- Canada

- /

- Oil and Gas

- /

- TSX:KEL

Here's Why We Think Kelt Exploration (TSE:KEL) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Kelt Exploration (TSE:KEL), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Kelt Exploration

Kelt Exploration's Improving Profits

Kelt Exploration has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Kelt Exploration's EPS shot up from CA$0.61 to CA$0.83; a result that's bound to keep shareholders happy. That's a impressive gain of 37%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While Kelt Exploration did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

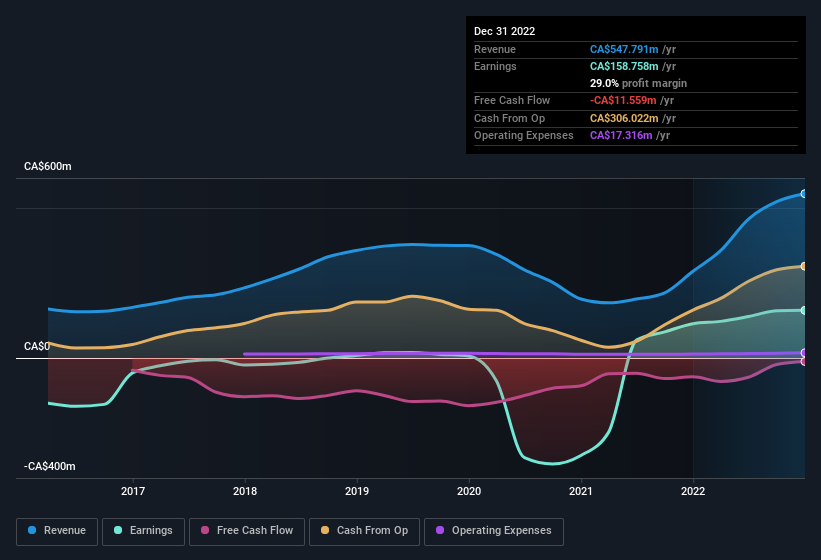

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Kelt Exploration?

Are Kelt Exploration Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Even though some insiders sold down their holdings, their actions speak louder than words with CA$414k more invested than sold by people who know they company best. An optimistic sign for those with Kelt Exploration in their watchlist. Zooming in, we can see that the biggest insider purchase was by CEO, President & Non-Independent Director David Wilson for CA$2.3m worth of shares, at about CA$6.36 per share.

The good news, alongside the insider buying, for Kelt Exploration bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a considerable amount of wealth invested in it, currently valued at CA$149m. Coming in at 17% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, David Wilson is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations between CA$550m and CA$2.2b, like Kelt Exploration, the median CEO pay is around CA$2.1m.

Kelt Exploration offered total compensation worth CA$1.8m to its CEO in the year to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Kelt Exploration Deserve A Spot On Your Watchlist?

You can't deny that Kelt Exploration has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for Kelt Exploration you should know about.

The good news is that Kelt Exploration is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kelt Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:KEL

Kelt Exploration

An oil and gas company, engages in the exploration, development, and production of crude oil and natural gas resources primarily in Western Canada.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives