- Canada

- /

- Energy Services

- /

- TSX:ESI

We Ran A Stock Scan For Earnings Growth And Ensign Energy Services (TSE:ESI) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Ensign Energy Services (TSE:ESI). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Ensign Energy Services

How Fast Is Ensign Energy Services Growing Its Earnings Per Share?

In the last three years Ensign Energy Services' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. To the delight of shareholders, Ensign Energy Services' EPS soared from CA$0.12 to CA$0.17, over the last year. That's a commendable gain of 44%.

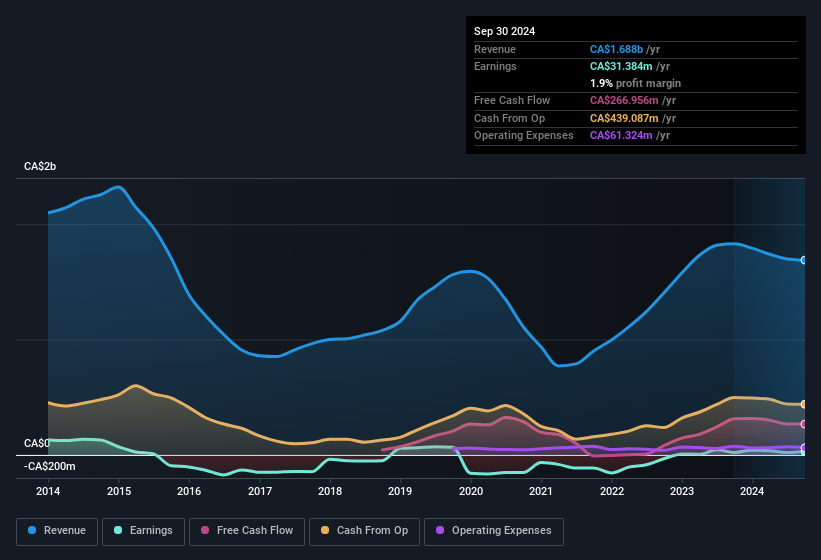

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While Ensign Energy Services may have maintained EBIT margins over the last year, revenue has fallen. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Ensign Energy Services' future EPS 100% free.

Are Ensign Energy Services Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Ensign Energy Services insiders spent CA$193k on stock, over the last year; in contrast, we didn't see any selling. This is a good look for the company as it paints an optimistic picture for the future. We also note that it was the Independent Director, Donna Carson, who made the biggest single acquisition, paying CA$50k for shares at about CA$2.87 each.

The good news, alongside the insider buying, for Ensign Energy Services bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth CA$146m. This totals to 27% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Looking very optimistic for investors.

Does Ensign Energy Services Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Ensign Energy Services' strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. Astute investors will want to keep this stock on watch. You still need to take note of risks, for example - Ensign Energy Services has 2 warning signs (and 1 which is significant) we think you should know about.

The good news is that Ensign Energy Services is not the only stock with insider buying. Here's a list of small cap, undervalued companies in CA with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Ensign Energy Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ESI

Ensign Energy Services

Provides oilfield services to the oil and natural gas industries in Canada, the United States, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives