- Canada

- /

- Oil and Gas

- /

- TSX:IPO

Those Who Purchased Inplay Oil (TSE:IPO) Shares A Year Ago Have A 20% Loss To Show For It

This month, we saw the Inplay Oil Corp. (TSE:IPO) up an impressive 36%. But in truth the last year hasn't been good for the share price. In fact the stock is down 20% in the last year, well below the market return.

View our latest analysis for Inplay Oil

Inplay Oil isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Inplay Oil saw its revenue grow by 22%. That's definitely a respectable growth rate. Unfortunately that wasn't good enough to stop the share price dropping 20%. You might even wonder if the share price was previously over-hyped. However, that's in the past now, and it's the future that matters most.

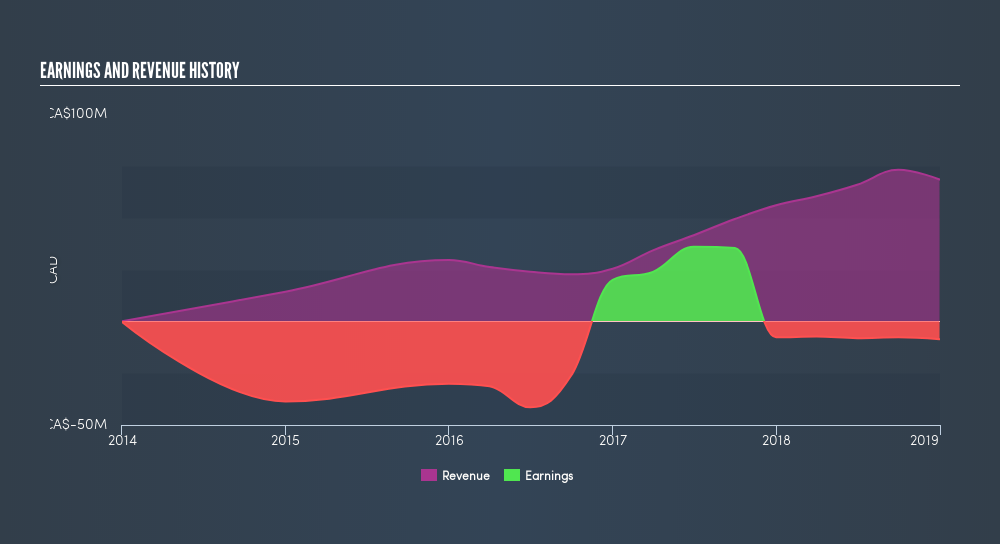

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Take a more thorough look at Inplay Oil's financial health with this freereport on its balance sheet.

A Different Perspective

Given that the market gained 7.8% in the last year, Inplay Oil shareholders might be miffed that they lost 20%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 22%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like Inplay Oil better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:IPO

InPlay Oil

Engages in the acquisition, exploration, development, and production of petroleum and natural gas properties in Canada.

High growth potential and fair value.

Market Insights

Community Narratives