- Canada

- /

- Oil and Gas

- /

- TSX:LCFS

Tidewater Renewables Ltd.'s (TSE:LCFS) market cap surged CA$34m last week, public companies who have a lot riding on the company were rewarded

Key Insights

- The considerable ownership by public companies in Tidewater Renewables indicates that they collectively have a greater say in management and business strategy

- The largest shareholder of the company is Tidewater Midstream and Infrastructure Ltd. with a 69% stake

- Using data from analyst forecasts alongside ownership research, one can better assess the future performance of a company

A look at the shareholders of Tidewater Renewables Ltd. (TSE:LCFS) can tell us which group is most powerful. With 69% stake, public companies possess the maximum shares in the company. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

As a result, public companies collectively scored the highest last week as the company hit CA$266m market cap following a 15% gain in the stock.

Let's delve deeper into each type of owner of Tidewater Renewables, beginning with the chart below.

See our latest analysis for Tidewater Renewables

What Does The Institutional Ownership Tell Us About Tidewater Renewables?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

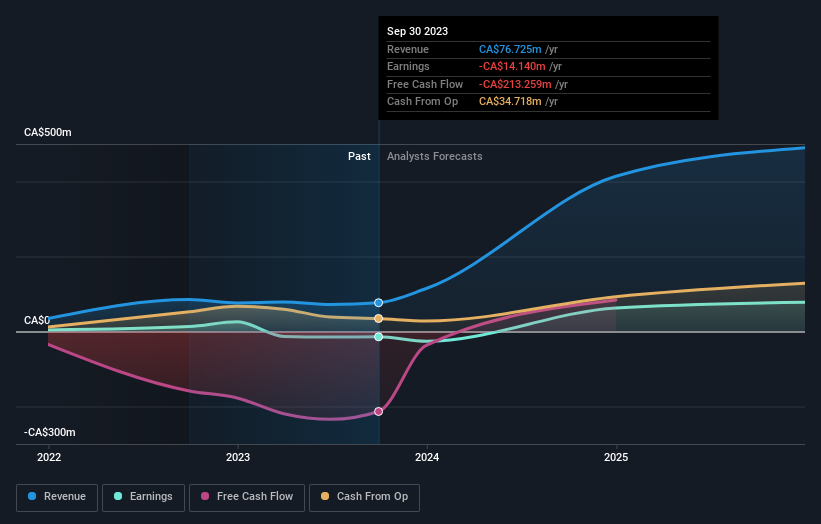

Tidewater Renewables already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Tidewater Renewables' earnings history below. Of course, the future is what really matters.

Hedge funds don't have many shares in Tidewater Renewables. Tidewater Midstream and Infrastructure Ltd. is currently the company's largest shareholder with 69% of shares outstanding. This essentially means that they have extensive influence, if not outright control, over the future of the corporation. Meanwhile, the second and third largest shareholders, hold 2.4% and 1.8%, of the shares outstanding, respectively.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Tidewater Renewables

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own less than 1% of Tidewater Renewables Ltd.. It appears that the board holds about CA$349k worth of stock. This compares to a market capitalization of CA$266m. Many tend to prefer to see a board with bigger shareholdings. A good next step might be to take a look at this free summary of insider buying and selling.

General Public Ownership

With a 24% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Tidewater Renewables. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Public Company Ownership

We can see that public companies hold 69% of the Tidewater Renewables shares on issue. It's hard to say for sure but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Tidewater Renewables , and understanding them should be part of your investment process.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Tidewater Renewables might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:LCFS

Tidewater Renewables

Engages in production of renewable fuel in North America.

Very undervalued slight.