- Canada

- /

- Oil and Gas

- /

- TSX:ENB

Enbridge (TSX:ENB) Leverages Strategic Acquisitions and High Utilization for Sustained Growth

Reviewed by Simply Wall St

Click here to discover the nuances of Fortis with our detailed analytical report.

Strengths: Core Advantages Driving Sustained Success For Fortis

Fortis has demonstrated strong operational and financial performance, as highlighted by David Hutchens, President and CEO, who noted the company's consistent results from regulated utilities. The company’s capital investments are on track, with $1.1 billion invested in the first quarter alone, supporting a $4.8 billion capital plan for 2024. Additionally, Fortis has a robust growth outlook, with opportunities to expand and extend its plans. The company has a remarkable track record of increasing dividends for 50 consecutive years, with a 4% to 6% annual dividend growth guidance through 2028. The rate base is expected to grow by $12 billion to over $49 billion by 2028, supporting an average annual rate base growth of 6.3%. The recent release of the 2024 Climate Report underscores Fortis's commitment to mitigating climate-related impacts.

Weaknesses: Critical Issues Affecting Fortis's Performance and Areas For Growth

Despite its strengths, Fortis faces higher corporate costs, which tempered regulated utility growth. Jocelyn Perry, Executive VP and CFO, highlighted that the disposition of Aitken Creek impacted EPS by $0.03 in the quarter. Performance issues in Arizona, such as higher depreciation and operating costs, and lower retail revenue due to milder weather, also posed challenges. The company's share price is currently above the estimated fair value, indicating it may be overvalued compared to its peers and the industry average. Fortis's Price-To-Earnings Ratio of 19.1x is higher than the peer average of 18.6x, further suggesting potential overvaluation.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Fortis has significant opportunities for growth, particularly in renewable energy. With $7 billion earmarked for cleaner energy investments, the company plans to interconnect renewables to the grid and invest in renewable generation and energy storage in Arizona. The data center load growth in ITC Midwest, with Google's plans for a new data center coming online in 2026, presents another growth avenue. Regulatory developments, such as the BCUC's approval of FortisBC's renewable natural gas application, also offer potential benefits. Additionally, the MISO's draft tranche two portfolio release is viewed as a promising step forward for investment opportunities within ITC's footprint.

Threats: Key Risks and Challenges That Could Impact Fortis's Success

Fortis faces several threats, including regulatory and legal challenges. The Iowa District Court's decision in relation to the Iowa ROFR, as noted by Jocelyn Perry, poses a risk. Competitive pressures and market risks are also significant, with uncertainties around investment opportunities within ITC's footprint pending MISO Board approval. Economic factors, such as engagement with S&P on physical risks related to climate change, add another layer of complexity. Additionally, wildfire risks remain a concern, with no specific regulatory mechanisms addressing these issues, as highlighted by Perry.

Conclusion

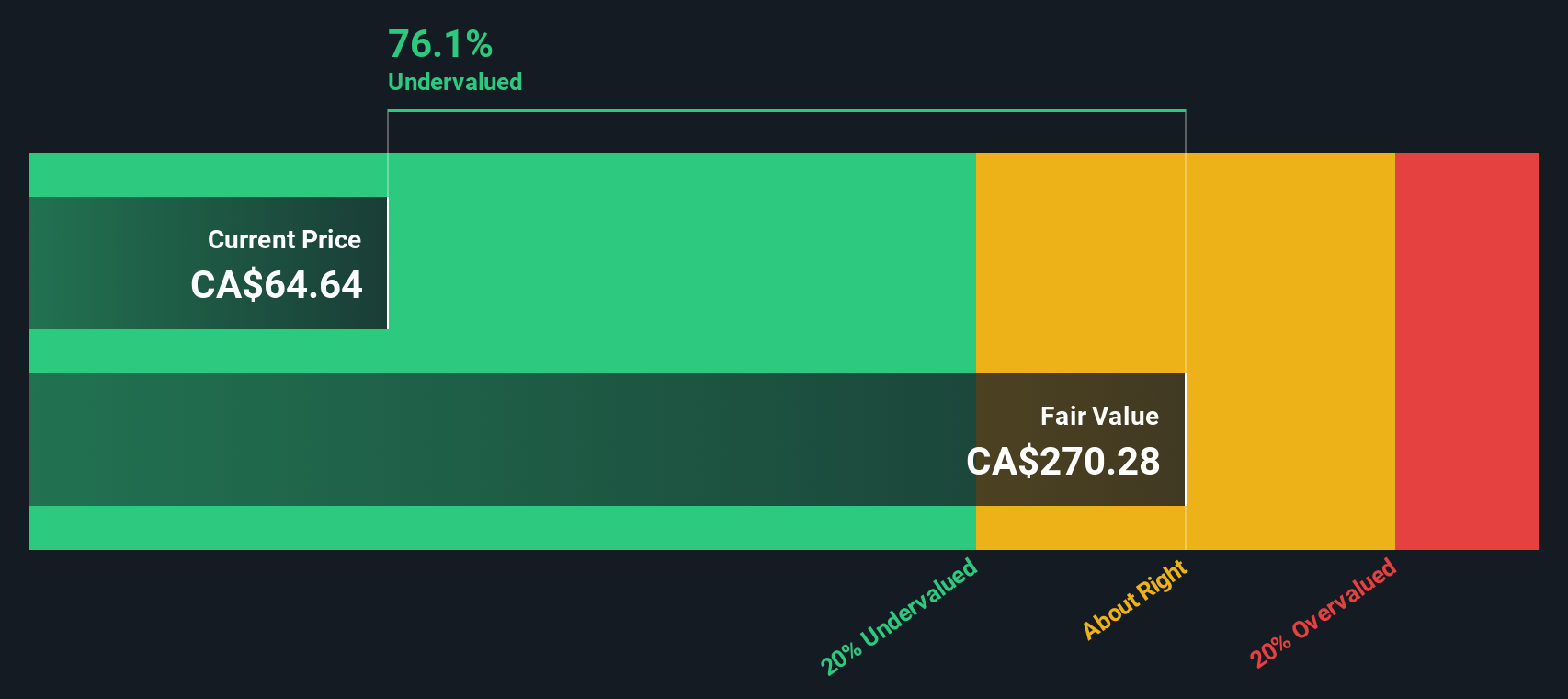

Fortis's strong operational and financial performance, driven by consistent results from regulated utilities and significant capital investments, underscores its potential for sustained success. However, higher corporate costs and performance issues in Arizona have tempered growth, and the company's share price, currently above the estimated fair value with a Price-To-Earnings Ratio of 19.1x compared to the peer average of 18.6x, suggests it may be overvalued. Despite these challenges, Fortis's commitment to renewable energy investments and regulatory approvals positions it well for future growth. Nonetheless, regulatory and legal challenges, competitive pressures, and economic factors, including climate-related risks, could impact its performance. Investors should weigh these strengths and weaknesses when considering Fortis's future outlook.

Next Steps

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Enbridge might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:ENB

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives