- Canada

- /

- Oil and Gas

- /

- TSX:ENB

Assessing Enbridge (TSX:ENB) Valuation After Its Recent Share Price Weakness

Reviewed by Simply Wall St

Enbridge (TSX:ENB) has been grinding lower over the past month, even though its long term total return track record remains strong. That disconnect naturally raises the question of whether the recent dip is overdone.

See our latest analysis for Enbridge.

Over the past month the 30 day share price return of negative 5.98 percent contrasts sharply with Enbridge's 1 year and multi year total shareholder returns, suggesting short term sentiment has cooled even as the long term income story remains intact.

If Enbridge has you thinking more broadly about resilient cash generators, it could be a smart moment to explore fast growing stocks with high insider ownership.

With Enbridge trading below analyst targets yet still delivering solid long term returns, is the recent weakness signaling an undervalued dividend giant, or is the market already baking in all the future pipeline driven growth?

Most Popular Narrative: 9.5% Undervalued

With Enbridge last closing at CA$64.30 against a narrative fair value near CA$71.07, the story points to modest upside built on durable cash flows.

Disciplined capital allocation, a growing secured project backlog with higher risk adjusted returns, and stable balance sheet management are set to drive predictable dividend growth and increasing free cash flow per share, addressing any current undervaluation as future earnings visibility strengthens.

Want to see how flat revenues, rising margins, and a premium earnings multiple can still add up to upside potential? The narrative walks through the cash flow math, the earnings bridge, and the valuation framework that supports this target, step by step, without relying on heroic growth assumptions.

Result: Fair Value of $71.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory setbacks or faster than expected decarbonization could pressure pipeline utilization, squeeze returns on new projects, and weaken the dividend growth narrative.

Find out about the key risks to this Enbridge narrative.

Another Lens On Valuation

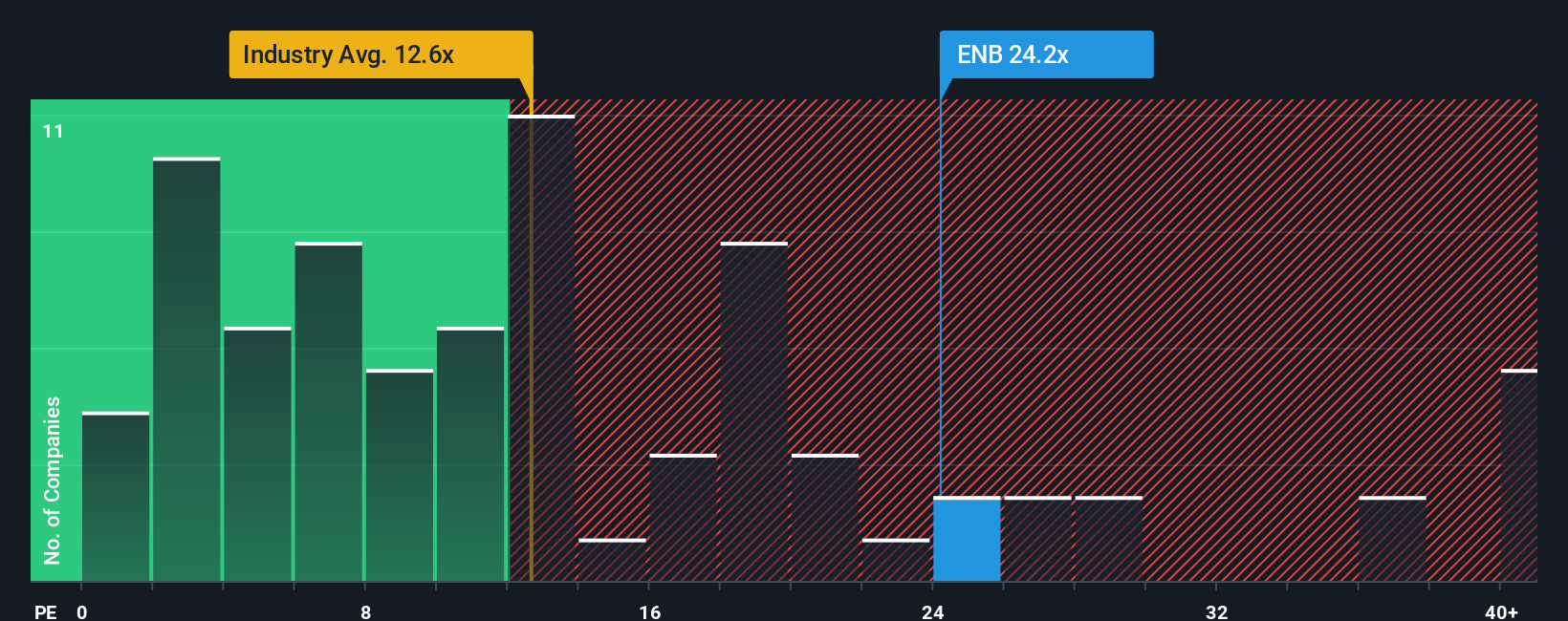

On earnings, the picture is less forgiving. Enbridge trades on about 25.1 times earnings versus a fair ratio of 20.6 times and a Canadian Oil and Gas average of 14.1 times. This suggests investors are already paying up for stability, leaving less room for error if growth underwhelms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enbridge Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Enbridge research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning focused stock ideas from our screener so you are not leaving potential opportunities on the table.

- Explore income potential with these 13 dividend stocks with yields > 3% that may help strengthen your portfolio cash flow when markets turn choppy.

- Look into these 24 AI penny stocks positioned at the forefront of emerging artificial intelligence trends.

- Review companies priced for potential opportunity using these 913 undervalued stocks based on cash flows before the broader market fully takes notice.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Enbridge might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ENB

Average dividend payer with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion