- Canada

- /

- Oil and Gas

- /

- TSX:KEY

How Investors May Respond To Keyera (TSX:KEY) Earnings and Revenue Declines Amid Dividend Commitment

Reviewed by Sasha Jovanovic

- Keyera Corp. recently reported third quarter and nine-month results for 2025, posting sales of CA$1.79 billion and quarterly net income of CA$85.22 million, both down from the prior year, while also affirming a fourth quarter dividend of CA$0.54 per share to be paid in December.

- A significant year-over-year drop in both revenue and earnings provides insight into current operational challenges and shifting market dynamics for the company.

- We'll examine how the reported decrease in quarterly earnings shapes Keyera's investment narrative and its outlook for long-term growth.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Keyera Investment Narrative Recap

To be a Keyera shareholder, you need confidence in its ability to generate stable fee-based cash flows from its integrated midstream platform, while navigating exposure to Western Canadian basin trends. The recent drop in quarterly earnings underlines near-term operational pressures, but does not fundamentally alter the most important catalyst for Keyera, the integration and performance of the Plains Midstream Canada acquisition. At the same time, the basin-specific risk of regional production volatility remains a key concern for the business.

Among recent announcements, Keyera’s completed debt financing totaling CA$2.3 billion and CA$500 million in subordinated notes is most relevant, as it supports the Plains acquisition. This move strengthens Keyera’s capital position as it seeks to realize the expected benefits of increased scale and connectivity, an immediate catalyst for volume growth and future revenue stability, despite this quarter’s earnings softness.

Yet, in contrast, investors should be aware of how persistent risks from regional production trends in Western Canada could challenge...

Read the full narrative on Keyera (it's free!)

Keyera's narrative projects CA$9.2 billion in revenue and CA$830.8 million in earnings by 2028. This requires 8.2% yearly revenue growth and a CA$300 million earnings increase from the current CA$530.4 million.

Uncover how Keyera's forecasts yield a CA$50.71 fair value, a 15% upside to its current price.

Exploring Other Perspectives

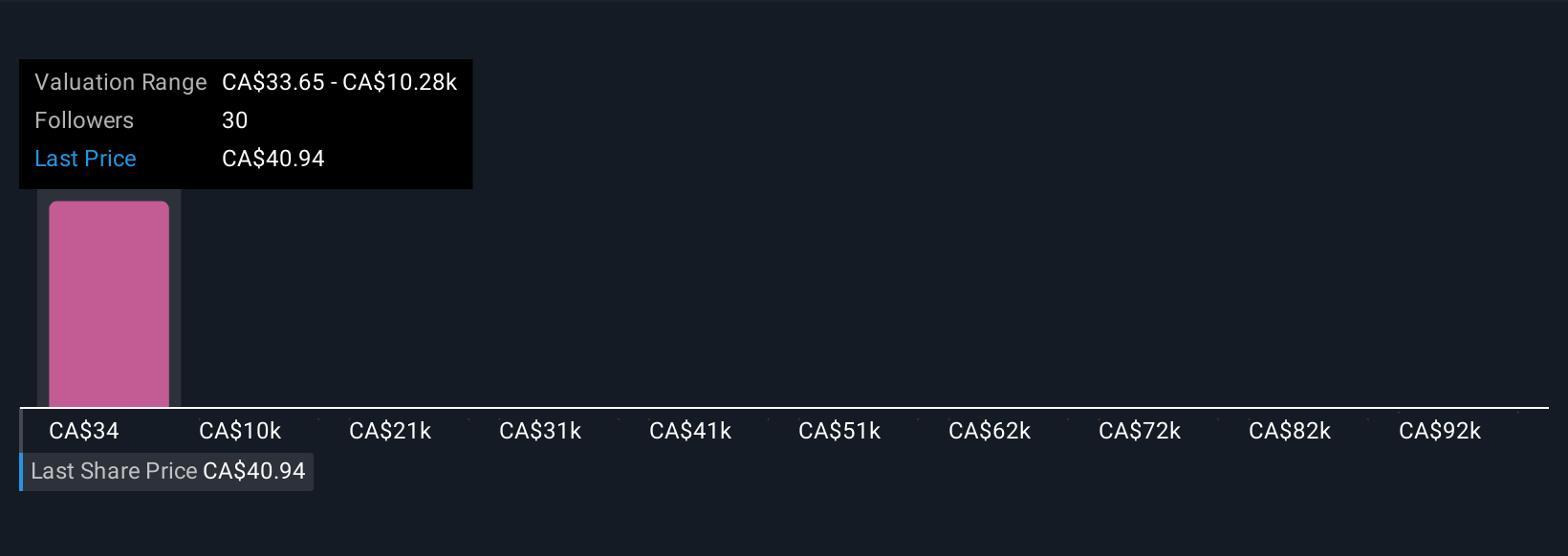

Seven community-sourced fair value estimates for Keyera range from CA$33.65 to an outlier above CA$102,000 per share. Many contributors see acquisition-driven scale as a growth driver, but your assessment of basin risk may shape a different outlook.

Explore 7 other fair value estimates on Keyera - why the stock might be worth 23% less than the current price!

Build Your Own Keyera Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Keyera research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Keyera research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Keyera's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keyera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KEY

Keyera

Engages in the gathering and processing of natural gas; and the transportation, storage, and marketing of natural gas liquids (NGLs) in Canada and the United States.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives