- Canada

- /

- Oil and Gas

- /

- TSX:FRU

How Will Freehold Royalties (TSX:FRU) Third-Quarter Results Shape Its Strategic Priorities?

Reviewed by Sasha Jovanovic

- Freehold Royalties Ltd. has announced it will release its third-quarter financial results after market close on November 13, 2025, with a conference call and webcast for stakeholders scheduled for the morning of November 14, 2025.

- This event offers investors and analysts direct access to insights regarding the company’s latest performance, financial position, and ongoing priorities.

- We’ll explore how this anticipated financial disclosure and management discussion could shape Freehold Royalties’ investment narrative amid investor curiosity.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

What Is Freehold Royalties' Investment Narrative?

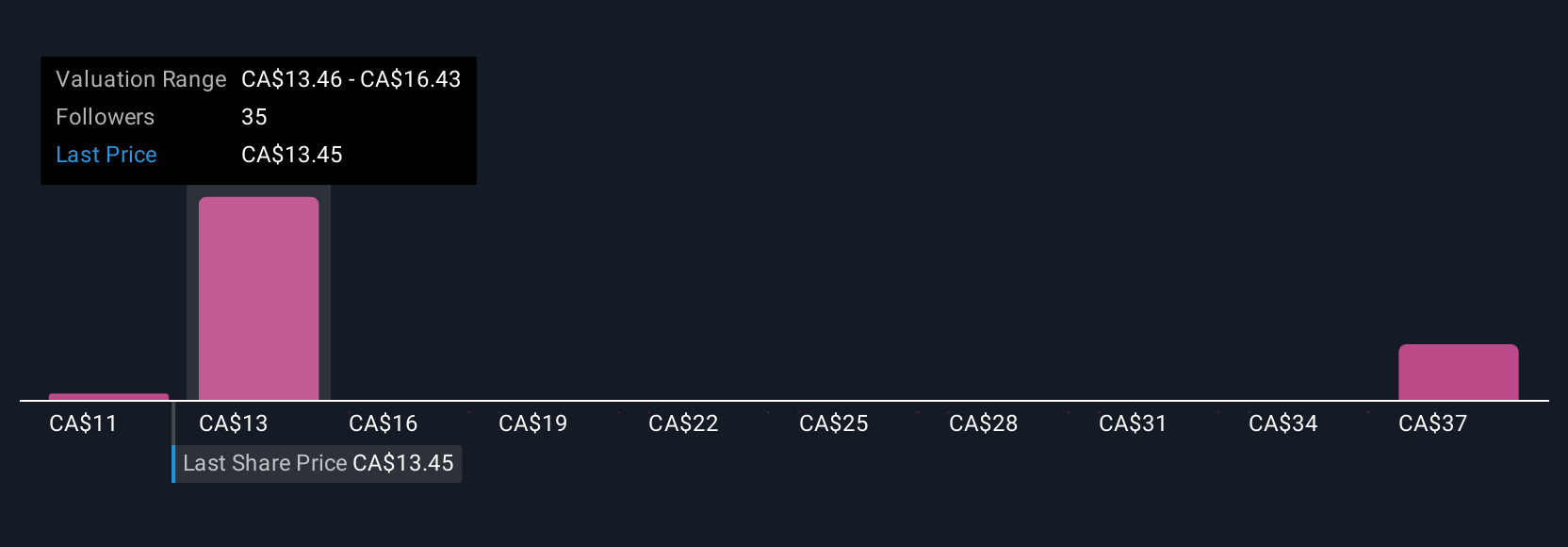

Being a Freehold Royalties shareholder requires confidence in the value proposition of a steady royalty stream, relatively lean operations, and exposure to ongoing commodity cycles. The upcoming release of Q3 results and management’s discussion may give context around soft spots in recent financials, such as the dip in net income through Q2 and flatlining revenues, which were weighing on short-term sentiment, and on the catalysts that matter, like dividend sustainability and guidance on acquisition plans. With production growth stabilizing and generous (if not fully covered) dividend payouts continuing, the near-term risk profile still revolves around earnings stability and management’s ability to offset any cash flow strains. The news itself may not fundamentally change the consensus on these key risks and catalysts, especially given modest recent price moves and relatively muted analyst target upgrades, but the call could still reframe market attention if there’s a shift in guidance or capital strategy. On the other hand, dividend coverage risks should not go unnoticed as they could affect investor returns.

Freehold Royalties' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 8 other fair value estimates on Freehold Royalties - why the stock might be worth 36% less than the current price!

Build Your Own Freehold Royalties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freehold Royalties research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Freehold Royalties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freehold Royalties' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FRU

Freehold Royalties

Acquires and manages royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Canada and the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives