- Canada

- /

- Oil and Gas

- /

- TSX:MEG

A Fresh Look at MEG Energy (TSX:MEG) Valuation as Shares Quietly Gain Momentum

Reviewed by Simply Wall St

Most Popular Narrative: 0.3% Undervalued

The prevailing narrative points to MEG Energy being almost fairly valued based on a blend of analyst consensus around future growth, margins, and risk factors.

Operational efficiency gains and technological improvements are expected to boost margins, lower emissions, and strengthen MEG's ESG standing and market appeal.

What is the secret sauce behind this razor-thin undervaluation? Hidden behind the headline figure are some bold projections about future revenues, profit margins, and a much higher earnings multiple than today. Could this be the contrarian opportunity you are looking for, or are these growth assumptions just too optimistic?

Result: Fair Value of $29.11 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, unexpected setbacks at Christina Lake or major shifts in oil prices could easily turn this steady outlook on its head.

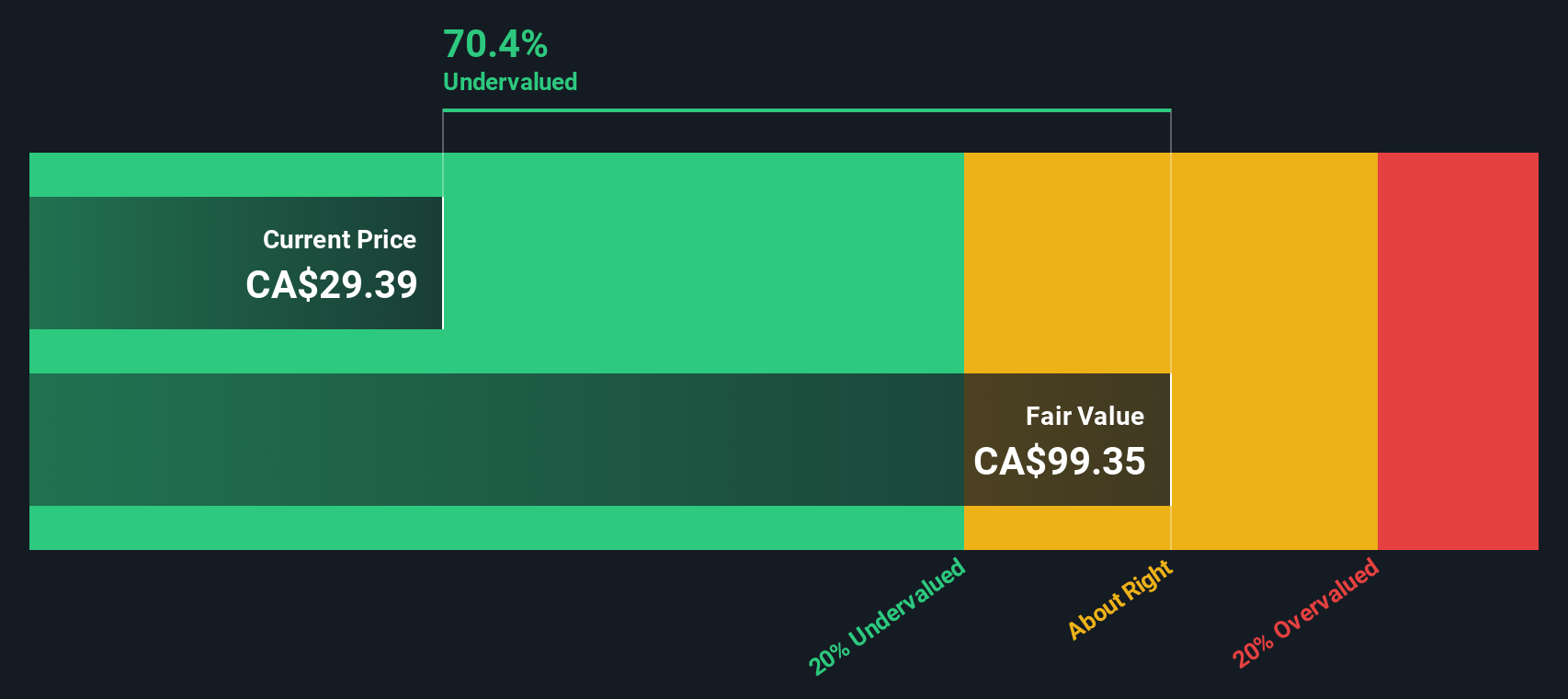

Find out about the key risks to this MEG Energy narrative.Another View: Our DCF Tells a Different Story

Looking at MEG Energy through the lens of our DCF model, the picture changes. This approach suggests the shares could be trading well below what they are really worth. Which valuation feels more believable?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own MEG Energy Narrative

If you see things differently or want to explore the numbers on your own terms, you can build your own narrative in just minutes. Do it your way

A great starting point for your MEG Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Hunting for More Winning Ideas?

Smart investors never settle for just one story. Open up new opportunities by targeting companies set for growth, stability, or sector disruption with these proven strategies:

- Amplify your returns and spot hidden gems by uncovering undervalued companies brimming with potential, all in one place with undervalued stocks based on cash flows.

- Tap into the AI revolution by tracking early-stage innovators shaking up technology. Start with AI penny stocks to pinpoint those making real progress in artificial intelligence.

- Strengthen your portfolio with reliable income by finding stocks offering healthy yields and solid fundamentals, just by using dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:MEG

MEG Energy

An energy company, focuses on in situ thermal oil production in its Christina Lake Project in the southern Athabasca oil region of Alberta, Canada.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives