- Canada

- /

- Oil and Gas

- /

- TSX:CVE

Cenovus Energy (TSX:CVE) Reports Strong Q2 Earnings and Dividend Increase, Highlights Growth Potential

Reviewed by Simply Wall St

Take a closer look at Cenovus Energy's potential here.

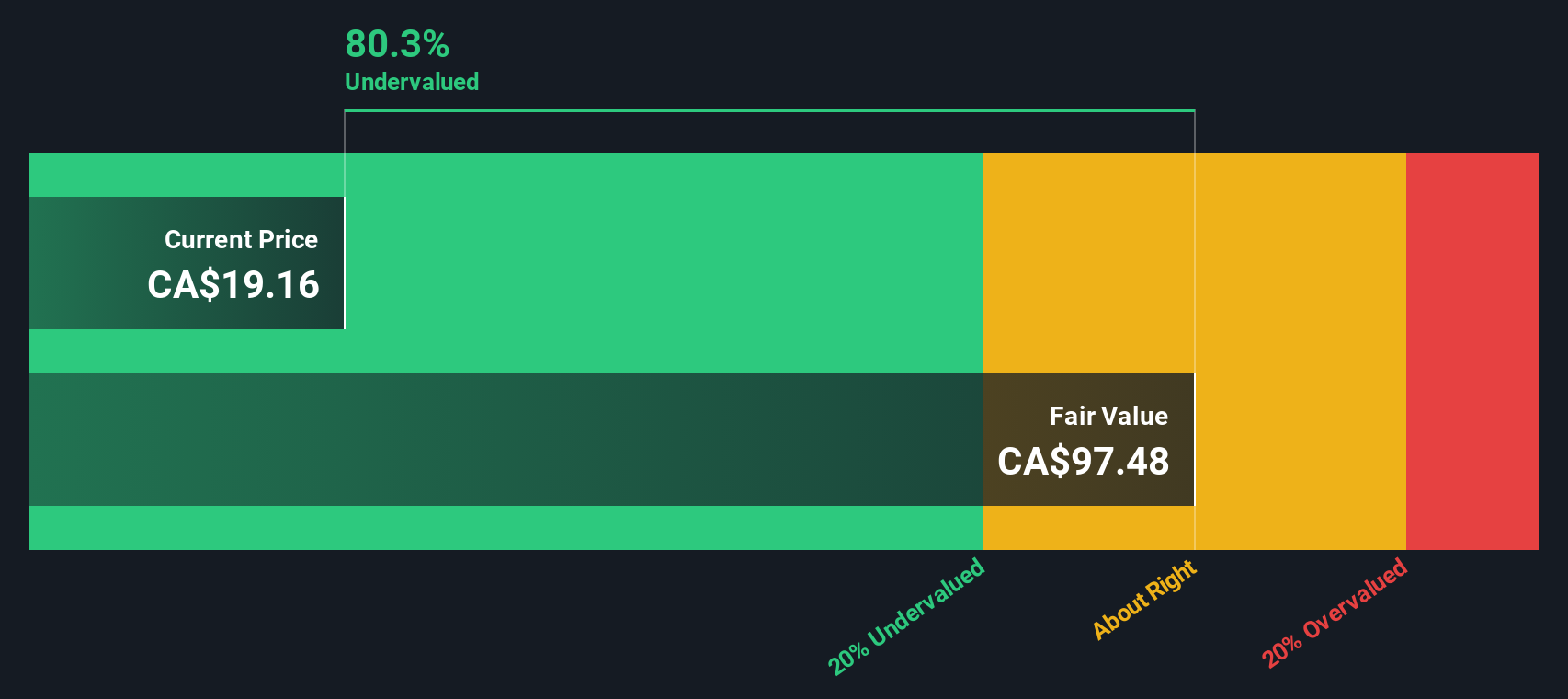

Strengths: Core Advantages Driving Sustained Success For Cenovus Energy

Cenovus Energy has demonstrated robust financial health, achieving a net debt target of $4 billion and committing to returning 100% of excess free funds flow to shareholders, as highlighted by CEO Jonathan McKenzie. The company generated $2.9 billion in operating margin and $1.2 billion in free funds flow in the second quarter, reflecting strong financial performance. Operationally, Cenovus maintained production levels of over 800,000 BOE per day, with exceptional performance in its oil sands assets. Furthermore, the company is considered a good value based on its Price-To-Earnings Ratio (9.1x), which is below both the industry average (11.7x) and the peer average (13.5x), and it is trading significantly below its estimated fair value (CA$75.73). This valuation underscores the company's strong market positioning and financial health.

Weaknesses: Critical Issues Affecting Cenovus Energy's Performance and Areas For Growth

Despite its strengths, Cenovus faces challenges, particularly in its downstream segment. The planned turnaround at the Lloydminster Upgrader impacted Canadian refining results, as noted by Jonathan McKenzie. Additionally, the company incurred one-time expenses of $220 million during the quarter. The management team, with an average tenure of 1.4 years, is relatively new, which may pose challenges in strategic continuity. Moreover, Cenovus's earnings growth over the past year (23%) is below its 5-year average (49.3% per year), indicating a slowdown. These factors, coupled with a forecasted decline in earnings (-1.2% per year) and revenue (-1.4% per year) over the next three years, suggest areas for improvement.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Cenovus Energy has several growth opportunities, particularly in its oil sands projects. The Narrows Lake tie-back to Christina Lake is on schedule, and the company expects to exit the year with production well above 800,000 BOE per day. Additionally, strong regional gas demand in Asia has contributed to an operating margin of $264 million, presenting a lucrative market opportunity. The company's focus on cost containment and achieving attractive netbacks at strip prices further enhances its competitive position. Strategic initiatives and market trends indicate potential for leveraging growth and expanding market share.

Threats: Key Risks and Challenges That Could Impact Cenovus Energy's Success

Regulatory and operational risks pose significant threats to Cenovus Energy. The optimization of planned turnaround activities in the downstream business, while necessary, has been a distraction and requires careful management. Market competition and pricing volatility also present challenges, with heavy differential in Alberta widening by $1 or $2, as noted by Geoff Murray. Additionally, the company's dividend payments have been volatile over the past 10 years, and earnings are forecasted to decline by an average of 1.2% per year for the next three years. These external factors could impact Cenovus's growth and market share, necessitating strategic adaptations to mitigate risks.

```html

Conclusion

Cenovus Energy's strong financial health, evidenced by achieving a net debt target of $4 billion and generating substantial free funds flow, positions the company well for sustained performance. Despite challenges in the downstream segment and a relatively new management team, the company's strategic initiatives in oil sands projects and cost containment efforts offer significant growth potential. Additionally, Cenovus's Price-To-Earnings Ratio of 9.1x, which is below both the industry and peer averages, combined with its trading price significantly below its estimated fair value of CA$75.73, underscores its strong market positioning and potential for future appreciation. However, regulatory and operational risks, as well as earnings volatility, necessitate careful management to ensure continued success.

```Turning Ideas Into Actions

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:CVE

Cenovus Energy

Develops, produces, refines, transports, and markets crude oil, natural gas, and refined petroleum products in Canada, the United States, and China.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives