- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

Does the Recent Price Jump Signal Value in Canadian Natural Resources for 2025?

Reviewed by Bailey Pemberton

- Thinking about whether Canadian Natural Resources is a bargain right now? If you are eyeing opportunities or risks, getting the valuation angle right is essential before making any moves.

- The share price has climbed 4.6% in the past week and 11.1% over the past month, signaling fresh momentum and possibly a shift in how investors perceive its future prospects.

- Recent headlines have focused on the company's continued asset development in Alberta and noteworthy capital investments. These factors have drawn attention to its ability to capitalize on strong market conditions. There has also been renewed industry interest around Canadian energy policy changes, adding an extra layer of intrigue to recent price moves.

- When we run Canadian Natural Resources through our valuation checks, it scores 4 out of 6, suggesting undervaluation in most measures. In this article, we will walk through different ways to value the business, and at the end, introduce a method many investors overlook that could offer even more insight.

Approach 1: Canadian Natural Resources Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting these amounts back to their present value. This approach helps investors gauge whether a stock is trading below or above its calculated fundamental worth.

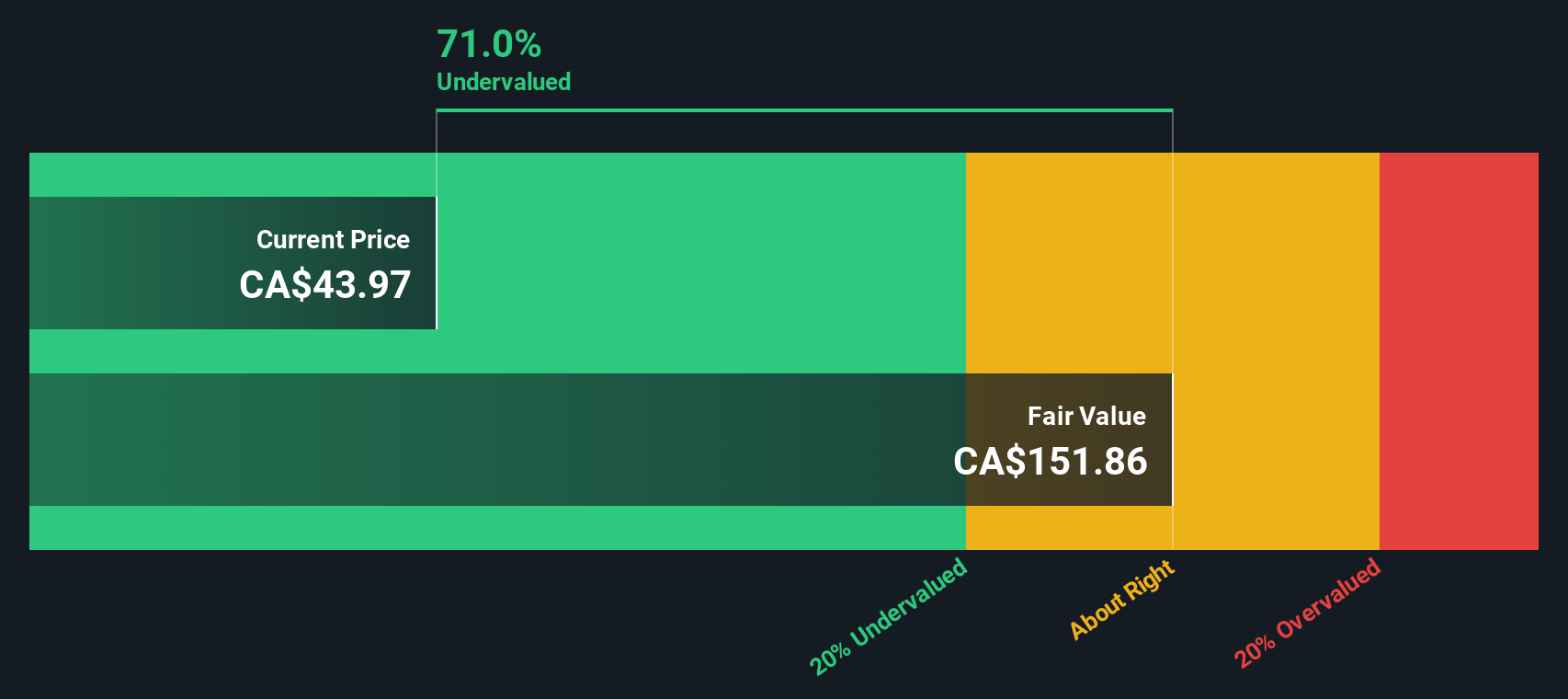

For Canadian Natural Resources, the latest reported Free Cash Flow stands at CA$8.87 billion. Analyst estimates cover roughly the next five years, after which longer-term projections are extrapolated and reach a projected CA$14.46 billion Free Cash Flow in 2035. These projections are based on expected growth rates and financial performance within the Oil and Gas sector, all expressed in Canadian dollars (CA$).

Bringing all these annual cash flow projections into today's terms, the DCF method calculates an intrinsic fair value of CA$157.70 per share. Compared to the current share price, this implies the stock is trading at a 70.3 percent discount to its estimated value. In other words, the DCF model signals that Canadian Natural Resources appears significantly undervalued by the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Canadian Natural Resources is undervalued by 70.3%. Track this in your watchlist or portfolio, or discover 894 more undervalued stocks based on cash flows.

Approach 2: Canadian Natural Resources Price vs Earnings

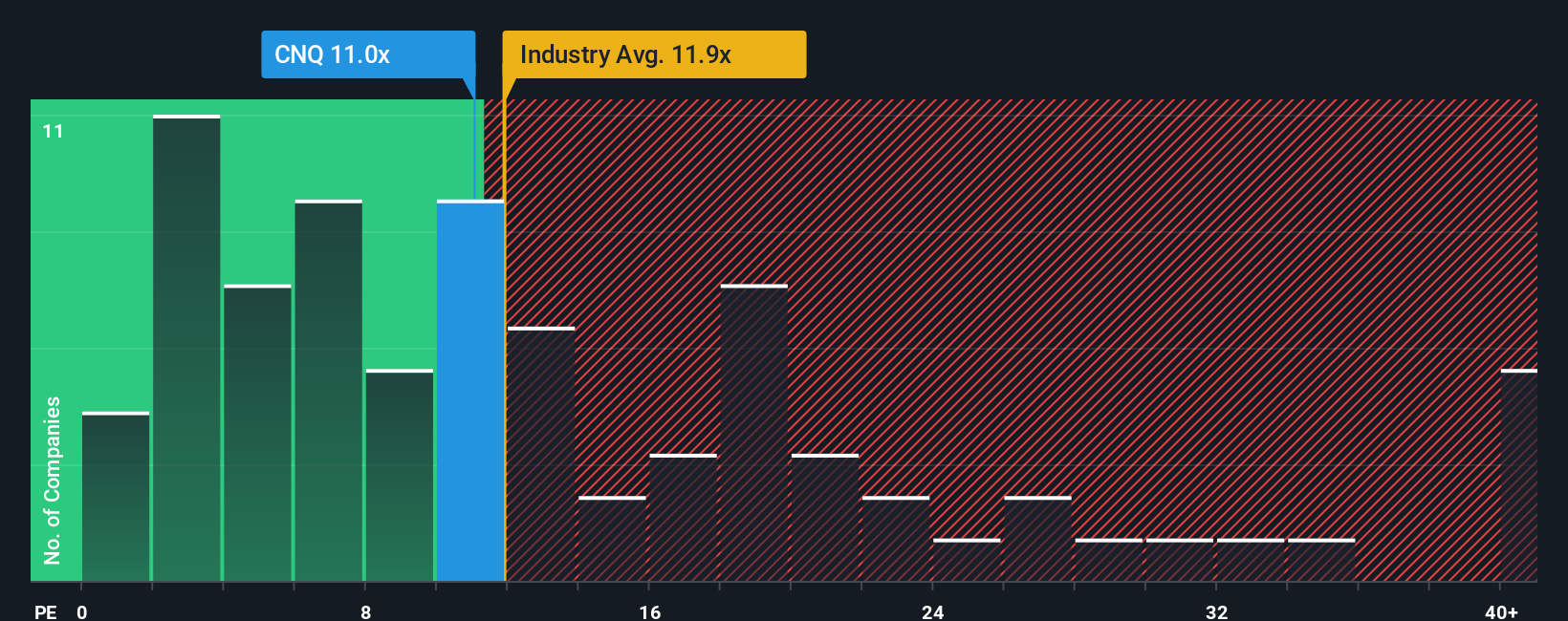

The Price-to-Earnings (PE) ratio is a popular tool for assessing the value of profitable companies like Canadian Natural Resources. It relates a company’s stock price to its earnings per share and helps investors see how much they are paying for each dollar of the company’s profit.

Growth prospects and business risks play a key role in determining what PE ratio is considered typical or fair. Higher earnings growth potential often justifies a higher PE, while elevated risks or slowing growth may warrant a lower multiple.

Canadian Natural Resources is currently trading at a PE ratio of 14.7x. This is close to both its industry average of 14.8x and its peer group average of 14.3x. However, Simply Wall St uses a “Fair Ratio,” which estimates a more tailored benchmark by considering the company's unique mix of expected profit growth, sector trends, profitability, market capitalization, and associated risks. For Canadian Natural Resources, the Fair Ratio stands at 16.7x.

Unlike broad industry or peer comparisons, the Fair Ratio accounts for specific financial characteristics and future prospects. This makes it a more holistic and realistic measure of value when assessing whether a stock is cheap or expensive given its circumstances.

Because Canadian Natural Resources’ current PE of 14.7x is noticeably below its Fair Ratio of 16.7x, the shares appear undervalued on this metric as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Canadian Natural Resources Narrative

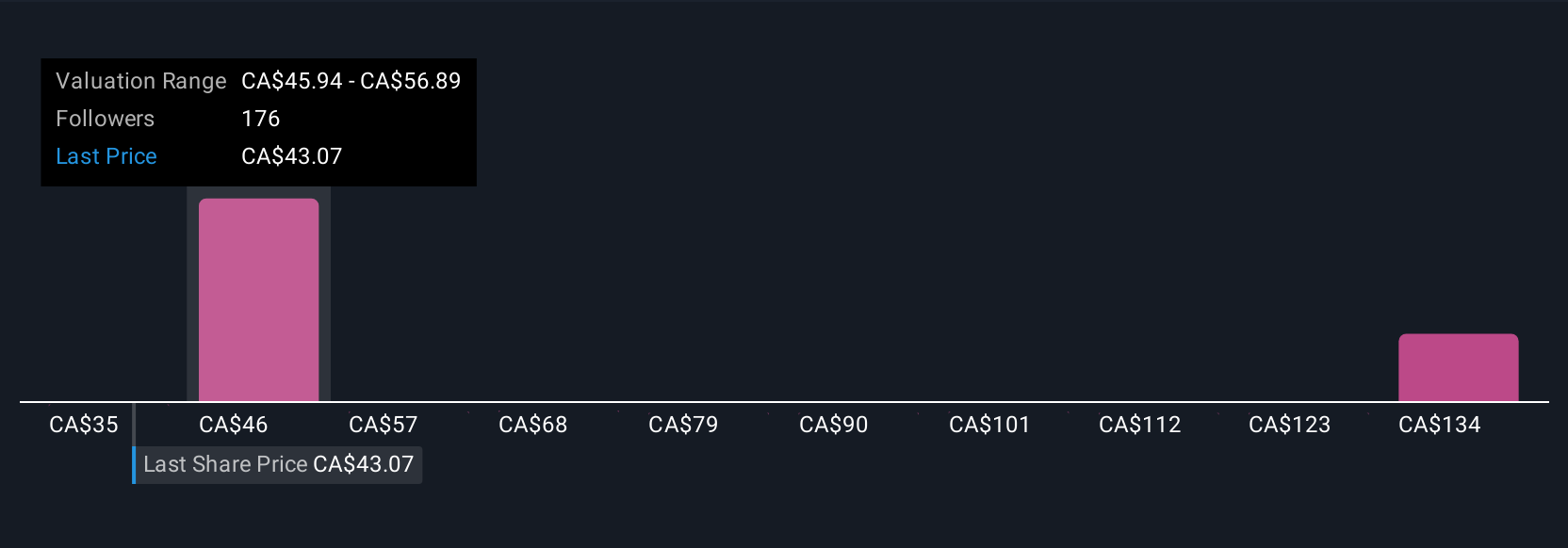

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are your personal, story-driven perspective about a company. This is where you connect the business’s story to your own expectations for its financial future. Simply put, a Narrative allows you to clearly lay out what you believe will drive the company’s future revenue, earnings, and margins, linking those assumptions to your fair value estimate.

Narratives bring investing to life by tying recent news or company events directly to your forecast and valuation, helping you decide whether Canadian Natural Resources is a buy, hold, or sell right now. On Simply Wall St’s Community page, you can easily explore or build Narratives just like millions of other investors already do. They are intuitive, quick to update with new information, and adjust your fair value score in real time as the outlook changes.

For example, today you’ll find that investors have very different views: the most optimistic Narrative assigns a CA$62.00 fair value per share for Canadian Natural Resources, while the most cautious sees just CA$45.00. Narratives let you chart your own path, compare your assumptions with others, and dynamically adapt to the market as the story evolves.

Do you think there's more to the story for Canadian Natural Resources? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNQ

Canadian Natural Resources

Engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) in Western Canada, the United Kingdom sector of the North Sea, and Offshore Africa.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives