Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Energy Fuels Inc. (TSE:EFR) shareholders should be happy to see the share price up 10% in the last month. But that doesn't change the fact that the returns over the last half decade have been disappointing. In that time the share price has delivered a rude shock to holders, who find themselves down 54% after a long stretch. So we're hesitant to put much weight behind the short term increase. We'd err towards caution given the long term under-performance.

Check out our latest analysis for Energy Fuels

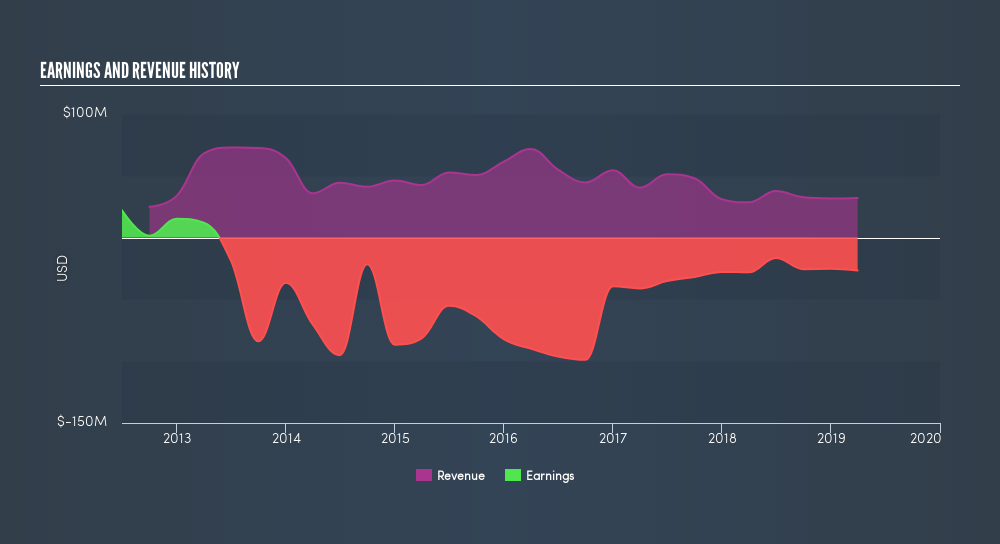

Because Energy Fuels is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years Energy Fuels saw its revenue shrink by 6.7% per year. While far from catastrophic that is not good. The share price decline of 14% compound, over five years, is understandable given the company is losing money, and revenue is moving in the wrong direction. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

If you are thinking of buying or selling Energy Fuels stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Energy Fuels has rewarded shareholders with a total shareholder return of 39% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 14% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. If you would like to research Energy Fuels in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like Energy Fuels better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:EFR

Energy Fuels

Engages in the exploration, recovery, recycling, exploration, operation, development, permitting, evaluation, and sale of uranium mineral properties in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives