- Canada

- /

- Oil and Gas

- /

- TSX:GEI

Gibson Energy (TSX:GEI): Assessing Valuation After Q3 Earnings, Leadership Changes, and Dividend Update

Reviewed by Simply Wall St

Gibson Energy (TSX:GEI) just released its third quarter earnings, showing a slight dip in revenue and profit compared to the same period last year. Investors are also taking note of a key leadership addition along with a confirmed dividend payout.

See our latest analysis for Gibson Energy.

This year, Gibson Energy’s share price has edged lower with a 4.9% year-to-date decline. However, total shareholder return tells a stronger story, up 12.5% over the last twelve months thanks to dividends. Recent momentum has improved with a 3.7% gain in the past week, as investors react to stable dividends and new leadership additions. This suggests some renewed optimism even as near-term earnings growth has eased.

If today's leadership moves have you thinking about the next wave of opportunities, now’s a smart time to broaden your perspective and discover fast growing stocks with high insider ownership

With Gibson Energy’s share price still trading at a discount to analyst targets despite resilient dividends and new leadership, investors may be overlooking value here, or the market may be accurately pricing in the company’s outlook for growth.

Most Popular Narrative: 9.9% Undervalued

According to the widely followed narrative, Gibson Energy’s fair value stands meaningfully above the current share price. The narrative sets out aggressive growth themes. Here is a revealing quote that shows what is driving the optimism.

Newly completed capital projects (Gateway dredging, Cactus II connection, Duvernay partnership with Baytex) are materially increasing terminal capacity, crude supply optionality, and throughput. These infrastructure expansions are expected to drive sustained high-margin, fee-based revenue growth and EBITDA as customer volumes ramp over the next several years.

Curious what earnings and margin leap this fair value really hinges upon? The big insight is a financial forecast built on outsized long-term profitability. Want to see which future milestones and industry shifts will make or break this price target? Click through to get the full story.

Result: Fair Value of $26.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cost pressures and heavy dependence on North American crude demand could challenge Gibson Energy’s earnings outlook and test the optimistic valuation case.

Find out about the key risks to this Gibson Energy narrative.

Another Perspective: Valuation by Earnings Ratio

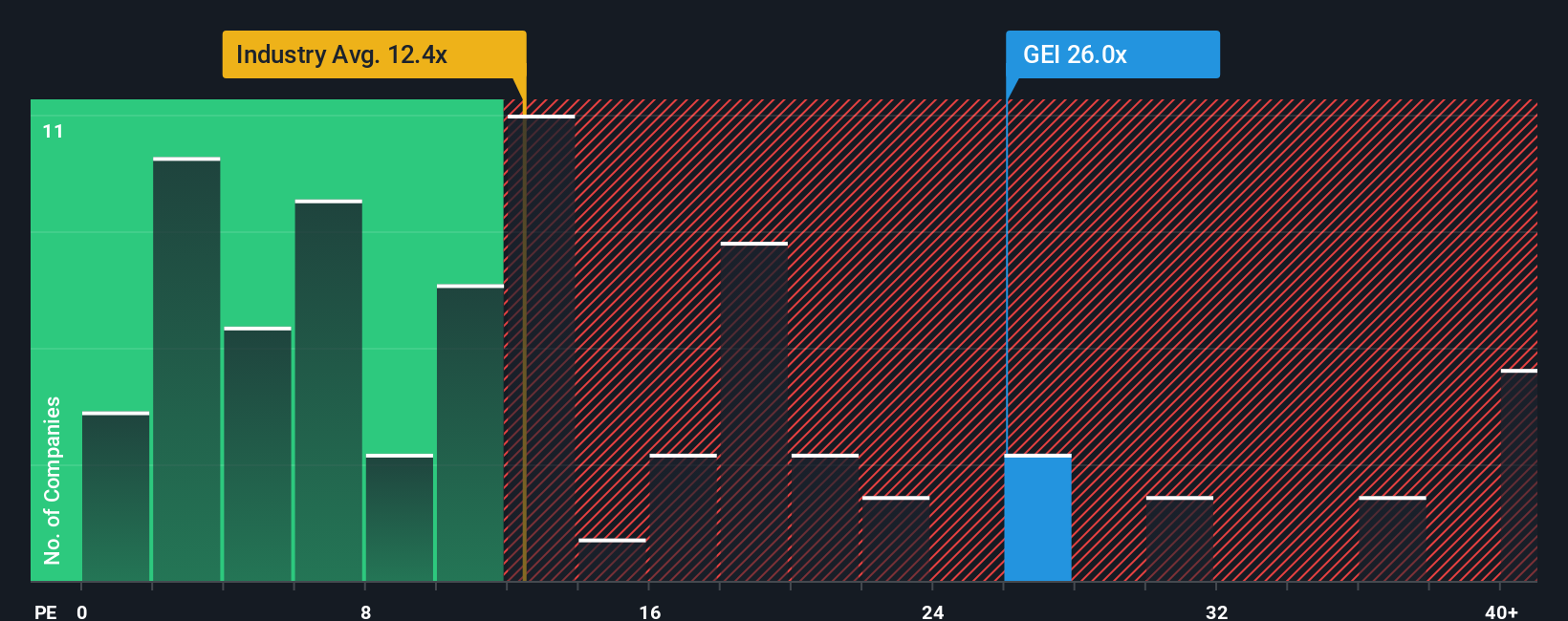

While analyst consensus points to Gibson Energy being undervalued, a look at its earnings ratio tells a different story. The company trades at 25.9 times earnings, which is higher than both the Canadian Oil and Gas industry average of 14.4x and the fair ratio of 15.9x. This suggests that, compared to peers and what the market could move toward, Gibson shares may actually carry some valuation risk rather than clear upside. Which assessment will turn out more accurate as market conditions evolve?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gibson Energy Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can build your own view with just a few clicks, and Do it your way.

A great starting point for your Gibson Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors seize the moment by staying alert to new trends, sectors, and opportunities. Don’t limit yourself; your best idea might only be a click away.

- Boost your portfolio’s income by considering these 14 dividend stocks with yields > 3%, where solid payout histories meet attractive yields.

- Jump ahead of the curve with these 27 AI penny stocks to tap into the explosive growth and innovation in artificial intelligence sectors.

- Catch companies trading at potential bargains by starting with these 883 undervalued stocks based on cash flows, designed for those hunting value in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GEI

Gibson Energy

Engages in the gathering, storing, optimizing, and processing of liquids and refined products in Canada and the United States.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives