- Canada

- /

- Oil and Gas

- /

- TSX:KEL

Kelt Exploration (TSE:KEL) delivers shareholders fantastic 36% CAGR over 5 years, surging 7.2% in the last week alone

For many, the main point of investing in the stock market is to achieve spectacular returns. While not every stock performs well, when investors win, they can win big. For example, the Kelt Exploration Ltd. (TSE:KEL) share price is up a whopping 366% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. In more good news, the share price has risen 18% in thirty days.

The past week has proven to be lucrative for Kelt Exploration investors, so let's see if fundamentals drove the company's five-year performance.

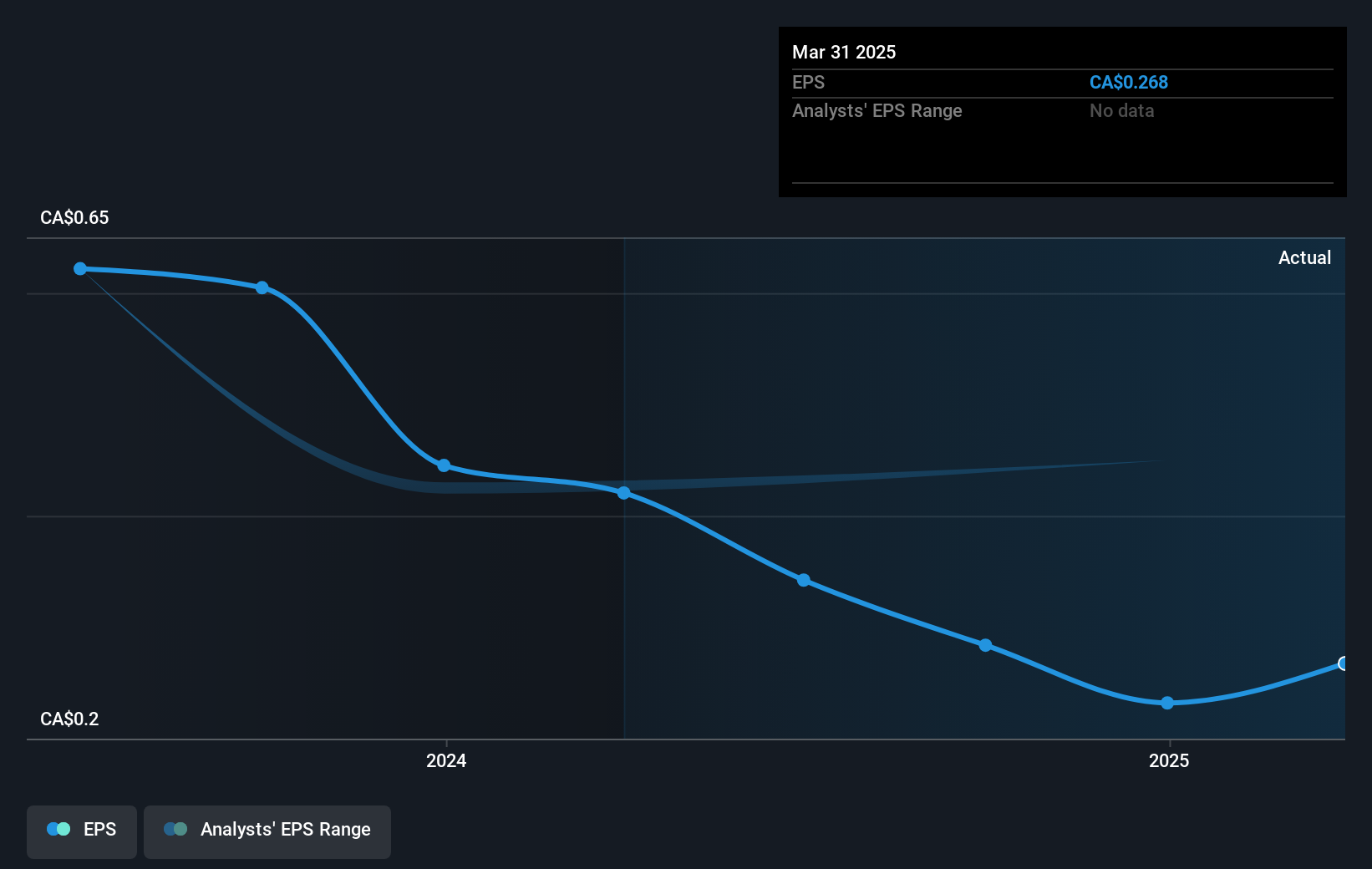

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, Kelt Exploration moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Kelt Exploration's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Kelt Exploration shareholders have received returns of 20% over twelve months, which isn't far from the general market return. It has to be noted that the recent return falls short of the 36% shareholders have gained each year, over half a decade. More recently, the share price growth has slowed. But it has to be said the overall picture is one of good long term and short term performance. Arguably that makes Kelt Exploration a stock worth watching. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Kelt Exploration you should know about.

Kelt Exploration is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kelt Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:KEL

Kelt Exploration

An oil and gas company, engages in the exploration, development, and production of crude oil and natural gas resources primarily in Western Canada.

Adequate balance sheet and fair value.

Market Insights

Community Narratives