- Canada

- /

- Oil and Gas

- /

- TSX:ENB

Enbridge (TSX:ENB): Assessing Valuation and Long-Term Potential Following Recent Modest Share Price Moves

Reviewed by Simply Wall St

Enbridge (TSX:ENB) shares have shifted modestly over the past month, even as energy markets remain in flux. For investors watching the company, recent price movement offers a fresh look at Enbridge’s longer-term returns and overall stability.

See our latest analysis for Enbridge.

Enbridge’s share price has seen some short-term softness, but context matters, as the company boasts an impressive 1-year total shareholder return of 23% and a standout 155% over five years. This kind of consistent long-term momentum suggests investors remain confident in both Enbridge's yield and its staying power, regardless of recent volatility.

If steady gains like these make you curious about other opportunities, it’s a good moment to broaden your search and discover fast growing stocks with high insider ownership

But with Enbridge’s recent performance and steady returns, the key question is whether the current valuation reflects untapped potential or if the market has already accounted for all future growth, leaving little room for upside.

Most Popular Narrative: 5.4% Undervalued

Compared to Enbridge’s last close at CA$65.40, the most widely followed valuation narrative puts fair value at CA$69.17, giving the shares a modest upside. The logic behind this estimate lies in future expansion, policy support, and smarter asset allocation. These factors could unlock more earnings power.

Disciplined capital allocation, a growing secured project backlog with higher risk-adjusted returns, and stable balance sheet management are set to drive predictable dividend growth and increasing free cash flow per share. These dynamics address any current undervaluation as future earnings visibility strengthens.

Curious how analysts arrive at this target? The forecast relies on a major shift in margins and long-term earning power. Find out what makes the math work and why one quantitative assumption could make all the difference in the years ahead.

Result: Fair Value of $69.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory unpredictability and stricter decarbonization policies could quickly shift Enbridge’s outlook. This may challenge near-term earnings stability and long-term asset values.

Find out about the key risks to this Enbridge narrative.

Another View: Market Ratios Flag a Premium

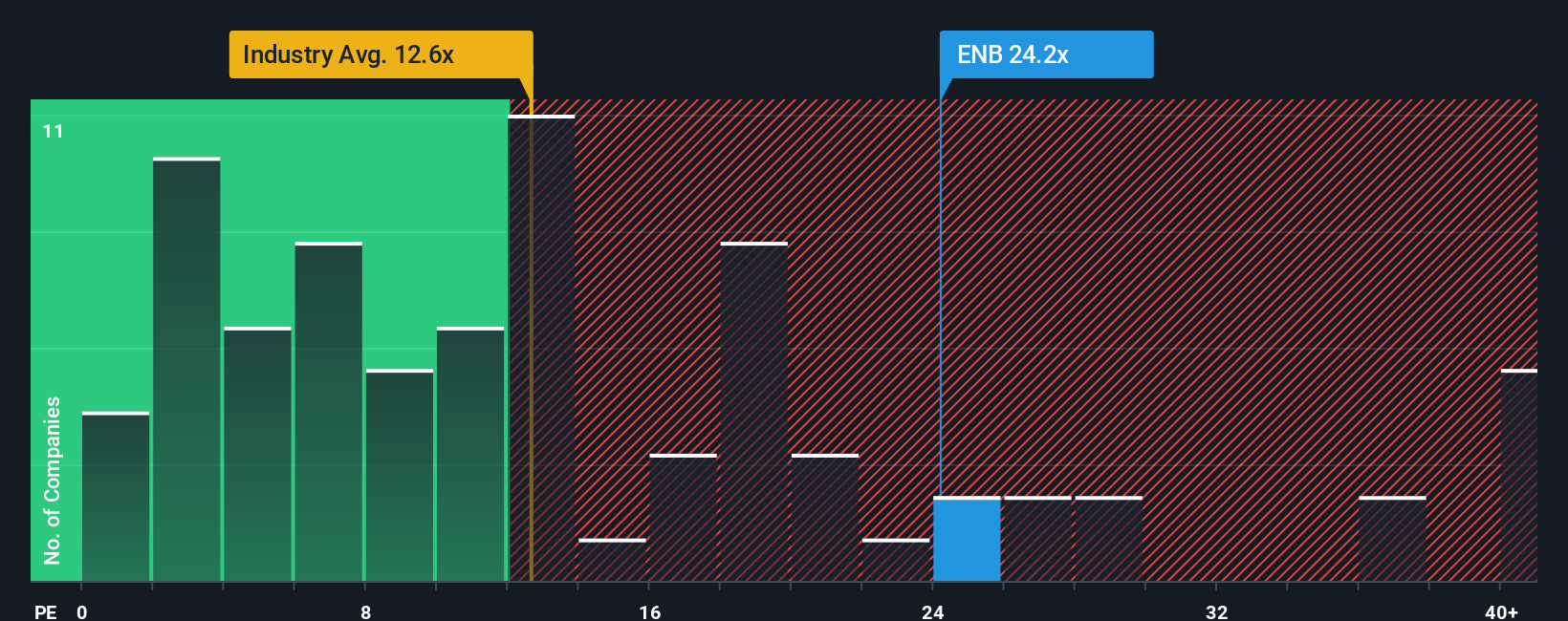

While analyst forecasts suggest some undervaluation, one key metric paints a pricier picture. Enbridge’s price-to-earnings sits at 22.9 times, considerably above its peer average of 17.7 and the Canadian Oil and Gas industry standard of 12.4. The fair ratio stands even lower at just 18 times. This kind of premium points to valuation risk if future growth does not accelerate as the market hopes. Could current expectations prove too optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enbridge Narrative

Prefer to run your own numbers or take a different angle? It only takes a few minutes to build your personal Enbridge story. Do it your way

A great starting point for your Enbridge research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great investors seize every opportunity. Start using the Simply Wall Street Screener to uncover stocks others might miss and take charge of your next move.

- Spot potential big winners by checking out these 3590 penny stocks with strong financials, which includes companies showing strong financials and untapped growth stories.

- Tap into tomorrow’s trends and invest early with these 26 AI penny stocks, featuring businesses that excel in artificial intelligence innovation and industry disruption.

- Boost your income with these 22 dividend stocks with yields > 3%, focusing on yields above 3 percent from businesses built for consistent, long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enbridge might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ENB

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives