- Canada

- /

- Energy Services

- /

- TSX:CEU

A Piece Of The Puzzle Missing From CES Energy Solutions Corp.'s (TSE:CEU) 30% Share Price Climb

CES Energy Solutions Corp. (TSE:CEU) shares have continued their recent momentum with a 30% gain in the last month alone. Looking further back, the 25% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

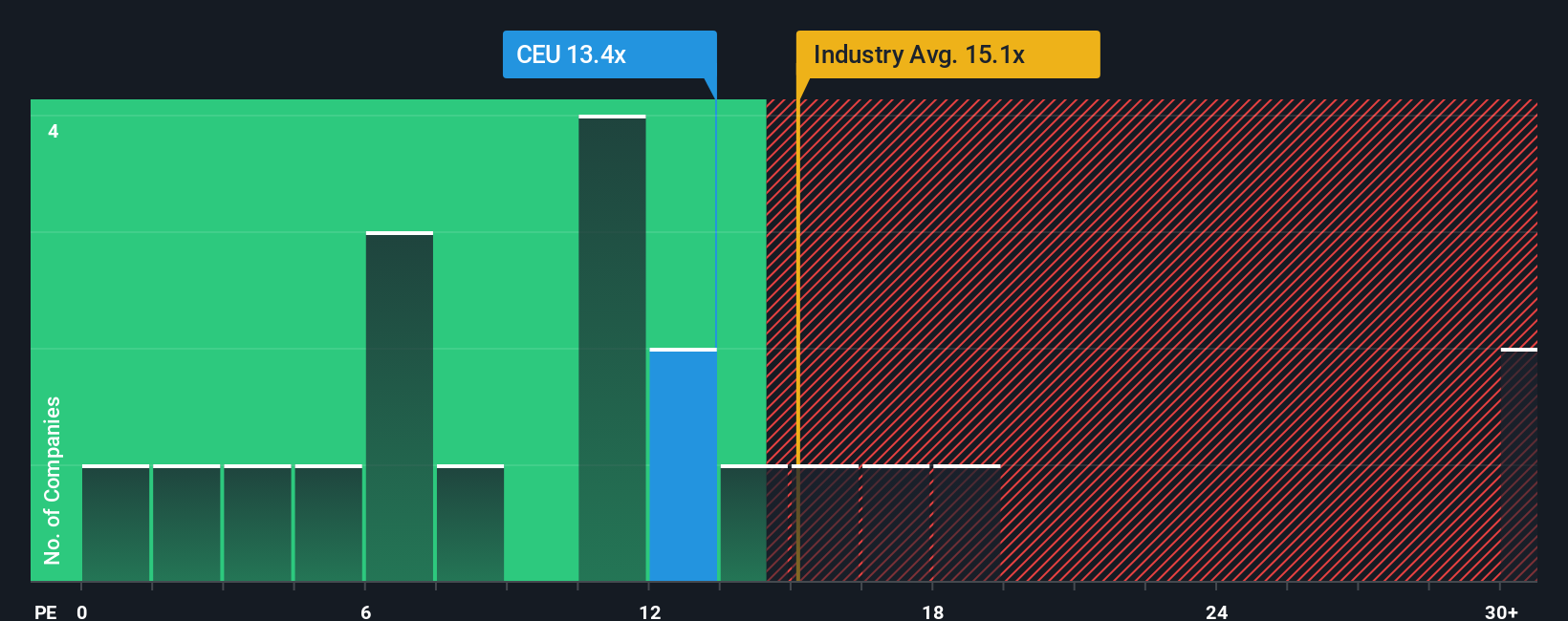

In spite of the firm bounce in price, CES Energy Solutions' price-to-earnings (or "P/E") ratio of 13.4x might still make it look like a buy right now compared to the market in Canada, where around half of the companies have P/E ratios above 16x and even P/E's above 27x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

CES Energy Solutions hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for CES Energy Solutions

Does Growth Match The Low P/E?

In order to justify its P/E ratio, CES Energy Solutions would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 5.1% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 169% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 19% each year as estimated by the eight analysts watching the company. That's shaping up to be materially higher than the 11% per year growth forecast for the broader market.

In light of this, it's peculiar that CES Energy Solutions' P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift CES Energy Solutions' P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of CES Energy Solutions' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Plus, you should also learn about this 1 warning sign we've spotted with CES Energy Solutions.

You might be able to find a better investment than CES Energy Solutions. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CEU

CES Energy Solutions

Engages in the design, implementation, and manufacture of advanced consumable fluids and specialty chemicals in the United States and Canada.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives