- Canada

- /

- Oil and Gas

- /

- TSX:ENB

Enbridge (TSX:ENB): Revisiting Valuation as Investor Interest Rises

Reviewed by Simply Wall St

Enbridge (TSX:ENB) has recently found its way into the spotlight again, prompting investors to take a closer look at what’s driving the attention. While there hasn’t been a headline-grabbing event in the news this week, the stock’s latest movements raise a familiar question: whether now might be the right time to revisit its valuation and long-term potential.

This year, Enbridge has posted a strong return, and momentum has built steadily over recent months. The share price is up about 8% so far in 2024 and nearly 28% over the past year, hinting that sentiment may be shifting among both income-focused and growth-oriented investors. With revenue dipping slightly but net income on the rise, investors are paying close attention to the balance between stability and growth.

So, is Enbridge currently presenting a real buying opportunity, or is the market already anticipating everything the company might deliver from here?

Most Popular Narrative: 2% Undervalued

According to the prevailing analyst narrative, Enbridge shares are currently trading slightly below their estimated fair value, suggesting a modest undervaluation in the market today.

The strategic build-out responding to surging electricity and data center needs, including utility-scale renewables, gas transmission expansions, and power generation projects, supports multi-year earnings and cash flow growth as power demand accelerates through the decade.

Curious about the financial engine behind Enbridge's steady valuation? This narrative is driven by a set of bold assumptions about long-term margins and future earnings, with profit multiples that differ from industry norms. The real story lies in the analytical projections powering their fair value. Ready to discover what numbers are moving the market’s consensus?

Result: Fair Value of $68.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory uncertainty and accelerating global decarbonization efforts could present challenges to Enbridge's growth narrative in the future.

Find out about the key risks to this Enbridge narrative.Another View: What Do Market Comparisons Tell Us?

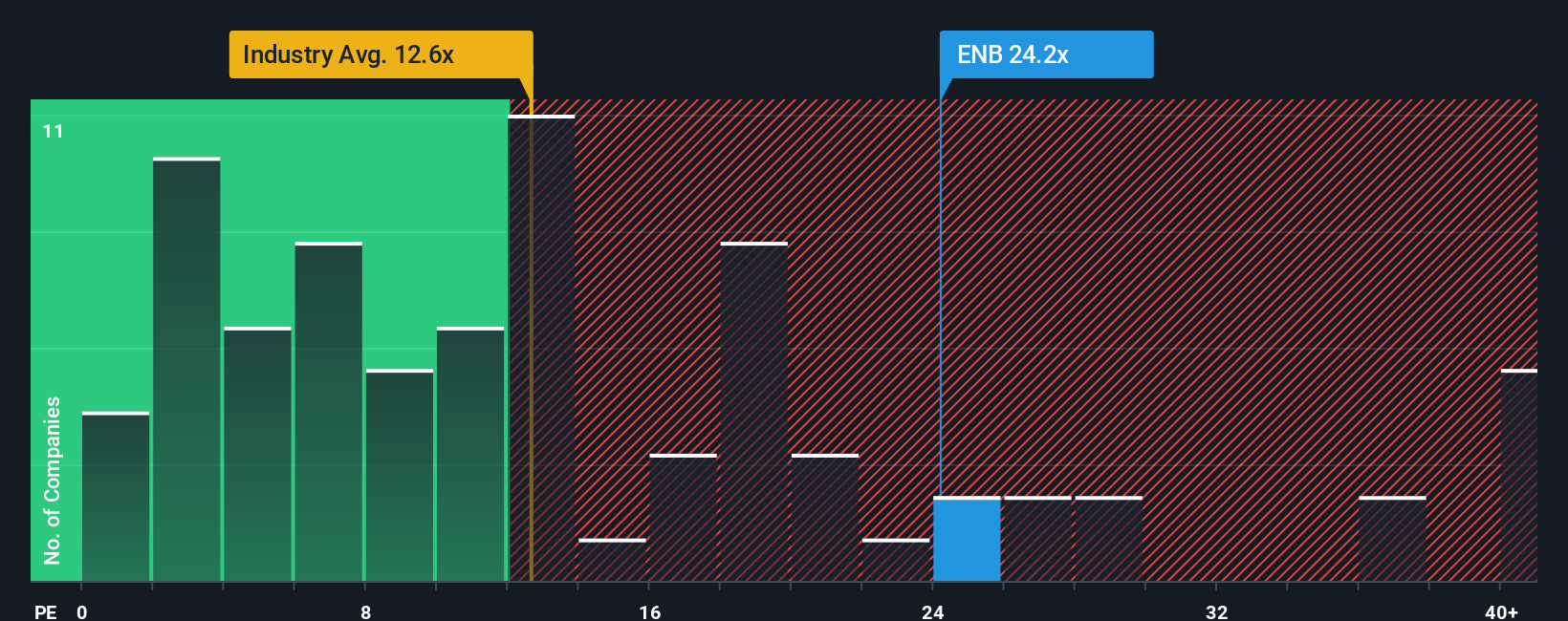

While analysts' projections suggest Enbridge is somewhat undervalued, comparing its price-to-earnings ratio to the broader industry paints a pricier picture. The market seems willing to pay more for Enbridge than for many oil and gas peers. Could this optimism be overdone, or is the premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Enbridge to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Enbridge Narrative

If you want to dig deeper or see things differently, you can shape your own analysis in just a few minutes. Do it your way.

A great starting point for your Enbridge research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Give your portfolio a boost by targeting stocks with untapped potential, breakthrough technology, or stable income streams. Check out these powerful ideas now so you never miss the next big mover:

- Uncover value opportunities by searching for companies trading below their intrinsic worth using our undervalued stocks based on cash flows.

- Ramp up your growth prospects by harnessing the momentum of innovative firms shaping tomorrow’s healthcare sector with healthcare AI stocks.

- Secure reliable income with picks that stand out for delivering robust yields through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enbridge might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:ENB

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives