less intensive capital spending for late 2025, and opportunistic hedging activities.

- Let's explore how NuVista's resilience in maintaining production targets, even with facility delays, influences the company's investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is NuVista Energy's Investment Narrative?

For anyone considering NuVista Energy, the core thesis often centers on the company’s capacity to deliver stable production growth in a volatile commodity market, while displaying financial discipline. The latest confirmation of 2025 production guidance near 83,000 Boe/d, even with delays at the Pipestone Gas Plant, shows a level of operational resilience many investors appreciate. Early ramp-up at Wapiti is a welcome offset, but with production slightly below earlier expectations, immediate upside from near-term catalysts may be more muted. Still, NuVista’s commitment to shareholder returns, disciplined capital plans, and a strong balance sheet continue to be key positives. The risks primarily revolve around execution, including the timely scaling of output in the back half of 2025, and commodity price uncertainty, both of which could sway short-term sentiment. The recent update provides some reassurance on execution risk, but doesn’t fully erase concerns around delivery timing or margin pressures. In contrast, uncertainty around commodity prices could still sway short-term outcomes.

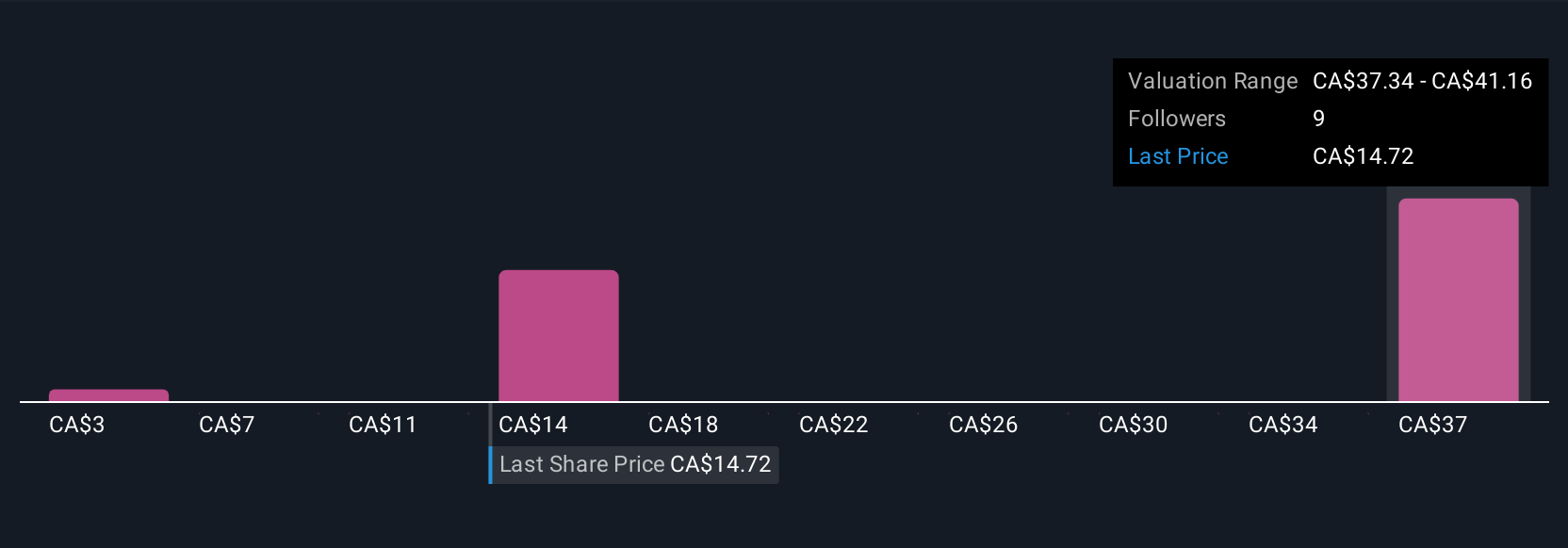

NuVista Energy's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on NuVista Energy - why the stock might be worth less than half the current price!

Build Your Own NuVista Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NuVista Energy research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free NuVista Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NuVista Energy's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuVista Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NVA

NuVista Energy

Engages in the exploration, development, and production of oil and natural gas reserves in the Western Canadian Sedimentary Basin.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives