- Canada

- /

- Energy Services

- /

- TSX:EFX

Enerflex (TSX:EFX) Is Up 7.0% After Strong Q3 Sales and Margin Gains - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Enerflex Ltd. recently reported third quarter 2025 results, with sales reaching US$777 million and net income rising to US$37 million, both higher than the prior year period.

- The company also saw a sharp increase in year-to-date net income, highlighting a period of significant operational improvement and margin expansion.

- We'll explore how Enerflex's robust sales and profit growth in the recent quarter influence its investment narrative and future outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Enerflex Investment Narrative Recap

Enerflex appeals to investors who believe in the ongoing relevance of natural gas in global energy markets and see value in its established recurring revenue streams, especially through U.S. contract compression and international projects. The latest quarterly results, which showed higher sales and a substantial increase in net income, reinforce confidence in short-term profitability; however, these gains do not eliminate the structural risks tied to margin normalization and ongoing industry transition pressures.

Among recent announcements, the September appointment of Paul E. Mahoney as CEO stands out as most relevant. Leadership continuity had been a concern, so having a permanent CEO in place could provide needed stability and focus, especially as the company works to sustain recent operational improvements and address challenges like energy transition risks.

Yet, despite improved earnings, investors should also be aware that if Enerflex does not accelerate its diversification beyond traditional gas solutions...

Read the full narrative on Enerflex (it's free!)

Enerflex's outlook anticipates $2.4 billion in revenue and $120.5 million in earnings by 2028. This is based on a 1.2% annual revenue growth rate and an $8.5 million decrease in earnings from the current level of $129.0 million.

Uncover how Enerflex's forecasts yield a CA$18.82 fair value, in line with its current price.

Exploring Other Perspectives

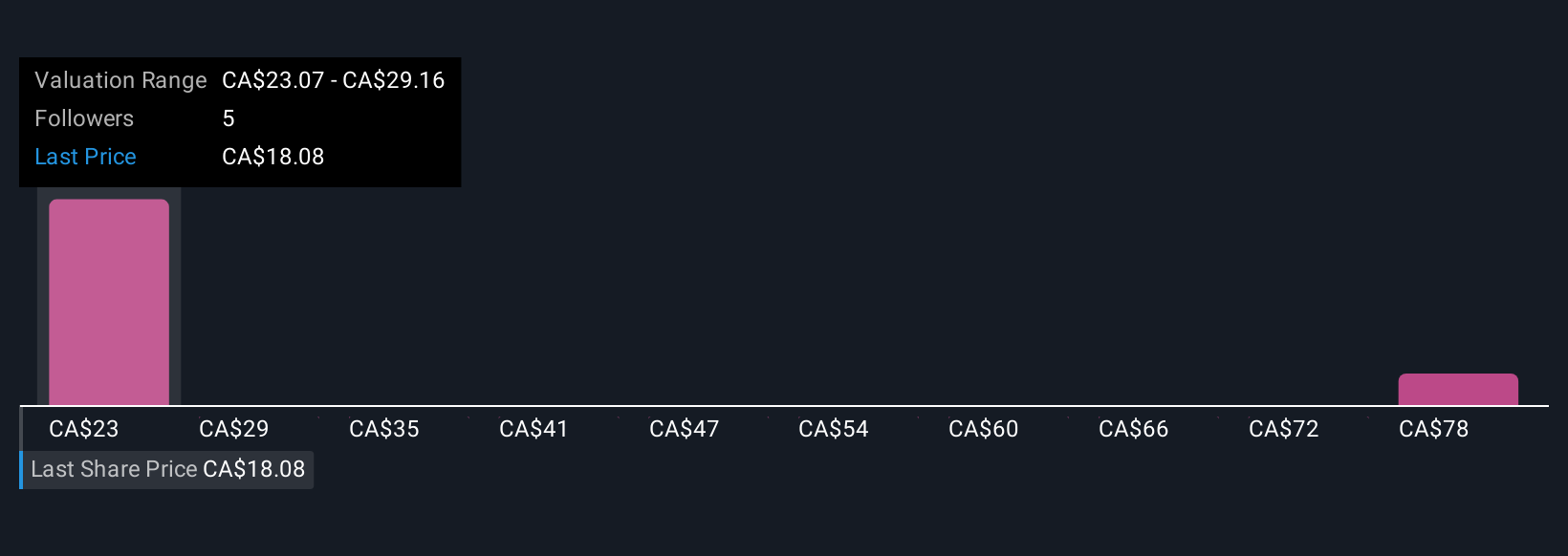

Community members at Simply Wall St have set fair value estimates for Enerflex between CA$18.82 and CA$36.41, highlighting wide views across just two contributors. While recent profit growth drives optimism, concerns about long-term sustainability amid shifting energy demand invite you to compare several perspectives for deeper insight.

Explore 2 other fair value estimates on Enerflex - why the stock might be worth just CA$18.82!

Build Your Own Enerflex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enerflex research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Enerflex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enerflex's overall financial health at a glance.

No Opportunity In Enerflex?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enerflex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EFX

Enerflex

Offers energy infrastructure and energy transition solutions in North America, Latin America, and the Eastern Hemisphere.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives