- Canada

- /

- Oil and Gas

- /

- TSX:KEY

Keyera (TSX:KEY) Valuation in Focus as Q3 Earnings and Debt Amendments Draw Investor Attention

Reviewed by Simply Wall St

Keyera (TSX:KEY) is set for a notable week, with its upcoming third quarter results on November 14 and a major move to amend the terms of its subordinated notes. Both events could influence its capital structure and investor outlook.

See our latest analysis for Keyera.

Interest in Keyera has picked up as anticipation builds for its earnings update and the company works through key changes to its debt structure. While the 1-month share price return stands at -11.76% and year-to-date at -6.67%, Keyera’s long-term story remains positive, with a three-year total shareholder return of 66.6% and a remarkable 208% over five years. Momentum may be volatile in the short term, but patient investors have benefited handsomely.

If you’re curious about what else is shaping the market landscape right now, it’s a good moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With Keyera now trading at a notable discount to analyst price targets and its fundamentals showing steady growth, is the current share price presenting a compelling entry point, or is the market already factoring in its future potential?

Most Popular Narrative: 18.3% Undervalued

Keyera’s most widely followed narrative values the company meaningfully higher than the current market price, with a fair value of CA$50.71 against a last close of CA$41.41. The valuation leans heavily on expectations of sustained long-term earnings and revenue growth from strategic expansions and acquisitions.

“The transformational acquisition of Plains' Canadian NGL business significantly increases Keyera's scale, connectivity, and access to key demand hubs, enabling more efficient product flows, enhanced market optionality, and projected mid-teens accretion to distributable cash flow per share. This supports stronger earnings growth.”

Want to know how this growth story justifies such a premium? There’s a surprising mix of ambitious profit projections and aggressive earnings multiples hidden in the narrative. Which factor is most critical? Unlock the details in the full analysis to see what’s truly behind the lofty fair value.

Result: Fair Value of $50.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to Western Canada and challenges integrating recent acquisitions could threaten Keyera’s growth outlook and put pressure on future earnings stability.

Find out about the key risks to this Keyera narrative.

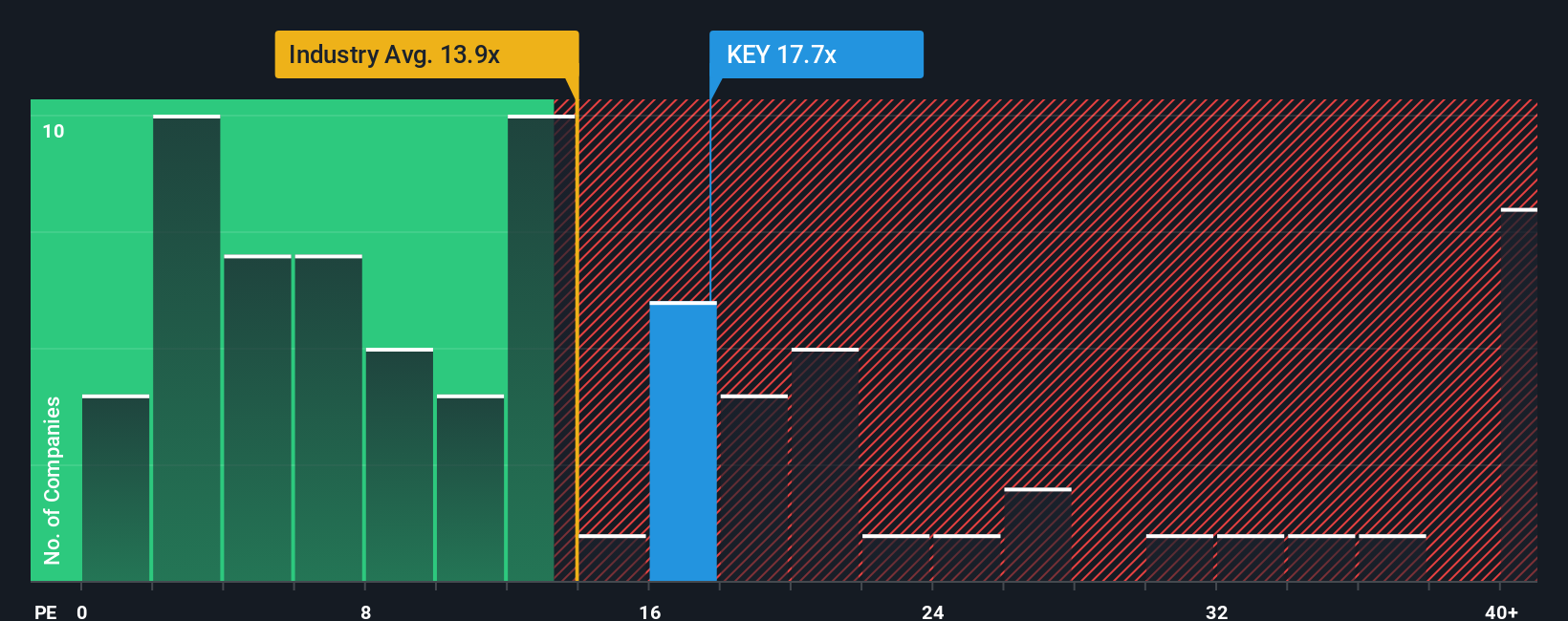

Another View: Assessing Value with Market Ratios

While fair value estimates suggest Keyera is undervalued, a closer look at its price-to-earnings ratio paints a more cautious picture. At 17.9x, it is higher than both peer averages (16.3x) and the broader Canadian Oil and Gas industry (12.4x). It also exceeds what our fair ratio model suggests is justified at 16.5x. This gap could signal that the market is pricing in more upside than fundamentals might support. So is there real opportunity left, or are investors getting ahead of themselves?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Keyera Narrative

If you see the story unfolding differently or want to dive into the numbers yourself, crafting a personalized Keyera narrative takes just a few minutes. Start by clicking Do it your way.

A great starting point for your Keyera research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Opportunities?

There’s a world of stocks beyond Keyera, and the right screen can help you spot winners before everyone else. Don’t let others get ahead while you sit on the sidelines.

- Target steady income streams and high yields by checking out these 22 dividend stocks with yields > 3%. These can deliver reliable returns and help strengthen your portfolio.

- Stay at the forefront of breakthrough technologies and future trends with these 26 AI penny stocks. Leading-edge companies in this area are shaping how we live and work.

- Boost your chances of capturing market mispricings with these 840 undervalued stocks based on cash flows, focusing on stocks trading below their fair value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keyera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KEY

Keyera

Engages in the gathering and processing of natural gas; and the transportation, storage, and marketing of natural gas liquids (NGLs) in Canada and the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives