Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Laramide Resources Ltd. (TSE:LAM) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Laramide Resources

What Is Laramide Resources's Debt?

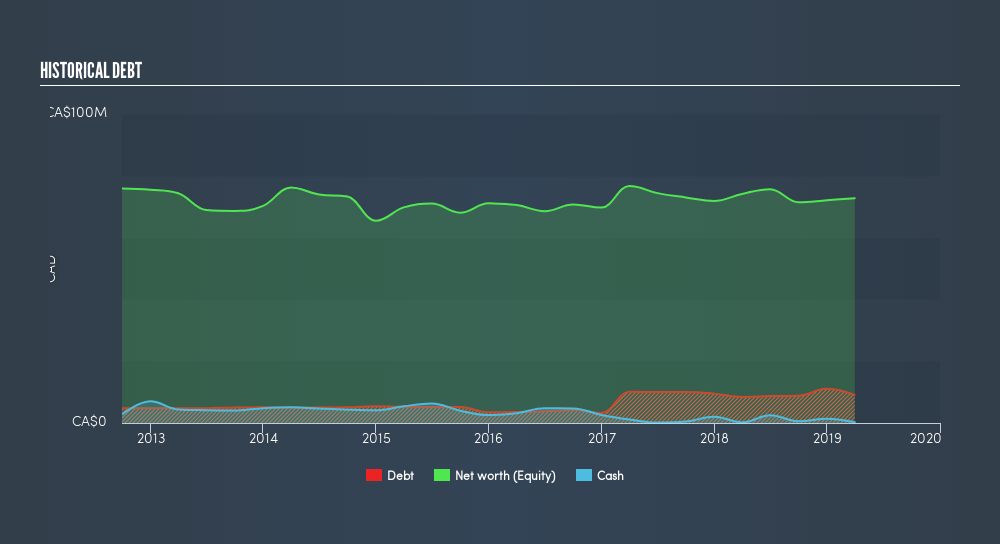

You can click the graphic below for the historical numbers, but it shows that as of March 2019 Laramide Resources had CA$9.11m of debt, an increase on CA$8.41m, over one year. However, because it has a cash reserve of CA$234.5k, its net debt is less, at about CA$8.87m.

How Strong Is Laramide Resources's Balance Sheet?

We can see from the most recent balance sheet that Laramide Resources had liabilities of CA$6.20m falling due within a year, and liabilities of CA$9.86m due beyond that. Offsetting this, it had CA$234.5k in cash and CA$123.5k in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$15.7m.

While this might seem like a lot, it is not so bad since Laramide Resources has a market capitalization of CA$46.2m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. Either way, since Laramide Resources does have more debt than cash, it's worth keeping an eye on its balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Laramide Resources's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Given its lack of meaningful operating revenue, Laramide Resources shareholders no doubt hope it can fund itself until it can sell some combustibles.

Caveat Emptor

Importantly, Laramide Resources had negative earnings before interest and tax (EBIT), over the last year. To be specific the EBIT loss came in at CA$1.5m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled CA$5.4m in negative free cash flow over the last twelve months. So in short it's a really risky stock. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Laramide Resources insider transactions.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:LAM

Laramide Resources

Engages in mining, exploration, and development of uranium assets.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives