Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. Historically, Crescent Point Energy Corp. (TSE:CPG) has been paying a dividend to shareholders. Today it yields 3.0%. Does Crescent Point Energy tick all the boxes of a great dividend stock? Below, I'll take you through my analysis.

See our latest analysis for Crescent Point Energy

5 checks you should do on a dividend stock

Whenever I am looking at a potential dividend stock investment, I always check these five metrics:

- Is their annual yield among the top 25% of dividend payers?

- Does it consistently pay out dividends without missing a payment of significantly cutting payout?

- Has the amount of dividend per share grown over the past?

- Is is able to pay the current rate of dividends from its earnings?

- Will it have the ability to keep paying its dividends going forward?

Does Crescent Point Energy pass our checks?

Crescent Point Energy has a negative payout ratio, which is usually not ideal.

When thinking about whether a dividend is sustainable, another factor to consider is the cash flow. A business with strong cash flow can sustain a higher divided payout ratio than a company with weak cash flow.

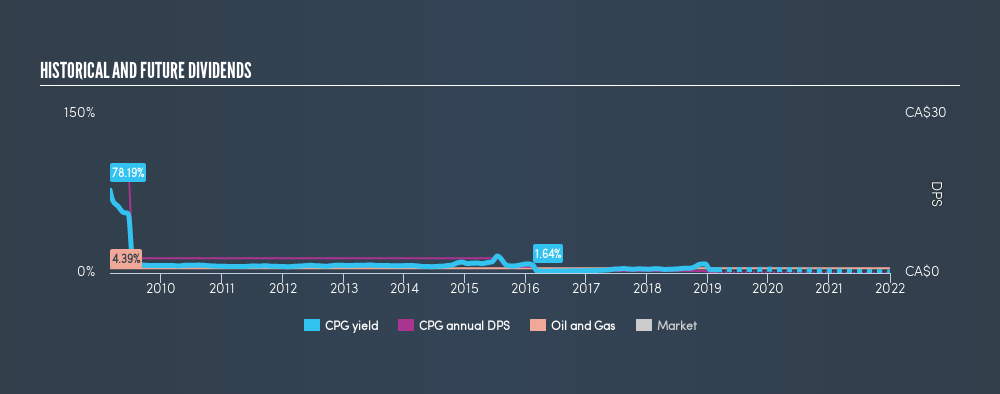

If there's one type of stock you want to be reliable, it's dividend stocks and their stable income-generating ability. Not only have dividend payouts from Crescent Point Energy fallen over the past 10 years, it has also been highly volatile during this time, with drops of over 25% in some years. This means that dividend hunters should probably steer clear of the stock, at least for now until the track record improves.

Compared to its peers, Crescent Point Energy produces a yield of 3.0%, which is on the low-side for Oil and Gas stocks.

Next Steps:

After digging a little deeper into Crescent Point Energy's yield, it's easy to see why you should be cautious investing in the company just for the dividend. But if you are not exclusively a dividend investor, the stock could still be an interesting investment opportunity. Given that this is purely a dividend analysis, I urge potential investors to try and get a good understanding of the underlying business and its fundamentals before deciding on an investment. I've put together three key factors you should look at:

- Future Outlook: What are well-informed industry analysts predicting for CPG’s future growth? Take a look at our free research report of analyst consensus for CPG’s outlook.

- Valuation: What is CPG worth today? Even if the stock is a cash cow, it's not worth an infinite price. The intrinsic value infographic in our free research report helps visualize whether CPG is currently mispriced by the market.

- Dividend Rockstars: Are there better dividend payers with stronger fundamentals out there? Check out our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:VRN

Veren

Engages in acquiring, developing, and holding interests in petroleum assets operations across western Canada.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives