- Canada

- /

- Oil and Gas

- /

- TSX:EFR

Energy Fuels (TSX:EFR): Heavy Losses Persist, High Valuation Tests Growth Narrative Ahead of Profitability

Reviewed by Simply Wall St

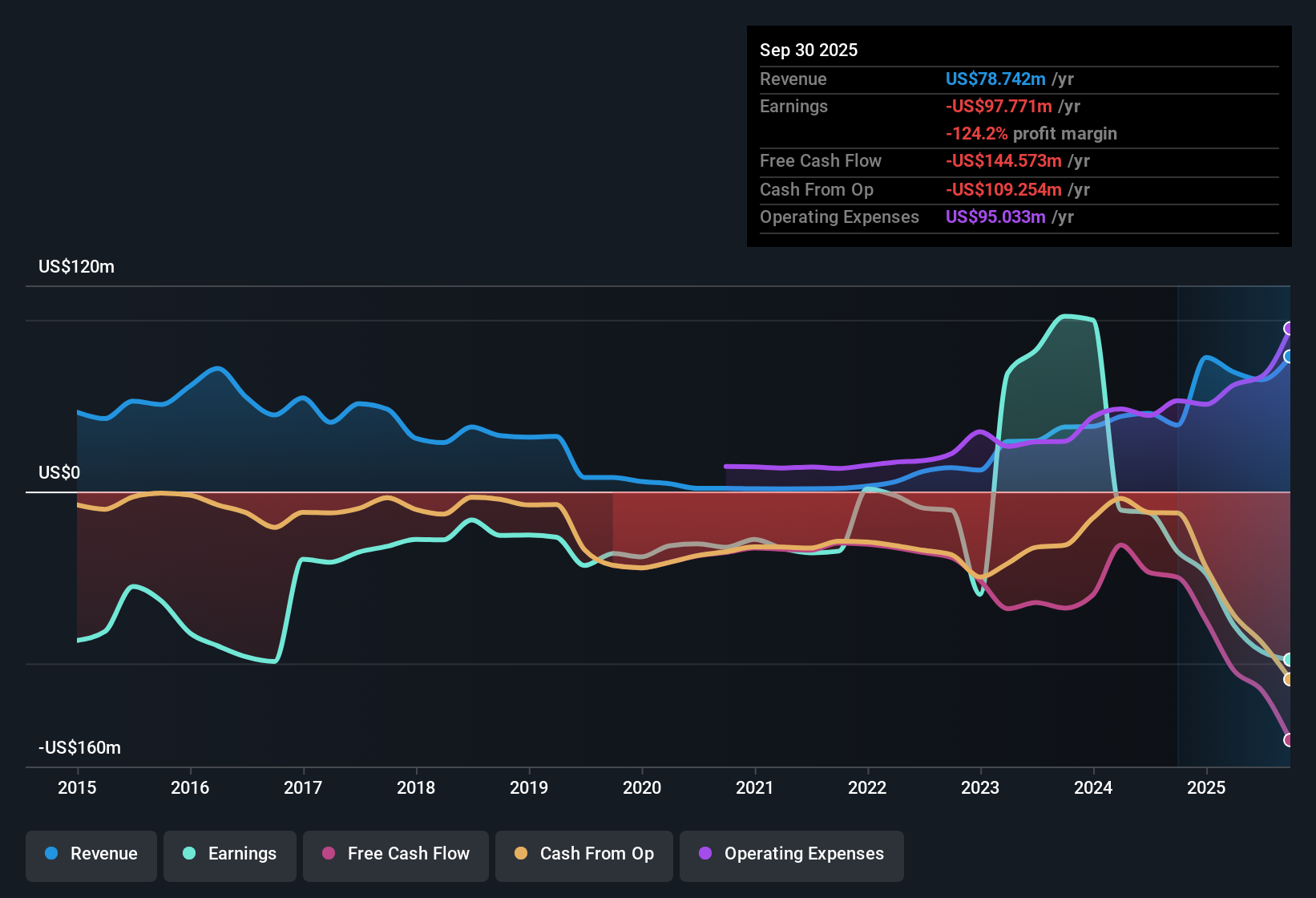

Energy Fuels (TSX:EFR) remains unprofitable, with losses having accelerated by 12.2% per year over the last five years. Shares trade at a steep Price-to-Sales Ratio of 49.9x, which is significantly higher than both the Canadian Oil and Gas industry average of 2.6x and its peer average of 14.2x. Despite recent share price volatility and dilution, consensus forecasts point to annual earnings growth of 70.14% and revenue growth of 38.8%, with profitability expected in the next three years.

See our full analysis for Energy Fuels.Next, we will put these headline numbers side by side with the prevailing narratives to see which stories hold up and which ones the latest earnings are starting to challenge.

See what the community is saying about Energy Fuels

Margins Set for Major Turnaround

- Analysts expect profit margins to climb from -143.0% today to 43.0% in the next three years, a swing of over 180 percentage points as higher-grade uranium and rare earth production ramps up.

- According to the analysts' consensus view, this dramatic margin recovery is anchored in the Pinyon Plain mine delivering low-cost uranium ($23 to $30 per pound) and the White Mesa Mill’s Phase 2 expansion targeting commercial heavy rare earth production.

- Consensus notes that rising gross margins and clearing out higher-cost inventory will accelerate cash generation and support a jump in net earnings.

- These improvements depend on executing cost controls and realizing the benefits of new supply contracts amid global supply chain moves.

- To see whether analysts expect this margin surge to drive sustainable profits for Energy Fuels, read the full Consensus Narrative. 📊 Read the full Energy Fuels Consensus Narrative.

Share Dilution and Funding Needs Loom

- Outstanding shares are projected to increase by 7.0% per year for the next three years, adding funding flexibility but also diluting existing holders as major development-stage projects move forward.

- Analysts' consensus narrative flags capital-raising risks as Energy Fuels funds the Donald and Toliara projects, with future cash flow relying on the company's ability to secure government support, offtake agreements, or favorable loan terms.

- Bears point out that delays or challenges here could trigger additional dilution and weigh on eventual margin expansion and shareholder returns.

- On the flip side, smooth project funding and government support would reinforce long-term upside for both the uranium and rare earths businesses.

Premium Valuation Hinges on Execution

- Energy Fuels trades at a 49.9x Price-to-Sales Ratio, a steep premium to both the Canadian Oil and Gas sector average of 2.6x and its peer average of 14.2x, sharpening the debate around fair value as the stock price stands at $24.01.

- Analysts' consensus narrative frames this premium as a bet on rapid scale-up and delivery of new production, with full buy-in dependent on hitting $553.4 million in revenue and $237.8 million in earnings within four years.

- If the company’s margin rebound and project ramp-up proceeds as expected, today’s multiples may look justified or even cheap relative to long-term cash flows.

- Missed milestones or cost overruns, however, put downside pressure on both valuation and future price targets.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Energy Fuels on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the data suggest a different story to you? Share your viewpoint and shape the narrative in just a few minutes. Do it your way

A great starting point for your Energy Fuels research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Energy Fuels’ premium valuation and ongoing share dilution depend heavily on flawless project execution and margin recovery. This situation leaves investors exposed if targets are missed or costs climb.

If you want to sidestep such uncertainty, focus on these 843 undervalued stocks based on cash flows to discover companies offering better value and stronger fundamentals today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Fuels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EFR

Energy Fuels

Engages in the exploration, recovery, recycling, exploration, operation, development, permitting, evaluation, and sale of uranium mineral properties in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives