- Canada

- /

- Oil and Gas

- /

- TSX:DML

Assessing Denison Mines (TSX:DML) Valuation Following Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Denison Mines.

Denison Mines’ recent 9.5% decline in share price over the past month stands out against its impressive longer-term story. Momentum is still strong, with a 23% share price return over the past 90 days and a remarkable 25% total shareholder return in the past year. This suggests that while sentiment can shift quickly in the uranium space, long-term holders have continued to see robust gains.

If you’re looking for other opportunities with similar growth potential, now’s a smart time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With Denison’s recent dip and its long streak of outperformance, the big question for investors now is whether the current share price undervalues the company’s future uranium prospects or if the market is already looking ahead and pricing in further growth.

Price-to-Book of 6x: Is it justified?

Denison Mines currently trades at a price-to-book ratio of 6x, which stands out when measured against Canadian oil and gas peers. With a recent closing price of CA$3.61, the valuation metrics suggest the market is pricing in high expectations for future growth or asset value realization.

The price-to-book ratio compares a company’s market value to its underlying net assets. In mining and commodity sectors, this measure is especially relevant because it reflects the value investors place on resource reserves and future production relative to current accounting book value. Here, a 6x multiple indicates investors are willing to pay a significant premium above Denison’s book value, which is often a sign of anticipated operational or sector breakthroughs.

Compared to industry benchmarks, Denison’s price-to-book ratio is substantially higher than the Canadian oil and gas industry average of 1.6x, and also well above the peer average of 4.4x. This premium could reflect optimism about Denison’s uranium assets or signify that shares are expensive relative to asset value. If the market shifts or sector sentiment changes, valuations could move closer to these peer and industry levels.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 6x (OVERVALUED)

However, weak net income growth and the company’s significant discount to analyst price targets could lead to a reassessment of Denison’s current valuation.

Find out about the key risks to this Denison Mines narrative.

Another View: DCF Model Tells a Different Story

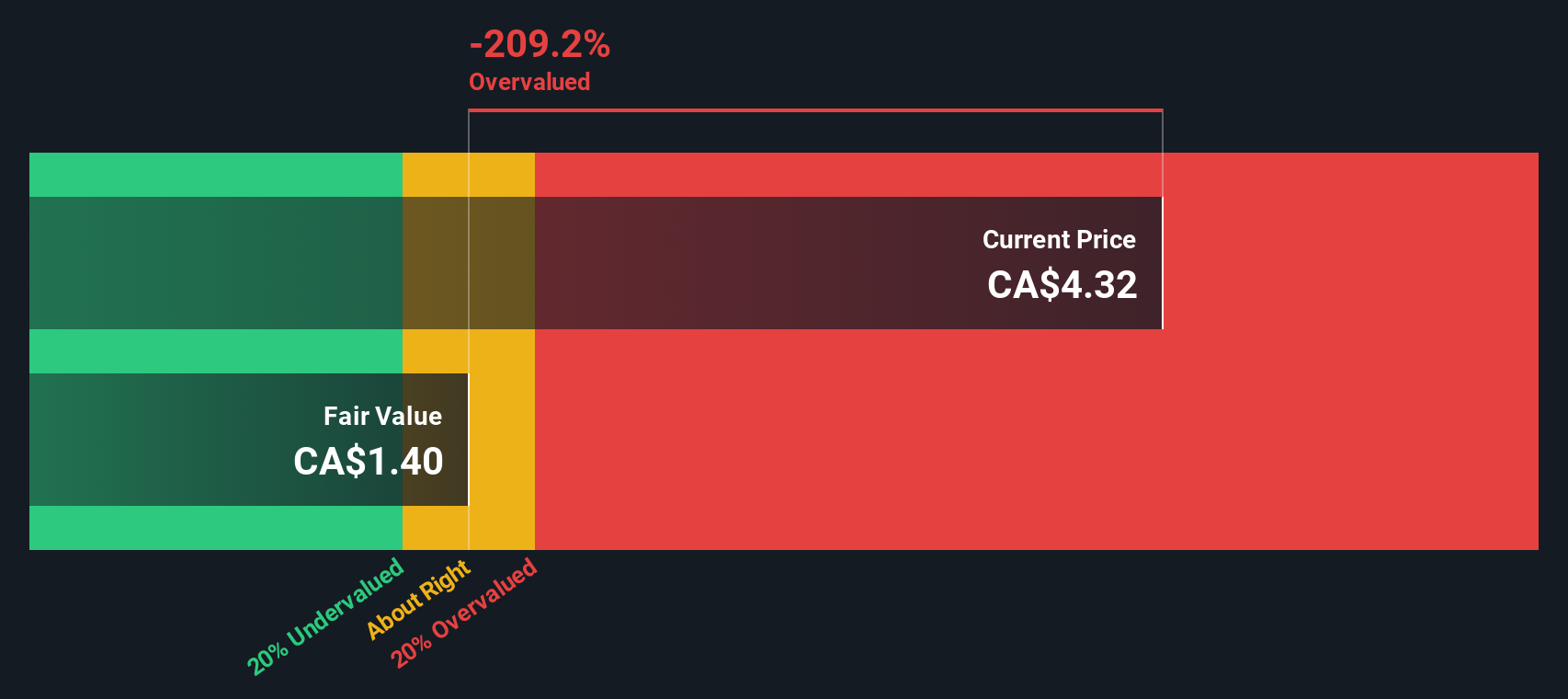

While the price-to-book ratio suggests Denison Mines is trading at a premium, our DCF model paints a more cautious picture. According to the SWS DCF model, Denison's current price sits well above its estimated fair value. This suggests the stock may actually be overvalued based on underlying cash flows. Could this gap signal a turning point or a longer-term challenge for patient investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Denison Mines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Denison Mines Narrative

If you want to dive deeper or have your own take on Denison Mines, you can build a custom narrative in just a few minutes with Do it your way.

A great starting point for your Denison Mines research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by; the market is full of exciting stocks that may fit your unique portfolio goals. Move ahead of the crowd with these focused searches:

- Tap into high yields and steady income streams by reviewing these 16 dividend stocks with yields > 3% with robust dividend payouts and consistent long-term performance.

- Seize the rise of transformative healthcare by scanning these 32 healthcare AI stocks pushing boundaries with cutting-edge medical AI and innovative treatment solutions.

- Ride the next wave in finance by selecting these 82 cryptocurrency and blockchain stocks spearheading advancements in cryptocurrency and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DML

Denison Mines

Engages in the acquisition, exploration, and development of uranium bearing properties in Canada.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives