- Canada

- /

- Energy Services

- /

- TSX:CEU

Will CES Energy Solutions' Share Buyback Shape a New Capital Allocation Story for TSX:CEU?

Reviewed by Sasha Jovanovic

- CES Energy Solutions recently reported its third quarter 2025 financial results, showing sales of CA$623.22 million and a net income of CA$40.49 million, while also announcing the completion of a share buyback totaling 6,495,800 shares for CA$57.56 million and affirming its quarterly dividend of CA$0.0425 per share.

- The combination of increased sales, sustained shareholder returns through dividends and buybacks, and a slight decrease in earnings has drawn heightened attention to the company’s approach to balancing profitability and capital returns.

- We'll examine how the completion of a sizable share buyback program could influence CES Energy Solutions' future investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

CES Energy Solutions Investment Narrative Recap

To be a shareholder in CES Energy Solutions, you generally need to believe in the ongoing demand for advanced chemical solutions in drilling and production, and the company’s ability to win large, recurring contracts. The latest quarterly report, with higher sales but slightly lower earnings, does little to change the primary short-term catalyst, the success of bids for high-margin production chemical contracts, nor does it materially shift ongoing pressure from industry commoditization, which remains the most immediate risk.

Of the recent announcements, the completion of the 6,495,800 share buyback for CA$57.56 million stands out, signaling continued capital returns even as earnings softened. The scale of this buyback, nearly 3% of shares outstanding, may be viewed in direct relation to the company’s ability to maintain both flexibility for future growth and discipline in shareholder value initiatives, both important factors for near-term market perception.

However, what investors should be especially mindful of is that, despite growing revenues, the underlying risk from persistent pricing pressure and margin compression remains...

Read the full narrative on CES Energy Solutions (it's free!)

CES Energy Solutions is forecast to reach CA$2.7 billion in revenue and CA$221.4 million in earnings by 2028. This outlook assumes a 3.1% annual revenue growth and an earnings increase of CA$37 million from the current CA$184.4 million.

Uncover how CES Energy Solutions' forecasts yield a CA$11.16 fair value, a 3% downside to its current price.

Exploring Other Perspectives

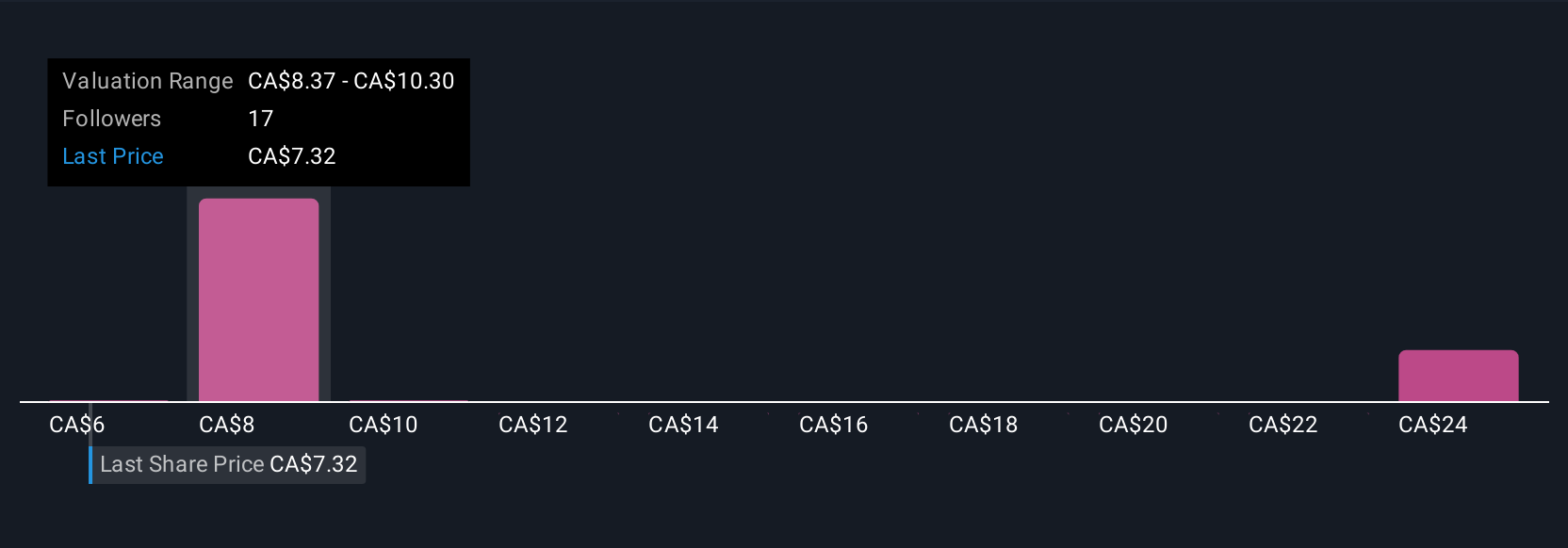

Fair value views from four Simply Wall St Community members span from CA$6.43 up to CA$30.27 per share. While these opinions differ widely, many remain focused on CES’s exposure to margin pressure as the key factor shaping future performance. Consider these viewpoints and see how each weighs the most prominent risks and opportunities.

Explore 4 other fair value estimates on CES Energy Solutions - why the stock might be worth over 2x more than the current price!

Build Your Own CES Energy Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CES Energy Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CES Energy Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CES Energy Solutions' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CEU

CES Energy Solutions

Engages in the design, implementation, and manufacture of advanced consumable fluids and specialty chemicals in the United States and Canada.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives