It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Inter Pipeline (TSE:IPL), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Inter Pipeline

Inter Pipeline's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Inter Pipeline grew its EPS by 7.1% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

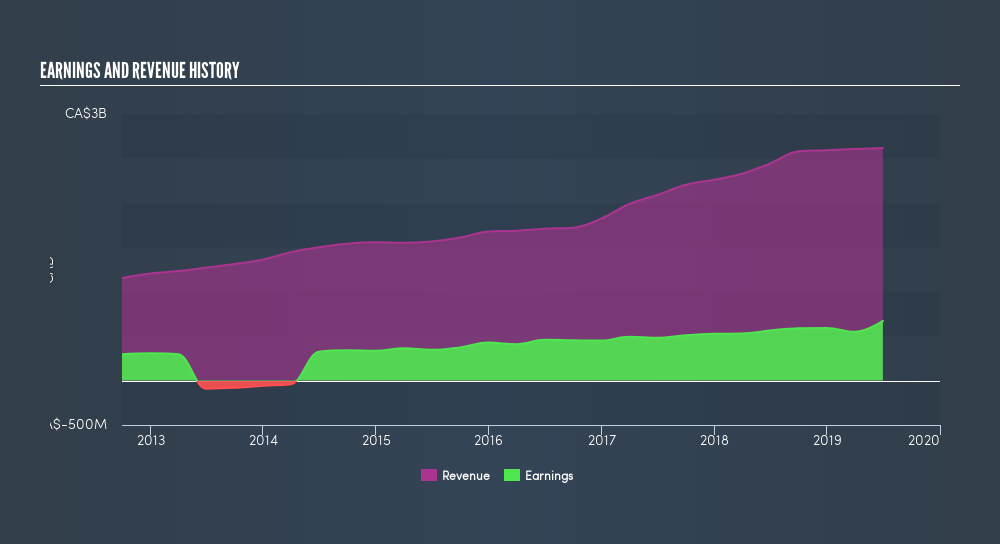

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While Inter Pipeline did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Inter Pipeline's future profits.

Are Inter Pipeline Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see Inter Pipeline insiders walking the walk, by spending CA$971k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. Zooming in, we can see that the biggest insider purchase was by President Christian Bayle for CA$482k worth of shares, at about CA$19.29 per share.

On top of the insider buying, it's good to see that Inter Pipeline insiders have a valuable investment in the business. To be specific, they have CA$20m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.2% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Chris Bayle is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Inter Pipeline with market caps between CA$5.3b and CA$16b is about CA$5.3m.

Inter Pipeline offered total compensation worth CA$3.9m to its CEO in the year to December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does Inter Pipeline Deserve A Spot On Your Watchlist?

One positive for Inter Pipeline is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. Of course, just because Inter Pipeline is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

As a growth investor I do like to see insider buying. But Inter Pipeline isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives