- Canada

- /

- Oil and Gas

- /

- TSX:KEL

Kelt Exploration (TSX:KEL): Assessing Valuation After Albright Gas Plant Launch Spurs Fresh Growth Prospects

Reviewed by Simply Wall St

Kelt Exploration (TSX:KEL) just announced the Albright Gas Plant is up and running near its Wembley and Pipestone operations. This enables the company to ramp up gas deliveries again after earlier delays.

See our latest analysis for Kelt Exploration.

News of the Albright Gas Plant’s commissioning seems to have energized investor sentiment, with Kelt’s shares gaining over 18% in the past month alone. This momentum adds to a solid backdrop. The stock’s total return for the past year sits at nearly 22%, and its five-year total shareholder return has soared well over 390%. This suggests that longer-term holders have seen exceptional gains despite some recent operational headwinds.

If this kind of turnaround success has you wondering what else is out there, it might be the perfect time to broaden your horizon and discover fast growing stocks with high insider ownership

With shares rallying and a new growth engine now online, the big question is whether Kelt Exploration is still trading at an attractive value or if the market has already priced in the next phase of growth.

Price-to-Earnings of 20.7x: Is it justified?

At CA$7.71 per share, Kelt Exploration is currently priced at a 20.7x price-to-earnings (P/E) ratio, which places it well above the Canadian Oil and Gas sector average. This makes the stock look relatively expensive compared to both peers and the broader industry.

The P/E multiple is a classic gauge of how much investors are willing to pay for each dollar of company earnings. For a business like Kelt Exploration, investors typically use it to weigh growth prospects, profitability, and sector positioning versus competitors. A premium multiple can reflect anticipated rapid growth or strong quality of earnings, but it can also mean the stock is running hot relative to fundamentals.

Kelt’s 20.7x P/E ratio is notably higher than its peer group’s average of 17.8x and also above the Canadian Oil and Gas industry average of 13.9x. On these metrics, investors are assigning Kelt a valuation premium that could be tough to justify if growth expectations are not met. There is also currently insufficient data to determine whether its Price-To-Earnings ratio aligns with our fair value regression models, so caution may be warranted when comparing the current price to long-term fair value levels.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 20.7x (OVERVALUED)

However, Kelt's premium valuation could face pressure if revenue growth slows or if the market re-evaluates sector sentiment in the coming quarters.

Find out about the key risks to this Kelt Exploration narrative.

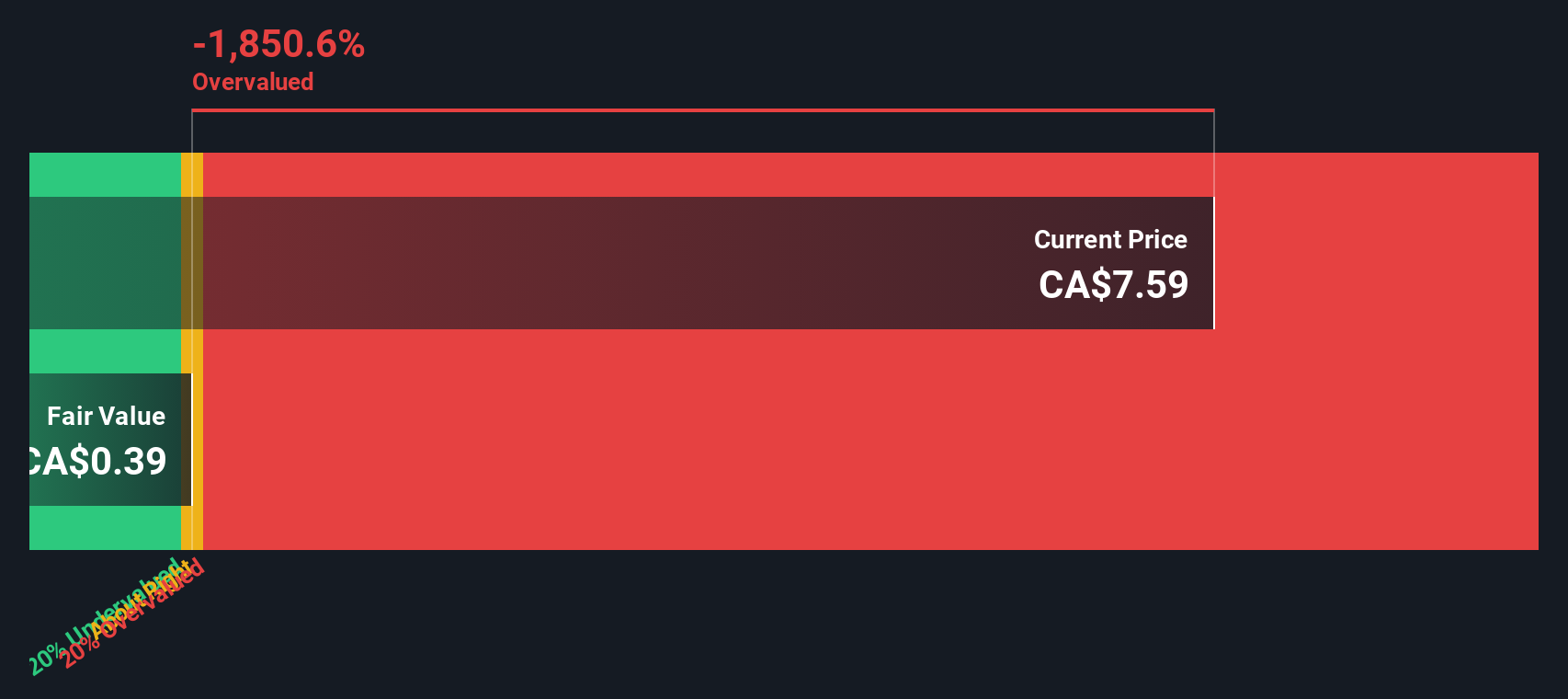

Another View: Discounted Cash Flow Says Overvalued

While the price-to-earnings approach signaled a steep valuation, our DCF model offers a different perspective. According to this method, Kelt is trading above its estimated fair value, indicating that the current price reflects very optimistic assumptions. Does this mean the market is getting ahead of itself, or is something being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kelt Exploration for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 884 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kelt Exploration Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can piece together your own outlook in just a few minutes. So why not Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kelt Exploration.

Looking for more investment ideas?

Smart investors go beyond a single story. Use the tools at your fingertips to spot tomorrow’s winners and avoid missing out on new market leaders.

- Boost your portfolio’s return potential by targeting hidden value with these 884 undervalued stocks based on cash flows, offering compelling cash flow opportunities the market might be overlooking.

- Tap into the future of medicine by checking out these 32 healthcare AI stocks, where innovative companies are reshaping biotech and diagnostics with artificial intelligence.

- Capitalize on price swings and growth catalysts by searching through these 3585 penny stocks with strong financials, which combine financial strength with high upside in overlooked sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kelt Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KEL

Kelt Exploration

An oil and gas company, engages in the exploration, development, and production of crude oil and natural gas resources primarily in Western Canada.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives