- Canada

- /

- Oil and Gas

- /

- TSX:CVE

Cenovus Energy (TSX:CVE) Margin Decline Undercuts Bullish Growth Narrative

Reviewed by Simply Wall St

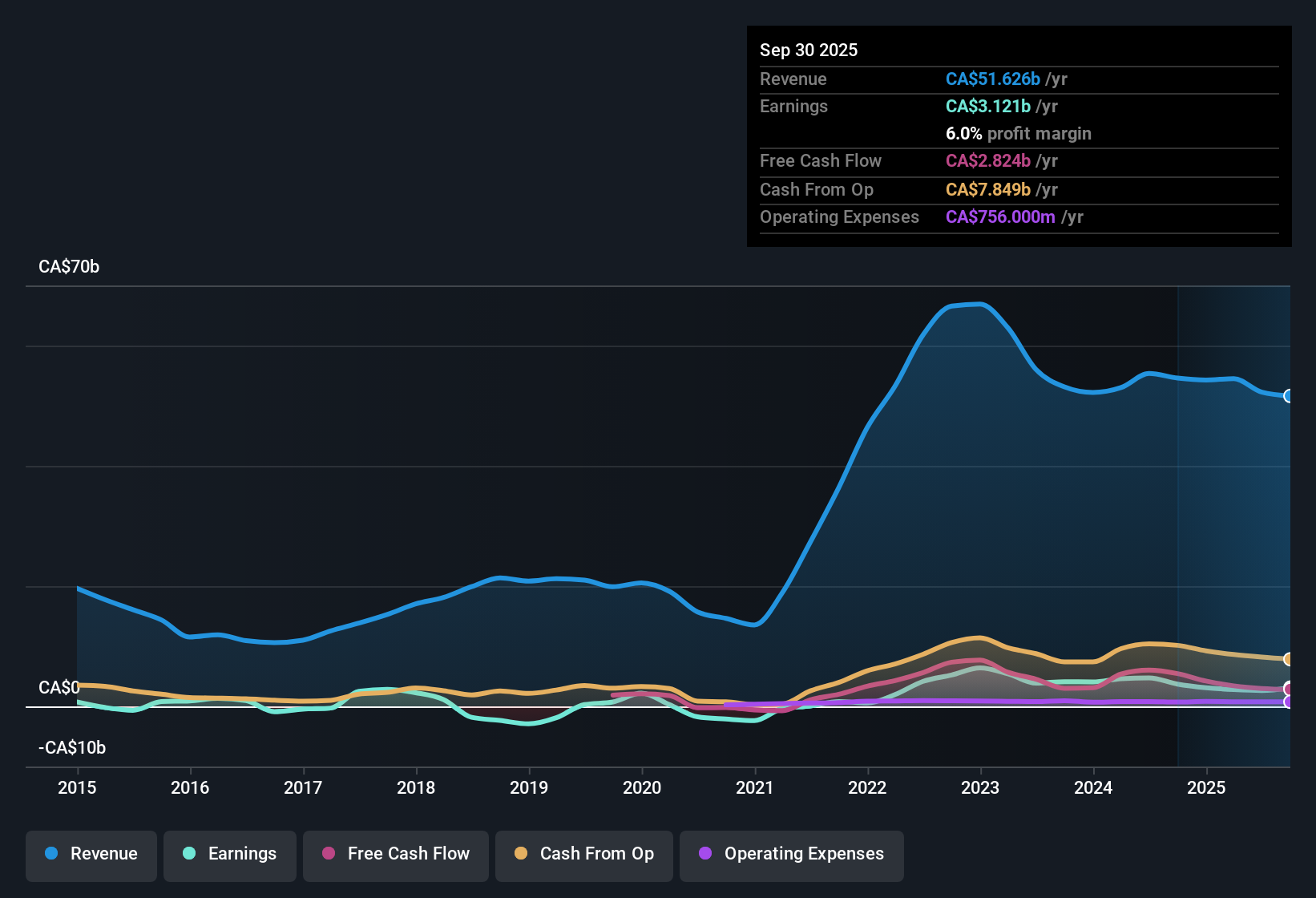

Cenovus Energy (TSX:CVE) posted revenue growth forecasts of 6.5% per year, outpacing the Canadian market’s 5% annual revenue growth, and expects earnings to rise 11.9% in line with the broader market. Despite healthy long-term trends, its net profit margin dropped to 5.1% from 8.6% last year, and the most recent year saw negative profit growth. Investors now face a mixed outlook, weighing continued growth prospects and a positive valuation angle against visible pressures on profitability and questions about dividend sustainability.

See our full analysis for Cenovus Energy.Now, let's see how this latest set of numbers matches up with the main market narratives. Some expectations may be confirmed while others could be put to the test.

See what the community is saying about Cenovus Energy

Analyst Target Price 17% Above Market

- With Cenovus shares at CA$23.70 and the analyst consensus target set at CA$27.77, analysts are expecting shares to climb by 17% if their scenario for higher earnings and margins plays out.

- Analysts' consensus view sees the pathway to this increase hinging on improved profit margins (assumed to rise from 5.1% today to 6.5% in three years) and total earnings hitting CA$3.9 billion by 2028.

- This optimism relies on higher free cash flow from large projects wrapping up, along with steady global energy demand supporting volumes and prices.

- However, some analysts are more cautious, forecasting earnings as low as CA$2.3 billion, showing not everyone is convinced future profit growth can be sustained at these levels.

Profit Margin Setbacks Counter Growth Story

- Cenovus’s net profit margin at 5.1% is not only down from last year’s 8.6%, but also puts it below analyst three-year forecasts (6.5%), exposing near-term gap versus long-term goals.

- Consensus narrative highlights two sides here:

- While major projects and cost initiatives are positioned to cut operating costs and support margin recovery, the recent drop reflects cost pressures and possibly weaker pricing, showing the company hasn’t locked in those expected gains yet.

- There is also a risk that ongoing capex for oil sands and shifting industry regulations could keep margins under pressure longer than bulls hope, which could delay the rebound that strong cash flow scenarios count on.

Trading Below DCF Fair Value, but Price-to-Earnings Looks High

- Cenovus trades well below its DCF fair value (CA$23.70 share price versus CA$83.57), but its PE ratio of 15.9x is above the Canadian oil and gas industry average (12.4x), signaling a premium that expects future growth to materialize.

- Analysts’ consensus view points to a nuanced valuation setup:

- On one hand, trading below DCF fair value and ongoing share buybacks support the value angle for longer-term investors.

- On the other, the premium PE means the market is already baking in strong earnings growth. If margin improvements do not come through, there is not much room for disappointment before the stock could underperform peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cenovus Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? In just a few minutes, you can turn those insights into your own story. Do it your way.

A great starting point for your Cenovus Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Cenovus's uncertain profit margins and questions around sustainable earnings growth suggest it may struggle to deliver reliable returns in changing market conditions.

If you want stocks that demonstrate more dependable profit growth and resilience, check out stable growth stocks screener (2103 results) for a shortlist delivering consistency through market ups and downs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CVE

Cenovus Energy

Develops, produces, refines, transports, and markets crude oil, natural gas, and refined petroleum products in Canada, the United States, and China.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives